Here are the most important news, trends and analysis that investors need to start their trading day:

- Dow set to gave back some of Monday's snapback rally

- Abercrombie & Fitch plunges, Best Buy dips after earnings

- Snap sinks after issuing profit warning, citing difficult economy

- Zoom Video jumps after it shows an ability to reduce costs

- SpaceX president defends Musk over sexual misconduct claims

1. Dow set to gave back some of Monday's snapback rally

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Dow futures fell more than 150 points Tuesday, poised to give back a chunk of Monday's nearly 2% advance. The S&P 500 also closed up roughly 2% to start the week after dipping into bear market territory at one stage on Friday before a late-session comeback saved the day. The Nasdaq on Monday rose 1.6%, but it remained in a bear market, down 20% or more from a prior high. The Dow Jones Industrial Average and S&P 500 both stayed in sharp corrections, down 10% or more from a prior high.

Wall Street just can't seem to sustain a rally as declines in multiweek losing streaks for the major stock benchmarks mount as investors worry about rising inflation and whether the Federal Reserve's tightening approach can stop it. Bond prices were the beneficiaries of Tuesday's premarket selling in stocks. With prices moving in the opposite direction of yields, the 10-year Treasury yield dropped to 2.8%.

2. Abercrombie & Fitch plunges, Best Buy dips after earnings

Abercrombie & Fitch lost more than 30% in premarket trading, set to become the latest retail stock disaster. The specialty retailer on Tuesday reported an unexpected quarterly loss, despite better-than-expected revenue. Analysts had expected a profit. Freight and product costs weighed on results. Abercrombie also cut its sales outlook for fiscal 2022, anticipating that the current economic headwinds will remain at least through the end of the year.

After initially rising, Best Buy shares turned negative — down roughly 2% — in the premarket after the electronics chain on Tuesday reported better-than-expected quarterly revenue. While same-store sales for the quarter fell 8%, that was a smaller drop than expected. Best Buy, however, did miss estimates on per-share profit as customers faced high levels of inflation and the company lapped a year-ago period fueled by Covid stimulus. The company also cut its outlook.

Money Report

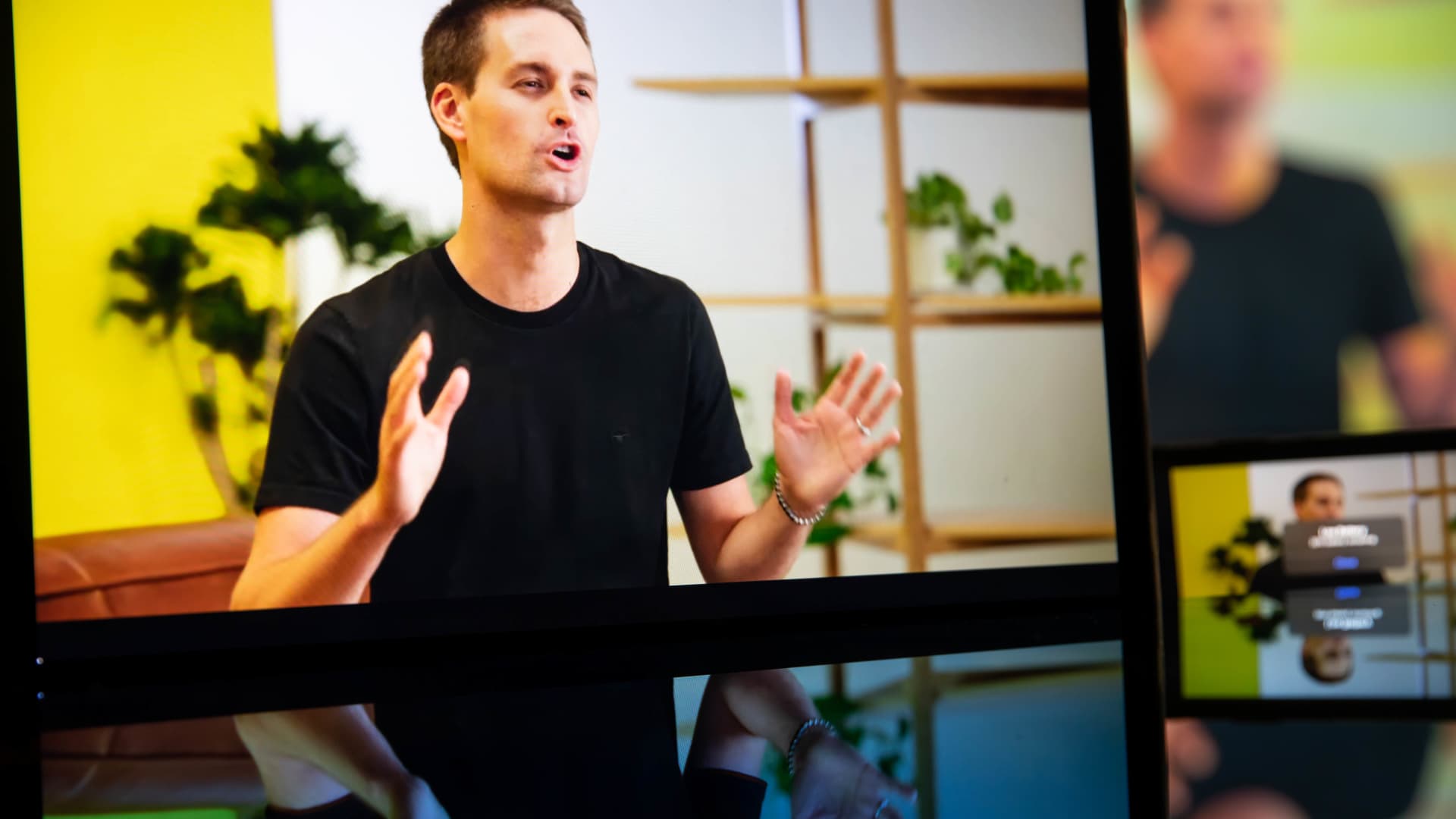

3. Snap sinks after issuing profit warning, citing difficult economy

Snap shares plunged more than 30% in Tuesday's premarket, the morning after the social media company issued a warning about its upcoming second-quarter results and said it would slow hiring. The Snapchat parent said it's dealing with a number of issues, including inflation, an uncertain economic environment and Apple's privacy policy changes.

- "We believe it is now likely that we will report revenue and adjusted EBITDA below the low end of the guidance range we provided for this quarter," CEO Evan Spiegel wrote in Monday's update. In April, Snap reported a first-quarter per-share loss and revenue that missed expectations.

4. Zoom Video jumps after it shows an ability to reduce costs

Zoom Video shares' after-hours surge cooled a bit for a gain of 4.5% ahead of Tuesday's opening bell. Zoom late Monday reported better-than-expected quarterly earnings and matched on revenue. The company also raised its profit outlook, showing an ability to reduce costs as explosive Covid pandemic-fueled growth decelerates.

- Demand for Zoom's flagship videoconferencing services has been waning as people return to offices. But the company has been shifting its emphasis to products aimed at the hybrid workplace.

5. SpaceX president defends Musk over sexual misconduct claims

SpaceX President and COO Gwynne Shotwell defended Elon Musk in a companywide message last week, responding to sexual misconduct allegations directed at the billionaire entrepreneur. "Personally, I believe the allegations to be false; not because I work for Elon, but because I have worked closely with him for 20 years and never seen nor heard anything resembling these allegations," Shotwell wrote to employees in an email sent Friday and seen by CNBC. Musk has denied the allegations, which claim he propositioned a flight attendant on one of SpaceX's private jets in 2016, calling them "wild accusations."

— CNBC's Melissa Repko, Peter Schacknow, Kif Leswing, Ari Levy, Lauren Feiner and Michael Sheetz contributed to this report.

— Sign up now for the CNBC Investing Club to follow Jim Cramer's every stock move. Follow the broader market action like a pro on CNBC Pro.