- Sam's Club announced it is testing a new app-based feature, Scan & Ship, that allows people to use a smartphone to buy items in the club and send purchases directly to the home.

- It's another example of how the warehouse club is using digital approaches to stand out from competitors like Costco.

- The warehouse club has acted as a tech incubator for parent company Walmart.

For Sam's Club shoppers, a trip to the store typically means lugging home big and often cumbersome items. A month's supply of diapers. Lawn chairs. Large cartons of chicken broth or giant boxes of cereal.

The Walmart-owned membership club is flipping that on its head as it tests a new digital tool. Customers at select clubs can browse the aisles, retrieve items that fit in the car trunk and ship other purchases directly to the home. They can check out all purchases in a single transaction on their smartphones.

Sam's Club CEO Kath McLay said the company sees technology as a way to improve the customer experience and build on its gains over the past year.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

"We want to have great items. We want to have disruptive prices. And we want to make sure that we're providing convenience to our members," she told CNBC. "What we really learned through the pandemic was that we need to stay true to that strategy."

During the health crisis, Sam's Club rolled out curbside pickup to all its stores, as customers sought fast, contactless ways to pick up online purchases. The Scan & Ship service, announced Tuesday, is the latest way that Sam's Club is using digital options to stand out from competitors. It will become a feature of Scan & Go, which allows customers to ring up purchases with a smartphone as they add items to their shopping carts.

The company has designed and launched app-based tools for employees, too, including a voice-enabled service called Ask Sam that helps locate items and answer customers' questions.

Money Report

By testing and launching new ways for consumers to shop, Sam's Club has driven its own growth and become a tech incubator for its parent company.

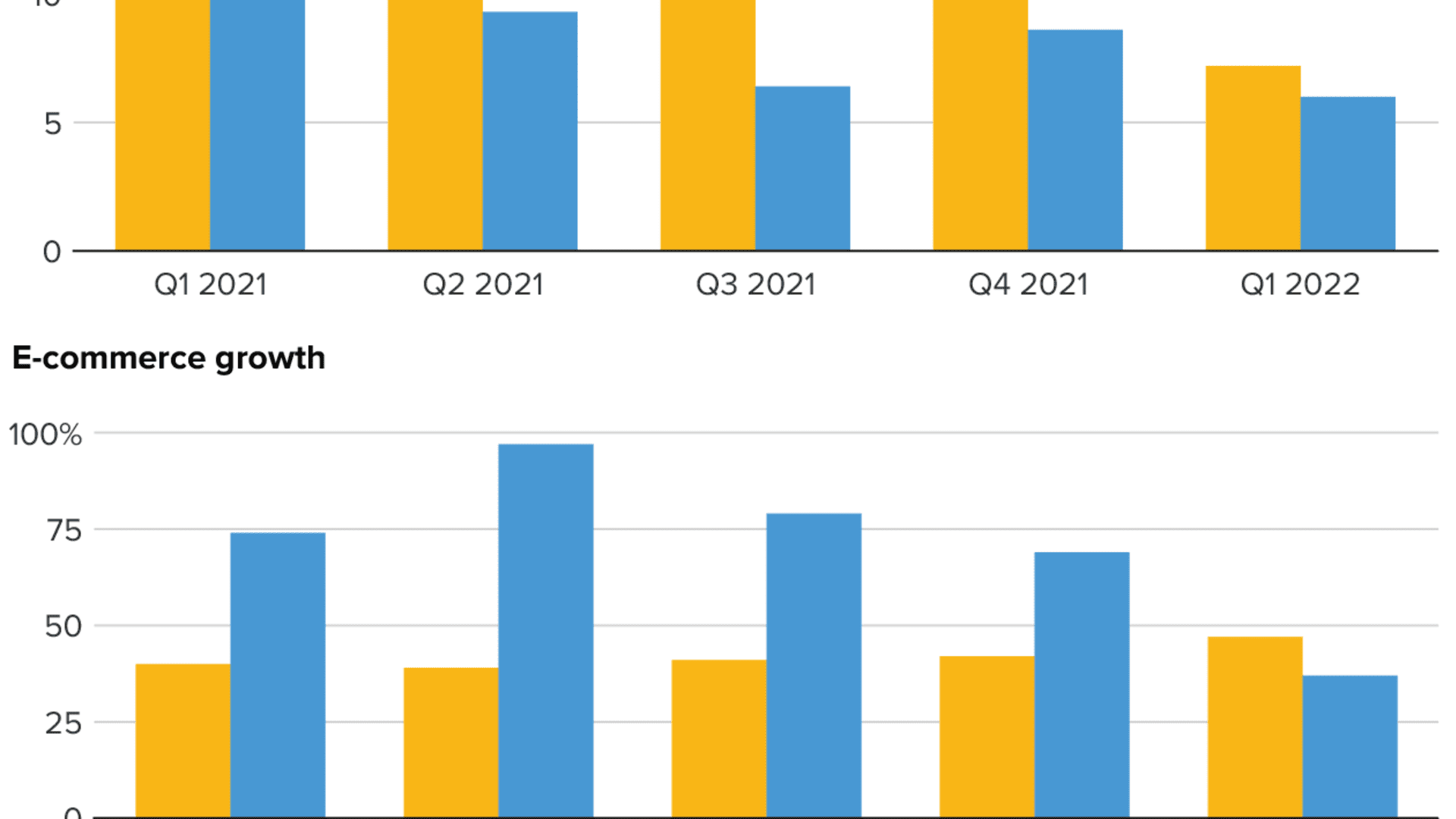

Comparable sales, a key metric that tracks sales at stores open for at least the past 12 months and online, have grown faster at Sam's Club than Walmart over the past year. In the first quarter ended April 30, Sam's Club's comparable sales growth and e-commerce growth outpaced its parent company as they rose 7.2% and 47%, respectively, compared with 6% and 37% at Walmart U.S.

Total membership at the warehouse club also hit an all-time high in the first quarter. The company does not disclose how many members it has.

A moment to shine

Warehouse clubs had a moment to shine during the pandemic as stock-up trips became the norm and some necessities, such as soap and paper towels, were hard to find. Shares of Costco and B.J.'s Warehouse Club outperformed the S&P 500 last year. BJ's stock rose nearly 64%, while Costco shares climbed 28% in 2020 compared with the 16% lift in the S&P 500.

The gains have been more modest since January. Costco shares increased 8% year to date, but the stock is trading near a 52-week high. It closed Monday at $407.88, giving it a market value of $180.31 billion. B.J.'s, which has a much smaller store footprint, closed at $48.19, bringing its market cap to $6.61 billion. Shares have climbed more than 29% year to date.

Walmart shares, which gained 21% last year, also surpassed the S&P 500. But Walmart's stock is down nearly 3% this year, bringing its market value to $392.44 billion. Investors have been worried about whether Walmart will be able top last year's strong performance.

Warehouse clubs have endured since Covid, surprising some investors who chalked up membership gains to a "period of panic" during the pandemic, said Steph Wissink, a managing director and retail analyst for Jefferies. Many of those customers are renewing memberships and continuing to fill up baskets, she said.

"It wasn't just a fleeting experience because of safety and stock-ups," she said. "It was a true destination change. They're buying more of their goods for their household."

Real estate and demographic trends are expanding the clubs' potential audience, Wissink said. As millennials get older, some are buying homes in the suburbs and living closer to warehouse clubs. Companies' new attitudes toward remote work have inspired some people to move out of cities into houses with bigger yards, closets and pantries.

"Buying two jugs of ketchup or buying two loaves of bread, all the sudden becomes a possibility," Wissink said.

The mix of items in baskets has changed in recent months, too, she said, as shoppers spent stimulus checks and bought more general merchandise like furniture and electronics.

McLay said Sam's Club has been surprised by some of the new patterns. For instance, she said, 45-count packs of toilet paper have remained a hot item because people became used to having backup inventory in their pantry. Food for home has sold at higher rates because workers with hybrid schedules now split their weeks between the home office and the corporate one.

Blending online, in-person shopping

McLay describes Scan & Go as "the closest you can get to an online purchase in the club."

Sam's Club, which has nearly 600 stores and about 100,000 employees, launched Scan & Go in 2016. Two years later, it opened Sam's Club Now, a smaller store in Dallas where it tests new tech with customers. A short drive from that store, it opened an innovation center in downtown Dallas with nearly 300 engineers, user experience designers and data scientists who help design Sam's Club technology.

Scan & Go gained new relevance over the past year, McLay said. It saw a nearly 44% increase in members using the Scan & Go app in the first quarter from a year earlier.

"I keep saying to the team, it felt like it was a product that we created, which was waiting for a moment like a pandemic, because people just absolutely flocked to contactless payment. And there it was ready to go," McLay said at a virtual conference hosted by Jefferies in June.

With Scan & Ship, Sam's Club will bring online and offline even closer together, McLay said. It is being tested in three stores: a club in Murrieta, California; one in McKinney, Texas; and the Sam's Club Now in Dallas. For Sam's Club Plus members, shipping to the home is free.

Eventually, the direct shipping feature will be expanded to other clubs and to more items, from playsets and patio furniture to mattresses.

Tim Simmons, chief product officer for Sam's Club, said stores may drive more sales by making certain purchases less of a hassle. "I would probably put more things in my cart if I didn't have to haul it home," he said.

The feature could also be used to sell out-of-stock items, merchandise that comes in other colors or sizes, or items like a motorcycle or bike that can be tricky to store in multiples on the sales floor, he said.

The goal is to make customer experience better, Simmons said. Over the past three years, it has taken numerous steps to achieve this. At its member services desk, it swapped out eight pieces of hardware for an iPad to speed up returns and sign-ups for new members. It turned binders of spreadsheets into a tool that uses machine learning to help bakers, butchers and other employees predict how many birthday cakes, rotisserie chickens or hoagies customers will need, based on past sales and factors like major holidays or weather patterns. And smartphone-based tools help workers prioritize tasks on the sales floor, such as restocking items, and assist managers in tracking the club's sales metrics.

Some of the technology born at Sam's Club is now used by Walmart — such as Ask Sam and Scan & Go, which is available to Walmart shoppers who belong to its membership program, Walmart+.

Along with serving as a tech incubator, Sam's Club has been a training ground for executives who have become senior leaders at Walmart and beyond. Doug McMillon was Sam's Club CEO before he became Walmart CEO. John Furner, another former CEO of Sam's Club, now leads Walmart's U.S. business as its president and CEO. And Roz Brewer, former Sam's Club CEO, went on to become chief operating officer at Starbucks and recently became CEO of Walgreens Boots Alliance.

Fending off Costco

For Sam's Club, technology is also a differentiator from Costco, its biggest rival.

Costco caters to a higher income consumer and charges more for its service, but it has been slower to adopt new features like curbside pickup. At the moment, that option is in a pilot phase at three clubs in New Mexico.

The average Costco member has a household income of more than $100,000 a year. They pay $60 to $120 a year for a premium membership. By comparison, a typical Sam's Club member has a household income of $75,000 to $100,000 and pays about $45 per year for a basic membership or up to $100 for a Plus membership. The figures are based on company comments and estimates by Jefferies. Costco has 60.6 million members, as of its most recent quarter that ended in May. Sam's Club does not disclose total membership.

According to Wissink, Costco emphasizes lucrative services that can quickly tally up, such as booking a car rental or vacation or ordering a hearing aid.

"You see that increasingly they have volume and value created beyond the walls of their boxes," she said.

So far that's working in Costco's favor. It drives nearly twice as much annual revenue per store as Sam's Club. It has a slightly larger footprint at those stores, 146,000 square feet on average at Costco compared with134,000 square feet at Sam's.

But Sam's Club has "always been more on the leading edge when it comes to digital integration," Wissink said.

Take the two companies' apps. Sam's Club app was downloaded almost twice as much as Costco's app last year in the U.S. — about 9.6 million times versus 4.9 million times, according to Apptopia, a company that tracks mobile apps' performance. Customers have given the Sam's Club app higher marks, too, with 78% of Sam's Club's users giving it positive reviews versus just 27% for Costco, according to Apptopia.

So far, the tech advantage isn't hurting Costco's performance, Wissink said. But it's possible that it could over time.

According to McLay, Scan & Go is "one of the stickiest products" Sam's Club has developed and it is "one of the most significant elements of why people renew with us."

McLay knows this because Sam's Club closely monitors factors that increase the chance of a member renewing.

"It's one of those things that is a little addictive," she said. "Once you do start using it and you have to go back and actually wait in a line in a retail outlet, it feels very yesterday."

—CNBC's Christopher Hayes contributed to this report.