Stocks fell on Wednesday as traders looked to the end of a losing year and braced themselves for 2023.

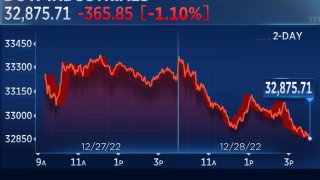

The Dow Jones Industrial Average lost 365.85 points, or 1.1%, to 32,875.71. The S&P 500 fell 1.2% to 3,783.22, and the Nasdaq Composite dropped 1.35% to 10,213.29.

Apple weighed heavily on the Dow as it broke a key level and fell to another 52-week low{

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Apple breaks key technical level, sets new 52-week low

Apple fell through the key $129 level and set a new 52-week low for a second day Wednesday.

Some analysts look at Apple, the largest market cap stock, as a bellwether for the overall market and a major influence on investor sentiment.

Money Report

"It's not great for the overall market," said Todd Sohn, technical analyst at Strategas. "The end of year is a funky time, but if it continues into the first couple of weeks of the year, it's for real."

Apple fell through $129 support in early trading Wednesday and touched a low of $126.41 before reversing. The stock was at $127.15 in afternoon trading.

"If your largest weight is weak and making new lows, that's not great. Your top player is not scoring," he said. Sohn said the five largest market cap names are still losing steam. "The silver lining is the influence on the (S&P 500) index is dropping."

--Patti Domm

Energy was the biggest laggard in the S&P 500 as oil and natural gas prices slid. EQT, APA and Marathon Oil were among the notable losers in the index. Meanwhile, Southwest Airlines continued its slide as it canceled flights amid severe winter weather conditions. The shares fell more than 5%.

"Stocks finally clawed into the green in unison, but it didn't hold," said said Louis Navellier, founder and chief investment officer of growth investing firm Navellier & Associates. "On low volume, the market is trying its best to keep its head above water after a disappointing start to the official Santa Claus rally. It's a bit of reversion to the mean as sectors hit hardest are seeing some bottom fishing."

"The market appears to be exhausted, understandably, no longer expecting a large technical rally and just hoping to get to Friday afternoon without any further meaningful losses," Navellier added. "Most of the year's major uncertainties: China [and] Covid, the war in Ukraine, tight energy supplies and hawkish central banks, will be waiting for us on the other side."

As the final week of trading winds down, the stock market is on track for its worst year since 2008. The Nasdaq has performed the worst of the three indexes, losing 34.7% this year as investors rotated out of growth stocks amid rising recession fears. The tech companies within the Nasdaq are also most sensitive to interest rate hikes. The Dow and S&P 500 are on track to lose 9.5% and 20.6%, respectively.

Economic data releases on Wednesday included pending home sales, which slipped 4.0% in November on a monthly basis, according to the National Association of Realtors. The drop came as high mortgage rates gave prospective buyers cold feet. Economists polled by Dow Jones had expected a decline of 1.8%.

"There are clear signs that the economy is slowing, as demonstrated today by pending home sales falling to the second lowest level on record," said Brian Levitt, global market strategist at Invesco. "Home sales are historically a good driver of economic activity as a new home sale supports many industries. At the same time rates continue to edge up as the Fed still signals a hawkish stance. In short, investors are hoping for the proverbial soft landing but challenges persist."

Lea la cobertura del mercado de hoy en español aquí.

Just in time for winter bills, nat gas touches lowest price since mid-March

January natural gas settled 10.9% lower Wednesday at $4.709 per thousand cubic feet, briefly touching $4.588, which was the lowest since March 15, less than a month after Russia invaded Ukraine.

Nat gas is lower by 32.1% so far in December, on pace for its third down month in four. But year-to-date, nat gas is still higher by 26.3% in 2022, and on the verge of posting its third straight annual advance after soaring almost 47% in 2021.

The rest of the energy complex has weakened too. February West Texas Intermediate crude oil is down 2% in December and on track to fall for the sixth month in seven. Same for North Sea Brent. Same for January gasoline contracts.

— Scott Schnipper, Gina Francolla

Stocks close lower on Wednesday

All of the major averages fell to end the day Wednesday.

The Dow Jones Industrial Average lost 366.55 points, or 1.1%. The S&P 500 fell 1.2% and the Nasdaq Composite fell 1.35%.

— Tanaya Macheel

CNBC Pro: China eases its Covid restrictions. That could spell a buying opportunity in these stocks

An reopening in the world's second-largest economy could spell a buying opportunity for investors as China unwinds much of its Covid restrictions.

Investors have taken recent developments as a signal to start snapping up China equities. They expect that China's economy could get a boost in 2023, while the U.S. and Europe continue to deal with the lagging effect of monetary tightening that could put a damper on economic growth.

"A lot of institutional investors have been very underweight Chinese equities," said Carlos Asilis, co-founder and CIO at Glovista Investments.

"And I think that that's been a mistake, because it has ignored this very important potential baseline case which is now being priced in, which is that of the Chinese economy undergoing next year a similar recovery path that we saw this year in the case of the United States," he added.

CNBC Pro subscribers can read the full story here.

— Sarah Min

Consumer and communications stocks aided in $10 trillion market rout in 2022

The U.S. stock market is down more than $10 trillion in 2022, and while tech stocks are the single biggest contributor, consumer discretionary and communications services stocks combined account for an even larger percentage of the loss.

That's according to a study by Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, which found that seven stocks (Amazon, Apple, Alphabet, Microsoft, Tesla, Meta Platforms and Nvidia) accounted for half the total decline.

Stocks in the S&P 500 index lost a combined $8.2 trillion. Tech stocks accounted for a majority (43% of the $8.2 trillion), trailed by consumer discretionary (23%) and communication services (21%).

Silverblatt used the S&P U.S. Broad Market Index, consisting of roughly 2,500 stocks, to measure the total market decline of $10 trillion.

— Scott Schnipper, Robert Hum and Christina Cheddar-Berk

First-quarter market rallies will be 'short-lived,' CIO says

Stocks could rally in the first quarter of 2023 on the back of data that signals slowing inflation, which could in turn signal the Federal Reserve can slow rate hikes, according to Richard Saperstein, chief investment officer of Treasury Partners.

But don't expect any long-term rallies, he said.

"We expect these stock market rallies to be short-lived," he said. "As the economy slows due to the lag effects of Fed tightening, we expect lower earnings estimates, which is likely to put pressure on stock prices for the balance of 2023."

— Alex Harring

U.S. will require negative Covid test from China travelers

Airline passengers entering the U.S. from China will need to have a negative Covid test, a federal health official announced on Wednesday.

The rule goes into effect on Jan. 5 and applies to all travelers who are at least two years of age from China, Hong Kong and Macau. The rule applies regardless of nationality or vaccination status.

After attempting a zero Covid policy for much longer than other major countries, China is now seeing a wave of infections after rolling back its public health restrictions in recen weeks.

— Jesse Pound

Apple breaks key technical level, sets new 52-week low

Apple fell through the key $129 level and set a new 52-week low for a second day Wednesday.

Some analysts look at Apple, the largest market cap stock, as a bellwether for the overall market and a major influence on investor sentiment.

"It's not great for the overall market," said Todd Sohn, technical analyst at Strategas. "The end of year is a funky time, but if it continues into the first couple of weeks of the year, it's for real."

Apple fell through $129 support in early trading Wednesday and touched a low of $126.41 before reversing. The stock was at $127.15 in afternoon trading.

"If your largest weight is weak and making new lows, that's not great. Your top player is not scoring," he said. Sohn said the five largest market cap names are still losing steam. "The silver lining is the influence on the (S&P 500) index is dropping."

--Patti Domm

Merck, Travelers among S&P 500 stocks hitting new highs

A handful of S&P 500 stocks traded near new record highs Wednesday despite the market selloff trend.

That included shares of Merck, which traded near levels dating back to at least 1978. Travelers also hovered near all-time highs back to its spin-off from Citi in 2002.

These stocks also hit new highs:

- Conagra Brands trading at levels not seen since August 2020

- Campbell Soup Company trading at levels not seen since June 2017

- Lamb Weston trading at levels not seen since February 2020

- Chubb trading at all-time high levels back through 1993 (ACE and Chubb are now one company)

- Hartford Financial trading at levels not seen since October 2021

- PG&E trading at levels not seen since February 2020

Technology stocks Amazon and Apple, meanwhile, traded near lows not seen since March 2020 and June 2021, respectively.

Tesla shares rose slightly, but traded near August 2020 lows, while Signature Bank hit levels last seen in November 2020.

— Samantha Subin, Chris Hayes

Stocks making the biggest moves midday

Check out the stocks making the biggest moves midday:

- AMC Entertainment – The entertainment stock dropped about 3% a day after CEO Adam Aron tweeted that he asked the company's board to freeze his 2023 pay and urged other executives to forgo salary bumps.

- Kala Pharmaceuticals — The biopharmaceutical company surged more than 200% following the Food and Drug Administration's acceptance of an investigational new drug application for its potential treatment for persistent corneal epithelial defect.

- Southwest Airlines – Shares of the airline dropped 2.5% as it continues to run a reduced schedule.

See the full list here.

— Alex Harring

Nasdaq Composite on track for worst December ever

The Santa Clause rally appears to be hibernating in 2022, and that could make for a historically bad December for the Nasdaq Composite.

According to Bespoke Investment Group, Wednesday's declines brought the Nasdaq's monthly return to -10.7%.

That would be the worst December on record for the tech-heavy index, surpassing 2002's 9.7% decline. A 9.5% decline in 2018 is the only other historical December that is nearly as rough as this year's, according to Bespoke.

— Jesse Pound

Stocks fall midday, Dow briefly falls 300 points

Although stocks were climbing to start the trading day, they reversed lower shortly after the open, with the Dow Jones Industrial Average briefly sliding 300 points.

Around noon, the Dow was down 296 points, or 0.9%. The S&P 500 fell 1% and the Nasdaq Composite dropped 1.2%.

— Tanaya Macheel

Investor Kari Firestone on how to navigate the market in 2023

A tough year for markets is coming to an end, with another dour outlook ahead for 2023.

But according to investor Kari Firestone, there are several reasons to remain optimistic in the new year.

The CEO and co-founder of Aureus Asset Management weighs in on valuations, and what the data shows about the S&P 500's performance following a down year.

CNBC Pro subscribers can read the full story here.

— Samantha Subin

Manufacturing outlook improves in Richmond area, Fed survey shows

Manufacturing activity in the northern Virginia and Delmarva area moved out of contraction territory in December as the shipment, new orders and jobs outlook improved.

The Richmond Federal Reserve's manufacturing index for December registered a plus-1 reading, up from -9 in November and considerably better than the -10 Dow Jones estimate. The index gauges the percentage of businesses reporting expansion vs. contraction.

There were, however, signs of inflation, as the wages index jumped 12 points to 37, while the prices paid and received indexes remained in positive territory, though with slightly lower readings than in November. Expectations indexes also were generally downbeat, particularly for local business conditions, which posted a -20 reading, compared to -1 in November.

The district covers the Baltimore, Richmond and Charlotte, N.C. regions.

—Jeff Cox

Tesla shares rebound

Shares of the electric vehicle maker rose 4% Wednesday.

In the previous session, the stock suffered an 11% drop after The Wall Street Journal reported the company will continue a weeklong production pause at a Shanghai facility. Tuesday marked the seventh straight day of losses for the stock.

That comes at the end of a tumultuous year for the electric-vehicle maker as owner Elon Musk executed a chaotic purchase of Twitter. Tesla's share value is down 69% this year.

"A year ago, Musk was a hero and there was panic buying to the upside," said Eric Jackson, founder of EMJ Capital, on "Closing Bell: Overtime." "Right now ... it's panic selling."

— Tanaya Macheel

Stocks open flat on Wednesday

The major averages were little changed to begin trading on Wednesday morning.

The Dow Jones Industrial Average rose 3 points. The S&P 500 opened just above the flat line while the Nasdaq Composite fell slightly.

— Tanaya Macheel

What to expect from fintech stocks in the new year

This year saw the deflating of several asset categories, from crypto to megacap technology, as the Federal Reserve raised interest rates.

Fintech companies are also in the midst of a reset. Many of them — particularly those dealing directly with retail borrowers — will be forced to shut down or sell themselves next year as startups run out of funding, according to investors, founders and investment bankers. Others will accept funding at steep valuation haircuts or onerous terms, which extends the runway but comes with its own risks, they said.

Read the full story here.

—Hugh Son

Stocks making the biggest moves in premarket trading

These are the stocks making the biggest moves in early morning trading:

- Tesla – Tesla gained 1.6% in the premarket, following a 7-day losing streak and declines in 10 of the past 11 sessions. Baird reduced its price target on the stock but continues to rate the stock "outperform".

- AMC Entertainment – AMC Entertainment rose 1.2% in premarket trading after CEO Adam Aron asked the movie theater chain's board to freeze his salary and urged other top AMC executives to do the same.

- Southwest Airlines – Southwest Airlines fell 1.3% in premarket action as it continued to cancel flights in its struggle to return to a normal schedule. Southwest has canceled thousands of flights over the past week following a severe winter storm and is limiting bookings over the next few days.

Check out our full list of early morning movers here.

— Peter Schacknow, Tanaya Macheel

European markets cautious as investors assess 2023 headwinds

European markets were mixed on Wednesday as investors look ahead to the various economic headwinds coming down the pike in 2023.

The pan-European Stoxx 600 index hovered around the flatline in early trade, with basic resources gaining 1% while tech stocks dropped 0.5%.

European stocks were buoyed on Tuesday after China officially announced that it will end quarantine for inbound travelers on Jan. 8 — symbolizing an end to the zero-Covid policy that it has held for nearly three years. Britain's FTSE 100 was closed for a public holiday on Tuesday and reopened Wednesday.

- Elliot Smith

Platinum on pace for best quarter since 2009

Platinum is on track for its best quarter since 2009 — and stocks associated with the metal are also posting strong performances.

The metal is trading up nearly 19.86% compared with the start of the quarter. That's the best performance platinum has seen since the first quarter of 2009, when it gained 19.89%.

If platinum surpasses that quarter, it will be the best quarter since the first in 2008. In that period, it gained 33.96%.

Stocks associated with platinum are rising in turn. During this quarter, Impala Platinum added 31.7%. Anglo American Platinum and Sibanye Stillwater followed, gaining 21% and 17.6%, respectively, in the same period.

The Platinum Investment Council attributed some of the price increase to physical stocks of the metal being imported into China, which has decreased supply elsewhere.

— Alex Harring, Gina Francolla

Tesla continues sliding after hours

Tesla continued falling in post-bell trading, losing 1.4%.

The move follows a Wall Street Journal report showing production at a Shanghai facility would remain paused as Covid spread among its Chinese workforce.

The stock lost 11% in Tuesday trading, marking the seventh straight day of declines. Tesla is on track for its worst month, quarter and year on record.

— Alex Harring

Stock futures open flat

The three major future indexes opened near flat as after-hour trading kicked off.

Futures connected to the Dow opened up just 9 points, trading near flat. S&P 500 and Nasdaq 100 futures also both opened near flat.

— Alex Harring