Have you always been financially faithful in your relationships?

If the answer is no, you're not alone.

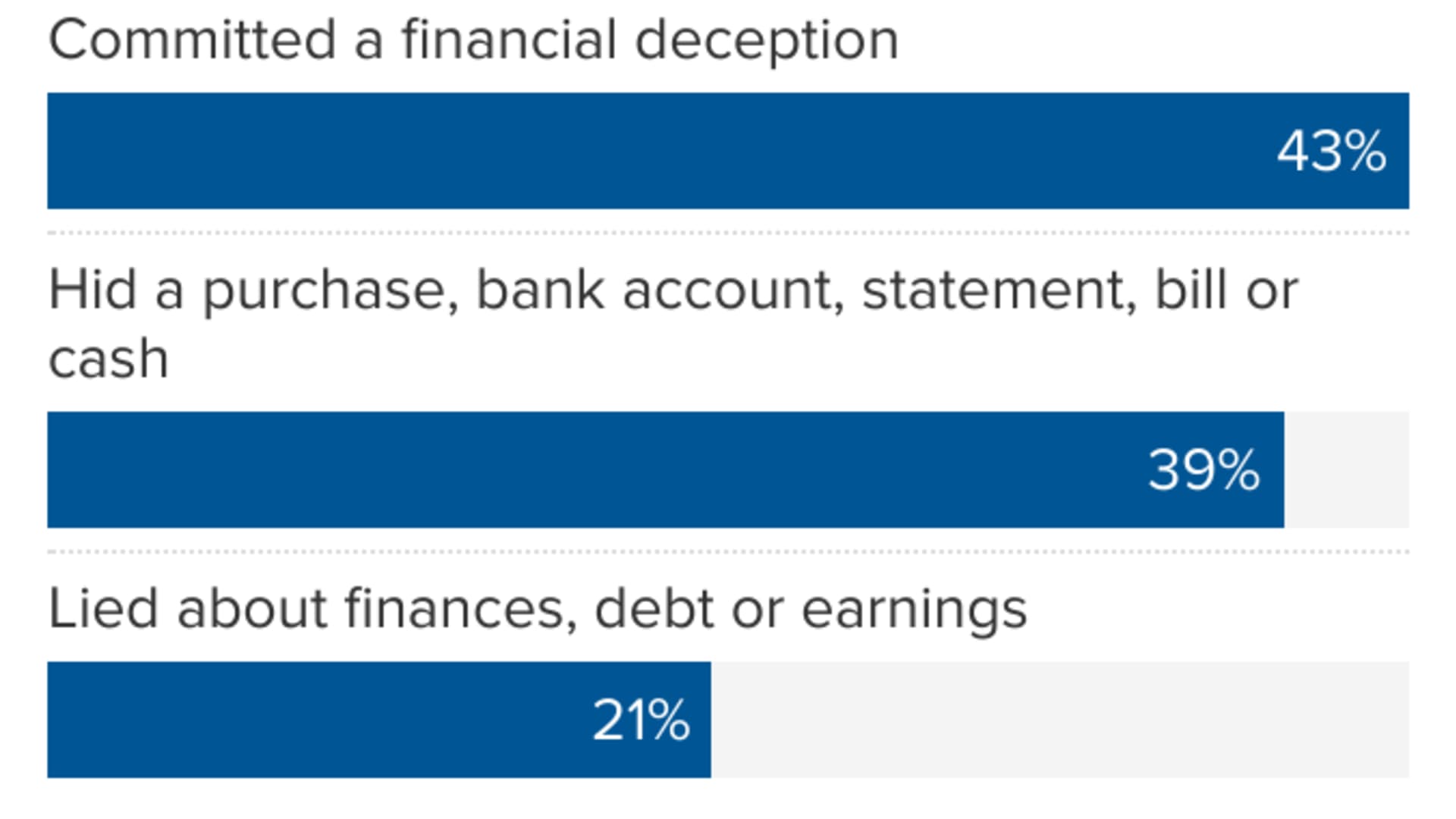

Some 43% of adults with combined finances in a relationship said they've committed an act of financial deception, according to a poll from the National Endowment for Financial Education.

Financial deception ranges from lying to your partner or spouse about money to hiding things such as cash, bills or a purchase, according to the report. The survey of more than 2,000 adults was conducted online by The Harris Poll in June.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Money is often a reason for stress in relationships and is even a leading cause of divorce. That may be because it's a difficult subject to broach.

"As a society, we talk about money with the assumption that everyone starts at the same place in terms of understanding, and that is very untrue," said Billy Hensley, president and CEO of the National Endowment for Financial Education, adding that this can make discussions about debt, saving and spending more uncomfortable.

Money Report

"At the foundation of it is that we don't provide enough financial education in schools or in any other venues so people have the confidence necessary to approach these topics early on," he said.

Why people commit financial infidelities

The survey found that most deceptions happen for a few main reasons. Thirty-eight percent felt that some aspects of money should remain private, 34% had discussed finances but thought their partner would disapprove and another 33% were too afraid or embarrassed about their finances to speak about it.

Of the couples who had experienced financial deception, 42% said that it resulted in a fight. Others said that the event eroded trust and privacy, led to separation of finances or triggered the termination of the relationship altogether.

To be sure, some respondents were able to use a financial infidelity to make their relationship stronger — 19% said they were closer after, and 16% said the deception helped them communicate more proactively later.

More from Invest in You:

The 'Great Resignation' is burning out those who stay

Use these resume strategies to stand out to recruiters

Switching jobs can boost income. When to put yourself on the market

Check in with your partner or spouse about money

If you have committed financial infidelity, it's probably best to come clean to your spouse or partner as soon as you can, said Hensley. That way, you can work through the issue together.

"Maybe it's time to recalibrate your financial relationship and say, 'you know what, this hasn't worked too well for us, is there a way we should do this that's better for us?'" Hensley said.

It may also be a good idea to work with a financial therapist or coach to have a neutral third party that can help you talk about money, Hensley said.

To avoid financial issues in a relationship, couples should discuss how they'd like to combine — or not combine — their finances before doing so, or before deciding to cohabitate.

It's important that people realize that there is not one way for couples to manage money. Some experts recommend that committed partners keep some aspects of their finances separate.

For example, Suze Orman, a personal finance expert and the host of the "Women and Money" podcast, has never had a joint bank account with her partner of more than 20 years.

"You have to have money of your own, the last thing you want to do is have to ask permission," said Orman. "You might have a joint account, for joint expenses, but then you each need your own individual account."

Couples should also discuss their financial goals and make sure they're on the same page — and check in regularly to track their progress as they work towards those goals.

"If you have shared goals and you've talked about the distribution of how you cover your bills and so forth, it takes a level of pressure off to be able to start your relationship or to be able to heal within your relationship," said Hensley.

Have you ever experienced or committed financial infidelity in a relationship? If you have and would be willing to share your story, email Carmen Reinicke at carmen.reinicke@nbcuni.com.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How to make money with creative side hustles, from people who earn thousands on sites like Etsy and Twitch via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.