Here are the most important news, trends and analysis that investors need to start their trading day:

- Stocks set to fall after record closings for Dow and S&P 500

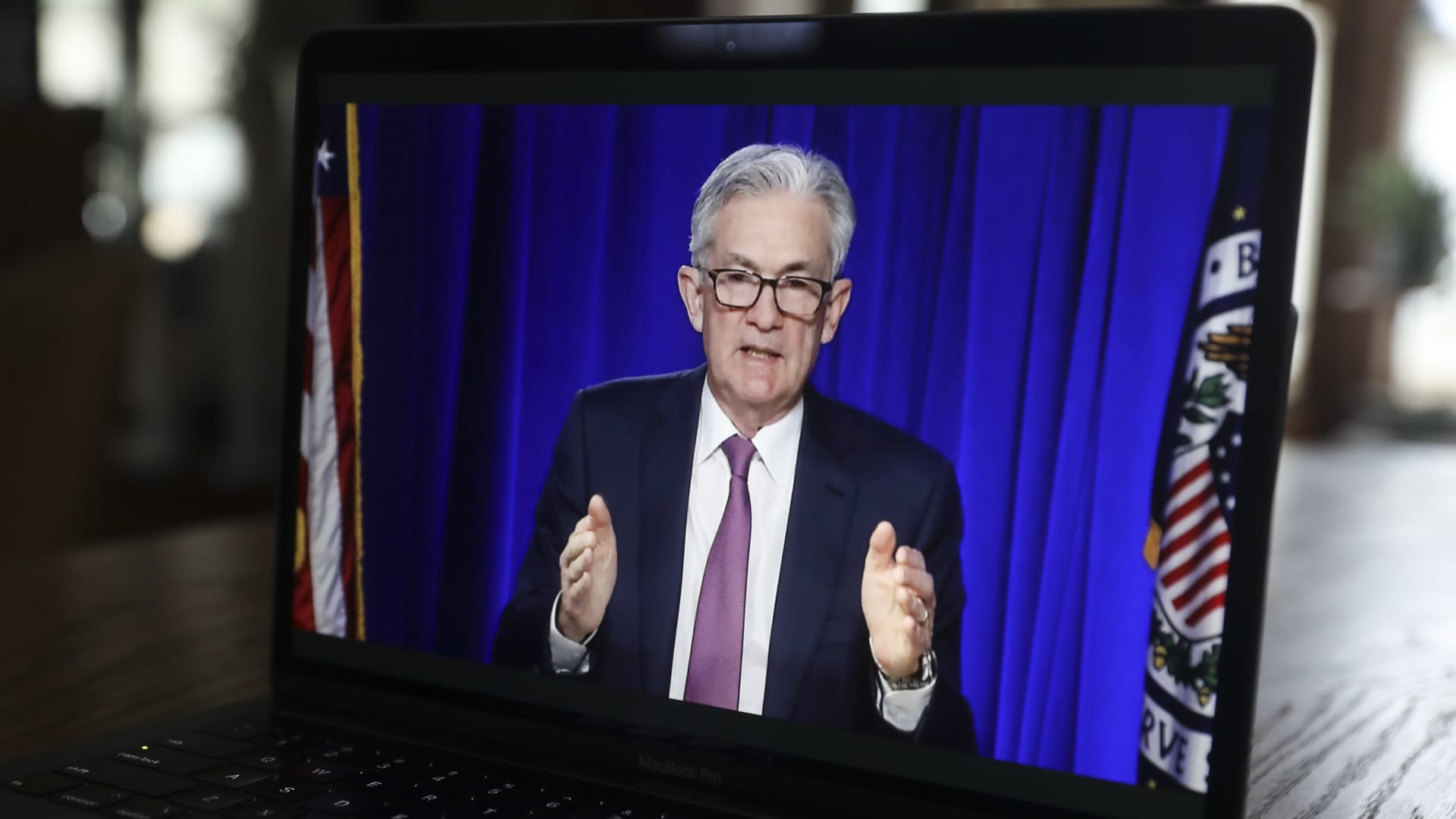

- Powell says ‘highly unlikely’ the Fed will raise rates this year

- Covid variant evades some vaccine protection

- CEOs meet for White House chip summit; Biden meets lawmakers on infrastructure

- Microsoft buys Nuance in $16 billion deal

1. Stocks set to fall after record closings for Dow and S&P 500

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

U.S. stock futures slipped Monday after Friday's rally on Covid reopening optimism lifted the Dow Jones Industrial Average and S&P 500 to record closings. The Nasdaq also advanced, leaving the tech-heavy index 1.5% away from its February record close. Stocks linked to the recovering economy led the gains. For the week, the Dow was up nearly 2%, the S&P 500 gained 2.7% and the Nasdaq was up 3.1%. Apple jumped more than 8% last week, while Amazon and Google-parent Alphabet gained more than 6%. They were steady in Monday's premarket as the 10-year Treasury yield held under 1.7% after a run of 14-month highs last month. Bitcoin surged and topped $60,000 again over the weekend.

Uber on Monday posted record gross bookings for March, signaling a pick-up in demand for ride hailing. The tech giant's rides business was hit hard by pandemic lockdowns last year. However, Uber benefited from a boom in food delivery, which helped to limit losses in 2020. Shares of Uber rose 2% in Monday's premarket.

Money Report

2. Powell says ‘highly unlikely’ the Fed will raise rates this year

Federal Reserve Chairman Jerome Powell reaffirmed the central bank's commitment to keep easy monetary policy in place, despite what he sees as a rapidly recovering economy from the depths of the pandemic. "I think it's highly unlikely that we would raise rates anything like this year," Powell told "60 Minutes" in an interview that aired Sunday. "I'm in a position to guarantee that the Fed will do everything we can to support the economy for as long as it takes to complete the recovery," he added. That support includes near-zero short-term borrowing rates and $120 billion a month in bond purchases.

3. Covid variant evades some vaccine protection

The coronavirus variant discovered in South Africa is able to evade some of the protection of the two-shot vaccine made by Pfizer-BioNTech, according to a new Israeli study. The researchers found the prevalence of the strain among patients who received both doses of the vaccine was about eight times higher than those who were unvaccinated.

Regeneron plans to ask the FDA to allow its Covid antibody therapy to be used as a preventative treatment. In a phase three clinical trial, the company said the drug cocktail reduced the risk of symptomatic infections in individuals by 81%. The therapy was given to then-President Donald Trump shortly after he was diagnosed with coronavirus last year.

4. CEOs meet for White House chip summit; Biden meets lawmakers on infrastructure

Almost 20 major companies worried about a global semiconductor chip shortage that has roiled the auto industry will send senior executives to a White House summit Monday. The meeting is expected to include General Motors CEO Mary Barra and Ford CEO Jim Farley, according to Reuters.

President Joe Biden is set to meet Monday with a bipartisan group of lawmakers to discuss his more than $2 trillion infrastructure plan. The GOP base remains overwhelmingly loyal to Trump, but Biden believes Republican leaders are overlooking everyday Americans eager for compromise and action.

5. Microsoft buys Nuance in $16 billion deal

Microsoft has agreed to buy speech-recognition firm Nuance Communications in $16 billion deal. Shares of Nuance soared nearly 19% in Monday's premarket. Buying Nuance expands Microsoft's capabilities in voice software. At $16 billion, Nuance would be Microsoft's second largest acquisition, after its $27 billion purchase of LinkedIn in 2016. Shares of Microsoft were little changed.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus blog.