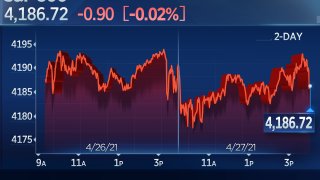

The S&P 500 closed little changed near its record level on Tuesday as investors braced for a big batch of tech earnings.

The broad equity benchmark ended the day less than 0.1% lower at 4,186.72 after hitting a record high in the previous session. The Dow Jones Industrial Average also closed flat at 33,984.93. The tech-heavy Nasdaq Composite slid 0.3% to 14,090.22.

Shares of Tesla fell 4.5% even after the electric carmaker posted record net income of $438 million. Tesla also beat Wall Street's earnings and revenue expectations handily, boosted by sales of bitcoin and regulatory credits. The shares have struggled this year, off by more than 20% from their record. The stock is still up more than 300% over the last 12 months.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

UPS shares soared more than 10% after earnings blew past Wall Street estimates. The company said first-quarter revenue was up 27%.

The first-quarter earnings season kicked into high gear this week with key megacap tech companies such as Alphabet, Microsoft and AMD reporting after the bell Tuesday. Apple and Facebook earnings follow on Wednesday after the bell.

"Despite the fact that expectations are high, I believe that we are going to see the FANG stocks deliver and I think that's the catalyst to continue the trajectory of the S&P 500 to new all-time highs," said Jeff Kilburg, chief investment officer at Sanctuary Wealth. "That's the paramount focus of the week."

Money Report

So far, with about a third of the S&P 500 having reported numbers, 84% of companies have turned in a positive earnings surprise, according to FactSet. However, stock moves have been relatively muted following the strong results with the market standing at record levels with high valuations.

On the data front, home prices in February registered the biggest gain in 15 years, rising 12% year over year and up from 11.2% in January, according to the S&P CoreLogic Case-Shiller home price index.

Meanwhile, consumer confidence climbed sharply to hit a pandemic high with The Conference Board's index jumping to 121.7, the highest since February 2020.

GameStop's stock jumped more than 5% after the video game retailer said it sold 3.5 million additional shares, raising $551 million to speed up the company's e-commerce transformation.

"Strong breadth measures suggest stocks still may have more upside," said Jeff Buchbinder, equity strategist at LPL Financial. "While valuations are elevated, they still appear reasonable when factoring in interest rates and inflation."

The Federal Reserve kicked off its two-day policy meeting Tuesday. The central bank is not expected to take any action, but economists expect it to defend its policy to let inflation run hot.

The latest CNBC Fed Survey sees the central bank staying on hold and keeping its asset-buying program in place at the same levels for the rest of 2021, despite growing concerns about an overheating economy.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now