(NECN: Peter Howe, Boston) - Behind secured closed doors at the powerful Boston law firm of Ropes & Gray, the board of directors of the embattled Market Basket chain met for hours Friday – but their only public comment was a giant rebuff to employees who’ve been demanding Arthur T. Demoulas be reinstated as CEO.

The board said it will consider and evaluate Arthur T. Demoulas’s bid to buy the 50.5 percent controlling stake in the company held by the Arthur S. Demoulas side of the family, his cousin with whom he’s been feuding for decades.

But even as many of the 71-store chain’s 25,000 employees have been spending days protesting, picketing, and urging shoppers boycott Market Basket until “Artie T” is returned as CEO, the board said: “Furthermore, the Board reaffirmed its election of Co-CEOs Felicia Thornton and James Gooch to manage the Company in accordance with the Company's bylaws." It was a statement that took off the table, for now, the one and only demand the employees are making: That Arthur T., fired June 23 after Arthur S. gained control of the board, come back.

About 7:30 p.m., the directors issued another statement: “The past month has been trying. We appreciate the strain this change of leadership has placed on our associates. We welcome back associates who are committed to Market Basket's customers. There will be no penalty or discipline for any associate who joins in what will be a significant effort to return to the unparalleled level of performance and customer service that have been hallmarks of the Market Basket brand. There will be no change to Market Basket's unmatched compensation and benefits.’’

Several employees and supporters of the Market Basket protesters attempted to communicate with Arthur S. Demoulas as he entered the Prudential Center for the board meeting, including Eleanor Corcoran, a social worker from Somerville, Mass., who shops at the Market Bssket there and said she wanted to help present more than 100,000 signatures on petitions to Arthur S. Demoulas and the board. “Arthur S. didn’t even make eye contact with me,’’ Corcoran said. “He just walked away.’’

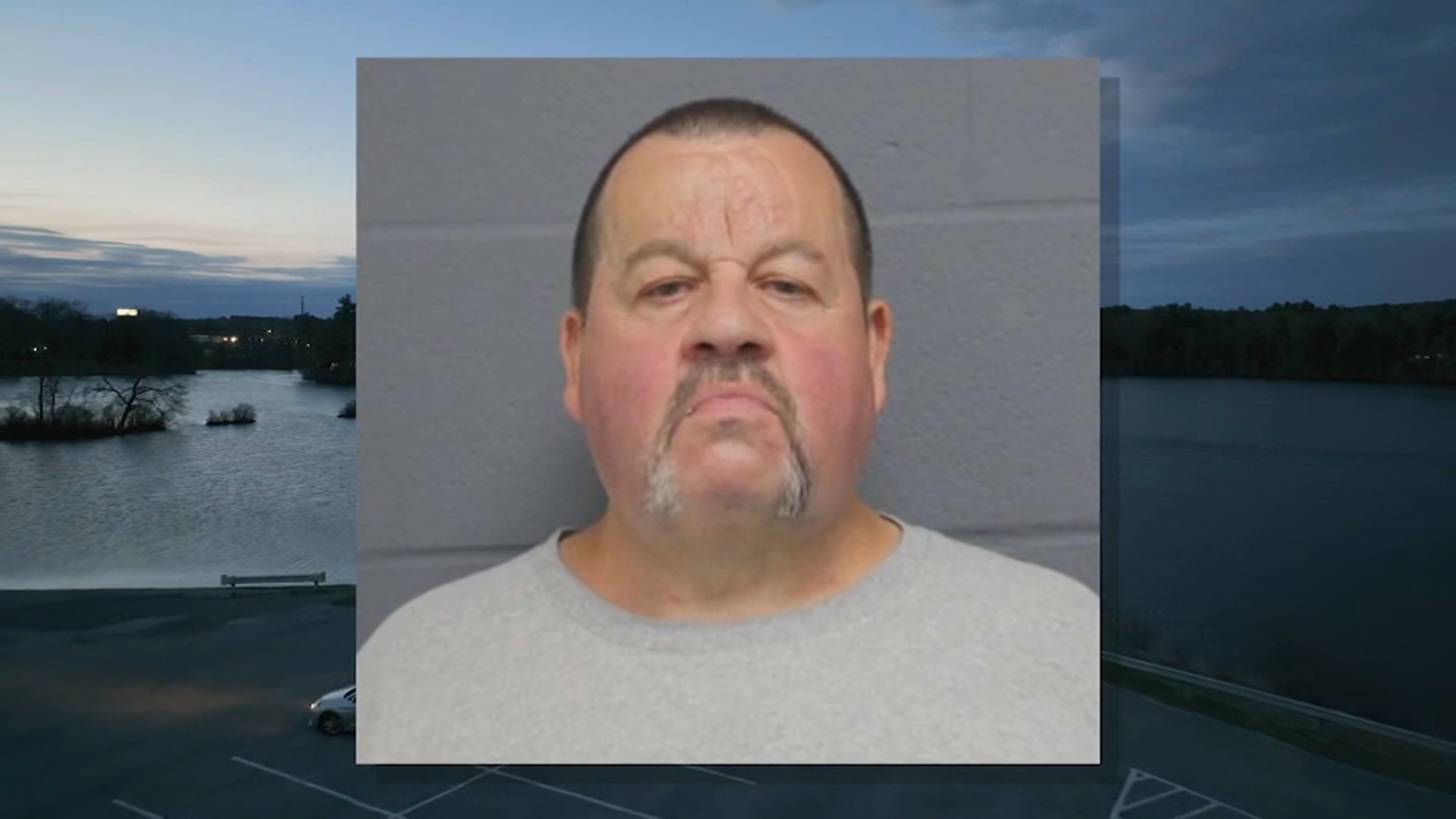

Christopher Stetson and William Caraballo, managers of the Market Basket store in Chelsea, also said they got completely frozen out by Arthur S. when they tried to approach him.

Caraballo reiterated that for workers, the only solution is to have the board agree to Arthur T.’s buyout offer, which is believed to be valued in the $2 billion range, and for him to come back as CEO. “There’s no other way around it,” Caraballo said.

Local

Here is the board’s first statement in its entirety:

"The Board of Directors of Demoulas Super Markets met today and confirmed that the

Company has received an offer from Arthur T. Demoulas and the other "B"

shareholders to acquire the remaining 50.5% of the shares of the Company. The Board

said that the offer was received prior to the deadline for the "B" shareholders to present

a proposal. Consistent with its fiduciary obligations, the Board will evaluate and

seriously consider this proposal, along with any other offers previously received and to

be received. Following its evaluation of all of the offers, it will convey its

recommendations to the Company's shareholders.

The Board acknowledges that it has heard from many stakeholders. The negative

behavior of certain current and former associates is at variance with the Company's

culture of putting the needs of the Market Basket customers first. It is now clear that it

is in the interests of all members of the Market Basket community for normal business

operations to resume immediately. Furthermore, the Board reaffirmed its election

of Co-CEOs Felicia Thornton and James Gooch to manage the Company in accordance

with the Company's bylaws."

Something worth noting: Under decades of case law, it’s well established that the fiduciary, legal duty of a board of directors when presented with a serious offer to buy the company is to “evaluate and seriously consider” the proposal, and refusing to do so can be grounds for a lawsuit.

The board gave no indication of when it would make a decision on the Arthur T. bid, and by the language of its statement, there’s no clear reason to assume it’s giving the Arthur T. bid any more than the minimum legal consideration it would have to give any such offer to buy the company.

With videographers Dan Ferrigan, Bob Ricci, and Abbas T. Sadek. NECN’s John Moroney contributed to this report.