The money you are putting into your 401(k) savings plan at work most likely won't be enough to retire early.

The average American in their 20s only has about $15,000 in their 401(k).

You're going to need to invest a lot more of your income if you want to save millions of dollars.

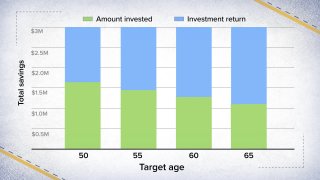

To save $3 million by the time you are 50, you'll have to put away a substantial amount as soon as you land your first job.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

CNBC crunched a range of numbers to give you some options.

Here's how much you will need to start investing every month to reach $3 million — broken down by your target age.

First, let's go over how we got the numbers. The math assumes you are starting with no money in savings, that your investments will earn 4% in annual returns, and that you begin saving at 22 and fresh out of college.

Money Report

Check out this video to dive into the figures.

More from Invest in You:

How Walmart and other big companies are trying to recruit more teenage employees

Americans are more in debt than ever and experts say 'money disorders' may be to blame

How much money do you need to retire? Start with $1.7 million

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.