Here are the most important news, trends and analysis that investors need to start their trading day:

- Dow set to rise 180 points to start final week of 2020

- Trump signs Covid-19 stimulus bill

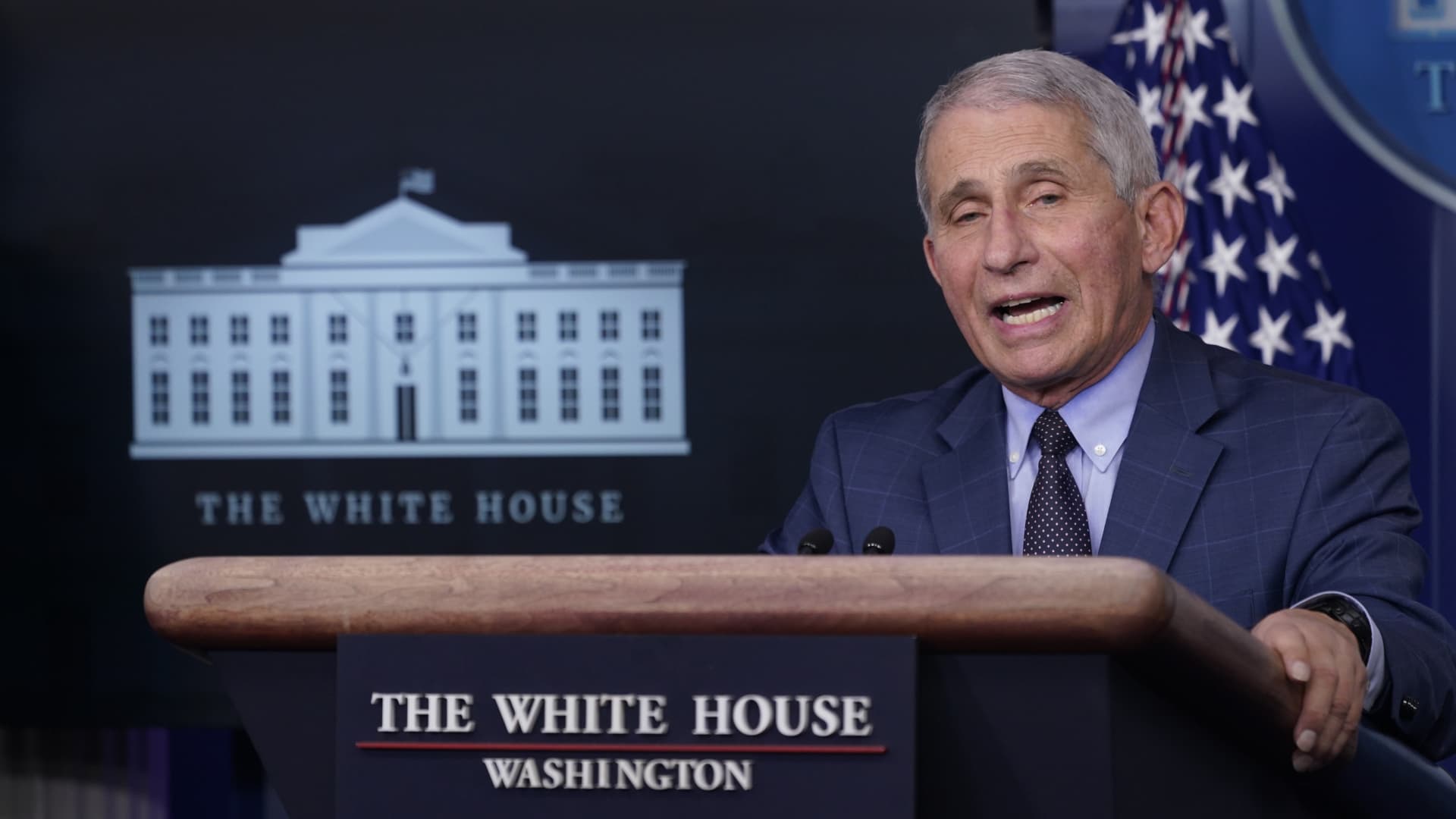

- Fauci warns of 'post-seasonal' infections surge

- Alibaba shares dip after China ramps up pressure on Ant Group

- U.K. expected to approve Oxford-AstraZeneca virus vaccine this week

1. Dow set to rise nearly 200 points to start final week of 2020

U.S. stock futures pointed to a higher open on Monday morning as traders enter the final trading days of a volatile year. Dow Jones Industrial Average futures gained 170 points, or 0.6%, implying an opening advance of about 200 points. S&P 500 futures climbed 0.7% along with Nasdaq 100 futures. Monday's advances came after President Donald Trump's unexpected signing of a the coronavirus stimulus bill. But the major averages could be under pressure this week as some traders may take profits after this year's surprisingly strong returns.

2. Trump signs Covid-19 stimulus bill

Five days after calling it a "disgrace," Trump signed into law the coronavirus relief and government funding bill that extends additional unemployment benefits into March and includes $600 in direct payments to most Americans. Trump had refused to sign the bill, in part because the measure did not include direct payments of $2,000. Economists across the country, along with the Federal Reserve, had called for more fiscal stimulus to aid the economy's recovery from the coronavirus pandemic.

Money Report

3. Fauci warns of 'post-seasonal' infections surge

Dr. Anthony Fauci said the U.S. could see a "post-seasonal" coronavirus surge after Americans gather for Christmas and New Year's celebrations. "Traveling and the likely congregating of people for the good warm purposes of being together for the holidays "adds pressure to the worsening crisis," Fauci said on CNN's "State of the Union." The U.S. is already in the middle of a Covid-19 spike. Over the past week, the U.S. has recorded an average of 189,578 daily new cases, according to a CNBC analysis of data compiled by Johns Hopkins University.

4. Alibaba shares dip after China ramps up pressure on Ant Group

The U.S.-listed shares of Alibaba dipped more than 1% in the premarket as Chinese regulators ordered Ant Group — an affiliate of Alibaba — to comply with government regulations amid heightened scrutiny of China's internet sector. Regulators ordered Ant to establish a financial holding company and maintain a certain amount of capital, adding the company should return to its payment-services origins, enhance transparency and prohibit unfair competition. "The rectification is an opportunity for Ant Group to strengthen the foundation for our business to grow with full compliance, and to continue focusing on innovating for social good and serving small businesses," Ant Group said in a statement.

5. U.K. expected to approve Oxford-AstraZeneca virus vaccine this week

The U.K. government is expected to approve a coronavirus vaccine develop by AstraZeneca and the University of Oxford this week. The Financial Times said the approval could come as soon as Tuesday, while the Sunday Telegraph newspaper reported the vaccine could be approved Monday. Earlier this month, the U.K. began rolling out a Covid-19 vaccine developed by Pfizer and German firm BioNTech.