- Vesting schedules — the length of time you must be at an employer for its 401(k) matching contributions to be 100% yours — can be up to six years.

- Fewer than a third of companies provide immediate access.

- Despite potentially having to wait years, experts say it's nevertheless worth contributing at least enough to get the company match.

It appears most workers have to wait years for a company's 401(k) matching contributions to become entirely theirs.

The majority (82%) of employers that offer traditional 401(k) plans say they match a portion of their workers' account contributions, according to a report from human resources firm XpertHR. However, the research shows that just 28% let employees immediately take full ownership of that extra amount.

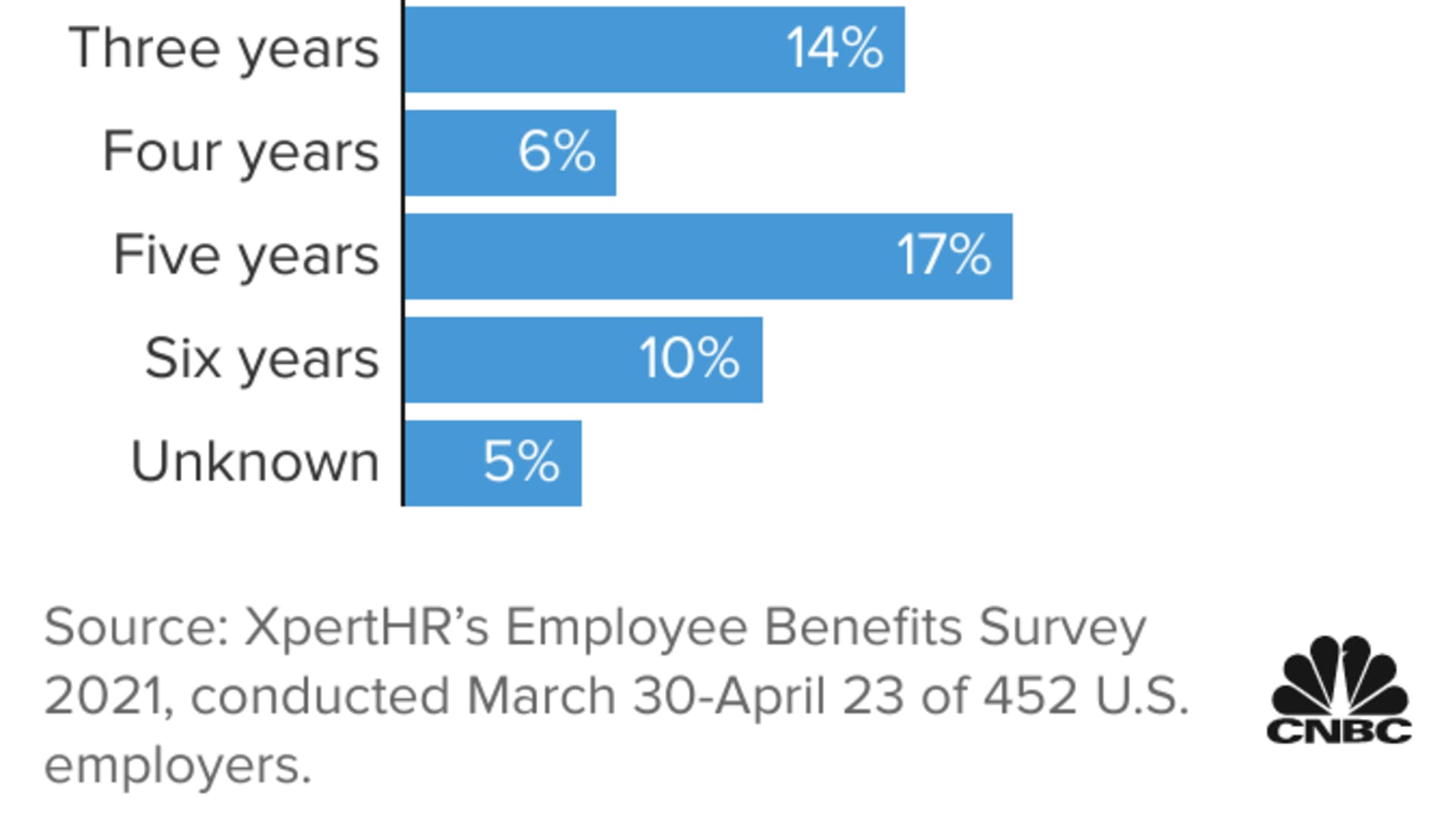

Otherwise, vesting times — how long you must work at the company for its matching contributions to be 100% yours — range from up to one year (13%) to six years (10%).

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

"Employers who do not [immediately] 100% vest the match do so because they want to reward longer-service employees," said Robyn Credico, managing director of retirement at Willis Towers Watson, a business advisory firm.

Vesting either happens gradually — e.g., 20% of the match is credited after one year, 40% after two years, and so on — or occurs all at once after the vesting period. (And, of course, any contributions you make to your account are always 100% yours.)

Money Report

"The additional money saved by not vesting short-term employees can be used to provide a large match to longer-service employees," Credico said.

The median number of years that workers stay with an employer is 4.1 years, according to the Bureau of Labor Statistics. The XpertHR report shows that 28% of employers require a waiting period of more than four years.

Despite the potential for a long crediting schedule, it's still worth contributing at least enough to get your company match if you can afford to, experts say.

"Even if you don't think you're going to stay at a particular company long enough to get the match, it's still worth contributing at least enough to earn it," said Kathryn Hauer, a certified financial planner with Wilson David Investment Advisors in Aiken, South Carolina.

"Financial planners continually beat the 'save-for-retirement' drum, and the amount you need to put in a 401(k) to get the match is well below the amount you should save each year," Hauer said.

Additionally, you never know what the future may hold career-wise, she said. In other words, you may end up staying at a company longer than you originally anticipated.

If you are able to contribute more than just enough to get the match, financial advisors generally recommend you do. The contribution limit for 2021 is $19,500, with workers age 50 and older allowed an extra $6,500 as a "catch-up" contribution for a total of $26,000.

The most common matching formula, according to Fidelity Investments, is a 100% match for the first 3% of your salary that you contribute, with a 50% match for the next 2%.

By way of example: Say your annual salary is $50,000. If you were just to contribute enough to get the employer match, the most common matching formula would mean you contribute 5%, or $2,500, in a year, and your company would put in another $2,000 — totaling $4,500. If you did that for only one year, the money would be worth about $26,200 in 30 years, based on a 6% annual return, according to Fidelity.

If you were to do that five years in a row, with your salary increasing 2% yearly, your account would be worth roughly $69,000 in 30 years. Ten years in a row? The account would hit $202,300 in three decades. And the amount that came from the employer match would be $89,900 — 44% — of it.

Remember, too, that if you have a traditional 401(k) plan, your contributions are made pretax, which reduces your taxable income (and, in turn, how much you pay in taxes), although your withdrawals in retirement will be taxed. If it's a Roth, your contributions are made after-tax, but distributions later in life are generally tax-free.

And, whether you contribute to a traditional or Roth 401(k), the company's match always goes into the former and is not taxable compensation. Also, employer contributions do not count toward the contribution maximums.