As high school graduation festivities come to an end, a new milestone is ahead for families of first-year college students — making the first tuition payment.

Invoices for the fall semester are often sent out at the beginning of July and payments are typically due the first week of August. Yet some families still may worry they won't have the money to cover it.

It may not be too late in the game to ask the school for more money, experts say, depending on your circumstances.

As colleges and universities aim to boost enrollments, there may be opportunities for incoming students to negotiate for more financial aid.

More from Invest in You:

Here's what college graduates face and what they can do about it

4 tips for college students to build a secure financial future

Quick tips to help college students start saving money

"We're seeing colleges move the needle," said Matt Carpenter, founder and CEO of College Funding Services in Salem, Massachusetts. "There's just more wiggle room than there ever has been."

Money Report

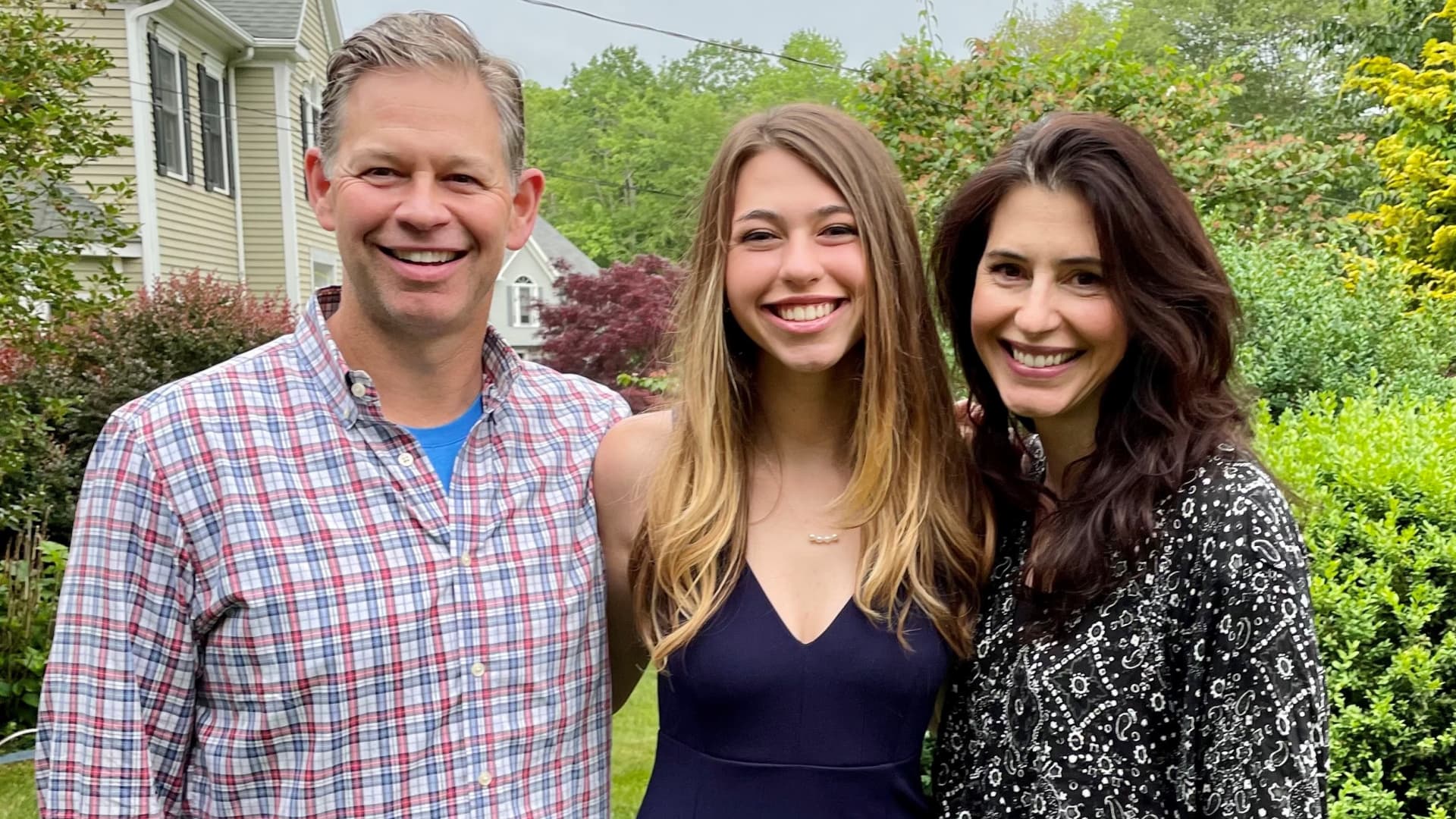

Julia Hull, a 2021 graduate of Trumbull High School in Connecticut, was thrilled when she got into her top college choice. And the most exciting part? The 18-year-old was accepted into Fairfield University's nursing school — and received a merit scholarship.

"I was really excited because I felt that all my hard work and all my late nights studying — it really paid off," she said.

Tuition, room, board and fees at the private university in Connecticut total around $70,000 for the 2021-22 school year. Julia's father Tom, 49, said her scholarship covers about 30% of the overall cost of attendance.

Even with that, Tom and his wife Lauren, 47, worried how they'd pay for the rest, since they didn't qualify for need-based financial aid.

"We were a little nervous and had some anxiety about whether we should go back to ask for more money or not," Tom said.

After meeting with a college funding consultant they decided to make the ask.

"We knew that there was a small window that we could be able to take advantage of," he said. "We wanted to maximize that and have the comfort knowing we weren't leaving any money on the table."

The Hull family followed their consultant's advice on how to officially "appeal" for more money.

"We made sure that we enclosed some of the letters of merit scholarship that she had for acceptances to show that we had some leverage," Tom said. "We asked for what I felt was a moderate appeal.

"We said, 'Our excitement level is very real ... if you can help us in this area that we'd be willing to commit.'"

And it worked.

Julia was awarded additional merit aid, covering about 3% of the cost of attendance, Tom said.

One-third of aid appeals succeed

Before the pandemic, about one-third of appeals were successful at most schools, said Robert Franek, editor of The Princeton Review. For the 2021-22 school year, he says that number has likely grown.

"Schools weathered some hard times in fall of 2020," he said. "But that doesn't mean they can't remain active and aggressive with financial aid and scholarship for those students that are coming into classes this year."

Financial aid decisions are made for this incoming freshman class based on federal income tax returns from 2019. In asking for more need-based aid, experts say be transparent about how your family's income and expenses have changed since then.

Juan Hernandez Ariano

"Be very specific, be very to the point," said certified financial planner , a director at WealthCreate in Houston. Explain in detail why you cannot afford the college you're trying to get into, he said.

You can also find free templates online that can help you write an appeal letter on your own.

Check out websites like Edmit, Road2College and SwiftStudent. Another website, TuitionFit, can help you compare your award letter to other offers that families with similar financial backgrounds have received so that you can use that information to help you ask for a better deal.

If a student gets additional financial aid or scholarship money, it is important to clarify whether the money is renewable or not, experts say. Typically, a student applies for need-based aid every year. Meanwhile scholarship money tends to be renewable as long as you maintain a certain GPA and credit load for courses.

And if you're not successful the first time you appeal, do not be discouraged.

"There's always a next year ... always future instances in which you will need to negotiate for financial aid," Hernandez Ariano said. "There's still hope."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: I used to owe $40,000 and now I’m on track to retire at 65 with over $1.5 million: Here’s my best advice via Grow with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.