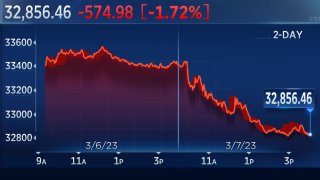

Stocks sold off sharply{

Stocks finish lower, Dow sheds 574.98 points

Stocks finished lower Tuesday after Federal Reserve Chair Jerome Powell hinted at higher rates.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

The Dow Jones Industrial Average shed 574.98 points, or 1.72%, to end at 32,856.46, while the S&P 500 lost 1.53% to close at 3,986.37 and below the 4,000 level. The Nasdaq Composite dropped 1.25% to settle at 11,530.33

— Samantha Subin

The Dow Jones Industrial Average shed 574.98 points, or 1.72%, to end at 32,856.46. The S&P 500 lost 1.53% to close at 3,986.37 and below the 4,000 level. The Nasdaq Composite dropped 1.25% to settle at 11,530.33.

Money Report

As the major stock indexes fell, the 2-year Treasury yield jumped to its highest level since 2007 at 5%. Tuesday's selloff brings the Dow into negative territory for 2023, down about 0.9%. The S&P and Nasdaq are up about 3.8% and 10.2%, respectively, for the year.

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell said in remarks to the Senate Banking, Housing and Urban Affairs Committee Tuesday morning. "If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

The comments indicated that the Fed may consider a larger rate hike than last month's 25 basis point increase at its next policy meeting on March 21-22.

They also signaled a potential return to a half-point rate hike at the central bank's March meeting, depending on the strength of incoming economic data, according to Morgan Stanley.

Powell's remarks could also mean that the peak rate for federal funds, also called the terminal rate, will likely go higher than previously expected, despite investor hopes that the Fed might stop hiking soon.

"This isn't surprising news, but it's a tough reminder for markets after such a brisk rally," said eToro U.S. investment analyst Callie Cox. "The Fed's top priority is getting inflation down, and for good reason. People are starting to factor in persistently higher inflation, which could be the worst-case scenario for long-term investors and run the risk of prices spiraling higher."

Bank shares led the losses as investors feared more rate hikes will tip the economy into a recession. Wells Fargo lost 4.7%. Bank of America, Goldman Sachs and JPMorgan Chase lost about 3% each. Mega-cap tech stocks also tumbled, with Apple, Alphabet and Microsoft falling at least 1% each.

Airline stocks bucked the broader{

Airlines outperform in a down market after DOJ blocks JetBlue's Spirit acquisition

Airlines are notable outperformers Tuesday after the Justice Department sought to block JetBlue's proposed $3.8 billion acquisition of Spirit Airlines on antitrust grounds.

The idea behind the rally is that legacy carriers will face less intense competition from a strengthened rival if Jet Blue and Spirit are not allowed to combine.

United Air (UAL) was rallying 4% in midday trading Tuesday, followed by Delta (DAL) at 2.3%, Alaska (ALK) up 2.1%, American (AAL) ahead 2% and Southwest (LUV) higher by 0.5%. (Separately, Evercore ISI upgraded Delta to overweight from in-line earlier in the day.)

The 20-stock Dow Transportation Average is up 12.2% year to date, more than twice the 5.8% gain in the S&P 500, despite the recent downtown in the rails (Norfolk Southern is off 2.8% Tuesday while CSX is lower by 2%).

The S&P Airlines Index, meanwhile, is higher by 2.1% Tuesday and up 19.3% year to date. The airlines as a group are 34.2% above their 52-week low, according to FactSet data.

— Scott Schnipper

sued to blockPowell's comments raise the stakes for February's jobs report out Friday morning, which could show a resilient labor market that allows the Fed to keep hiking. Economists expect 225,000 jobs were added last month, according to a Dow Jones survey.

Stocks finish lower, Dow sheds 574.98 points

Stocks finished lower Tuesday after Federal Reserve Chair Jerome Powell hinted at higher rates.

The Dow Jones Industrial Average shed 574.98 points, or 1.72%, to end at 32,856.46, while the S&P 500 lost 1.53% to close at 3,986.37 and below the 4,000 level. The Nasdaq Composite dropped 1.25% to settle at 11,530.33

— Samantha Subin

Six new S&P 500 52-week lows include Boston Properties at 13-year low

Six new 52-week lows in the S&P 500 on Tuesday included one office REIT that dropped to its weakest point in 13 years.

- Lumen Technologies (LUMN), all-time low back to CenturyTel/Embarq merger that created CenturyLink in 2008

- Hormel (HRL), lowest since March 2020

- Tyson Foods (TSN), lowest since Nov. 2020

- Centene (CNC), lowest since Oct. 2021

- CVS Health (CVS), lowest since August 2021

- Boston Properties (BXP), lowest since February 2010

— Scott Schnipper, Christopher Hayes

Jefferies names Oracle as a "tactical value pick"

Jefferies is bullish on Oracle shares, saying that investors can "expect more tailwinds than headwinds" on the software company.

"With two upcoming quarters of easier comps, short-term on-premise tailwinds from a softer public cloud demand backdrop, and a positive read through to back office app demand from WDAY, we believe growth expectations are reasonable," analyst Brent Thill wrote in a Tuesday note.

"We think that management announcing FY26 targets on the top and bottom lines at its analyst day signal increased confidence and visibility into the growth drivers of the business," Thill added.

Jefferies set its price target to $105, implying 18% upside from Monday's closing price. Oracle shares have gained about 8% in 2023.

— Hakyung Kim

F/m Investments adds six-month T-bill ETF to Benchmark series lineup

F/m Investments is launching the fifth fund in its US Benchmark series, which tracks specific parts of the Treasury curve.

The newest fund, the US Treasury 6 Month Bill ETF, will trade under the ticker XBIL. It is slated to begin trading on Tuesday.

Some of the short end funds in the series, which began last year, have found traction with investors. The three-month (TBIL) and 2-year (UTWO) Treasury funds each have more than $300 million in assets.

The funds are designed to hold the most current "on the run" Treasuries of the stated maturity. They are not derivative based products like single-stock ETFs.

"With this launch of XBIL, we're responding to investor demand for simplified access to the highest yielding US Treasury security today, with 6-month Treasuries yielding over 5%," said Alexander Morris, F/m's President and CIO, said in a press release.

— Jesse Pound

iPhone sell-through in China at 10% growth YTD, Barclays says

The percentage of Apple's iPhones sold in China has grown about 10% year-to-date, Barclays estimates – although growth decelerated to low single digits in the last three weeks.

The firm attributes the strength to better supply, pent up demand post Covid and price promotions, but said it doubts it's sustainable.

Meanwhile, February App Store growth surprised to the downside by posting 1% decline.

"Overall, we believe China reopening should benefit travel and entertainment first, not electronics/goods, which has been the sentiment we picked up from our on the ground checks. Higher inflation along with China reopening could also dampen consumer demand for electronics."

Barclays has an equal weight rating on Apple and a $145 price target.

— Tanaya Macheel

This 'major earnings driver' makes Bank of America the top retail bank, Mayo says

The key advantage Bank of America has is its technology, which helps it serve more customers at lower cost than rivals, Wells Fargo analyst Mike Mayo wrote recently.

The continuing benefits from its technology implementation will give Bank of America the "best 2023 spread of revenue vs. expense growth" and higher profit margins, Mayo wrote in a March 6 note.

CEO Brian Moynihan has preached the benefits of his "responsible growth" mantra, which has leaned heavily on technology to serve customers as he trims costs. The second biggest U.S. bank by assets after JPMorgan Chase already has the most efficient consumer banking division, with its efficiency ratio improving from 57% in 2021 to an estimated 46% by 2025.

"BAC can now serve more customers, provide more services, engage more often, and do so at lower cost," Mayo said.

In January, Mayo wrote that Bank of America shares could climb 55% this year on rising margins and earnings.

— Hugh Son

Virgin Galactic's cash burn is getting worse, Wells Fargo says

The free cash flow picture for Virgin Galactic is getting worse, according to Wells Fargo.

Analyst Matthew Akers, who has an underweight rating on the stock, said in a note to clients Tuesday that he expects the company to burn through more than $600 million in cash in 2023 and 2024.

"While SPCE still aims for a Q2 2023 commercial launch, its cash burn should continue to grow, peaking in 2024, and likely worse than consensus outlook for 2024 cash improving YOY," the note said.

Wells Fargo trimmed its price target on Virgin Galactic to just $2.50 per share, down from $3 previously.

— Jesse Pound

Netflix revenue gain will outweigh cancellations from password sharing clampdown, Loop Capital survey shows

Netflix's plan to crack down on password sharing should result in a net benefit for the company, Loop Capital said Tuesday.

In a note to clients, managing director Alan Gould said a survey of more than 500 Netflix users in the U.S. showed the change will increase revenue by 3%. That's smaller than the per-user revenue gain of 27%, offset partially by the fact that paying subscriptions would decrease by 19%.

Netflix said in early February it would start charging in Canada, New Zealand, Spain and Portugal. The streaming giant is expected to have data from those countries prior to instituting the policy in the U.S., which is its largest market at 40% of global revenue, Gould said.

Gould said he expects Netflix will implement the password sharing clampdown in the U.S. some time in the middle of 2023. That while initially create higher churn of subscribers and lower engagement, but those should move closer to historical levels by the second half of the year.

While having a hold rating on the stock, Gould said he now expects 2023 and 2024 earnings per share to come in 6% to 7% higher than he previously estimated. Gould also raised his price target by $10 as a result of the data to $330, which implies the stock could gain 5.8% from where it closed Monday over the next year.

Netflix is up 4.8% so far this year, a modest gain after losing 51.1% in 2022.

— Alex Harring

Stocks near session lows as final trading hour begins

Stocks hovered near session lows as the final hour of trading kicked off.

The Dow Jones Industrial Average shed about 570 points, or about 1.7%, while the S&P 500 lost 1.6%. The Nasdaq Composite dropped 1.3%.

— Samantha Subin

Odds of soft landing increasing despite Tuesday's selloff, says Wells Fargo's Han

Markets hit selloff mode Tuesday after comments from Federal Reserve Chair Jerome Powell indicated higher rates for longer.

But the market reaction, and repricing of inflation expectations may actually be a good thing for investors hoping for a softer landing, said Wells Fargo equity strategist Anna Han.

"What's also coinciding is the market is pricing in a higher chance of a softer landing," she said. "Again, it's strange to have both. It can feel uncomfortable, but that's constructive."

Stickier inflation may dash investors hopes near term for a Fed pivot, but it could actually payoff in the long-run, she added.

"Were inflation to come crashing down, the Fed was at risk of overdoing it, or tightening too much and tightening us into that recession," Han said. "That was a concern that there would be this misalignment with timing."

While inflation is easing slower than expected, the pace still reflects a healthy economy being impacted by the Fed, she added.

"If they can continue to nibble away at inflation, I think you raise the possibility and the chances of achieving that soft landing that we so desperately want," Han said.

— Samantha Subin

Stock pickers struggled in February, Bank of America says

Large cap active fund managers in February had their worst month since July 2022, according to Bank of America.

Equity strategist Savita Subramanian said in a note to clients that average fund in that category underperformed the Russell 1000 benchmarks by 41 basis points in February.

"The outperformers of 2022 largely outperformed in February after lagging in January: Value funds outperformed, while Growth funds lagged," Subramanian said.

Just 15% of growth managers beat their category index, compared with 66% of value managers. Overall, just 34% of managers came out ahead.

— Jesse Pound

Fed unlikely to raise rates by 50 basis points, Bleakley's Boockvar says

Peter Boockvar of Bleakley Financial Group still expects the Federal Reserve to raise rates by 25 basis points, not 50, despite Chair Jerome Powell's latest comments.

"After taking an Advil while watching the questions being asked of Powell and with Powell saying the dot plot in a few weeks will most likely tilt up in terms of the median end point of the fed funds rate from the previous 5.4%, the fed funds futures market is pricing in a 48% change of a 50 bps hike in two weeks," he wrote in a note. "I do not think the Fed goes 50 bps at any of the remaining rate hike meetings at this point after already slowing the pace and will continue on with 25 bps until it finally stops."

— Fred Imbert

Deteriorating market breadth spells trouble ahead, BTIG's Krinsky says

Deteriorating market breadth, even as the S&P 500 and Nasdaq Composite remain firmly in positive territory this year, is a troubling signal for investors, BTIG's Jonathan Krinsky said Monday.

On Monday, the Dow Jones Industrial Average and the S&P 500 closed higher after Goldman Sachs initiated coverage of Apple with a buy rating, despite pressure from rising bond yields. The iPhone maker, which makes up about 7% of the S&P, helped lift the broader index.

"The SPX traded up to 4078 so far [Monday], which was the upper end of our initial resistance zone," Krinsky wrote. "Given the events the rest of the week, the fact that yields remain firm, and this breadth divergence, our sense is even near-term risk/reward is now skewed to the downside here."

— Sarah Min

Airlines outperform in a down market after DOJ blocks JetBlue's Spirit acquisition

Airlines are notable outperformers Tuesday after the Justice Department sought to block JetBlue's proposed $3.8 billion acquisition of Spirit Airlines on antitrust grounds.

The idea behind the rally is that legacy carriers will face less intense competition from a strengthened rival if Jet Blue and Spirit are not allowed to combine.

United Air (UAL) was rallying 4% in midday trading Tuesday, followed by Delta (DAL) at 2.3%, Alaska (ALK) up 2.1%, American (AAL) ahead 2% and Southwest (LUV) higher by 0.5%. (Separately, Evercore ISI upgraded Delta to overweight from in-line earlier in the day.)

The 20-stock Dow Transportation Average is up 12.2% year to date, more than twice the 5.8% gain in the S&P 500, despite the recent downtown in the rails (Norfolk Southern is off 2.8% Tuesday while CSX is lower by 2%).

The S&P Airlines Index, meanwhile, is higher by 2.1% Tuesday and up 19.3% year to date. The airlines as a group are 34.2% above their 52-week low, according to FactSet data.

— Scott Schnipper

Watch S&P 500's low of 3928 last week and February's high of 4195, Strategas says

Last week's low of 3928 in the S&P 500 index and February's high of 4195 "remain big tactical levels," said Strategas Research Partners' head of technical analysis Chris Verrone in a Tuesday note to clients.

That range "likely holds some significance in the weeks and months ahead. 4195 is the big level on the high-side. In between, it remains a very bifurcated trading market," Strategas said. Meanwhile, "last week's low likely holds some increased significance," too.

Within the market, "Keep tabs on Homebuilders, after big rallies the group is starting to falter. Industrials largely remain leadership across the board – we feature PCAR today. Meanwhile, the weakness in Towers/Data Centers persists and TSLA is again rolling over under its 200-day average," according to the note.

Strategas continues to highlight continued strength in industrial stocks regardless of their market capitalization, noting recent relative outperformance among Russell 2000 industrials, for instance, saying "small-cap industrials [are] stretched," but are still showing "clear leadership."

— Scott Schnipper

S&P 500 new highs Tuesday dominated by industrial stocks

Industrial stocks dominated new, 52-week highs in the S&P 500 on Tuesday, accounting for eight of the nine:

- Booking Holdings (BKNG), highest since Feb. 2022

- Carrier Global (CARR), highest since January 2022

- Cummins Inc (CMI), highest since June 2021

- Ingersoll-Rand (IR), highest since Jan. 2022

- PACCAR (PCAR), all-time high back to 1971 IPO

- TransDigm Group (TDG), all-time high back to 2006 IPO

- United Airlines (UAL), highest since June 2021

- First Solar (FSLR), highest since Sept. 2008

- PG&E (PCG), highest since Feb. 2020

Outside the S&P 500, other 52-week highs Tuesday included:

- Deckers Outdoor (DECK), highest since Sept. 2021

- Dick's Sporting Goods (DKS), highest since Sept. 2021

- Hyatt Hotels (H), all-time high back to 2009 IPO

- nVent Electric (NVT), all-time high back to spin-off from Pentair in 2018

New S&P 500 52-week lows were:

- Advance Auto Parts (AAP), lowest since July 2020

- Hasbro (HAS), lowest since March 2020

- Gen Digital (GEN), lowest since Dec. 2020

Other 52-week lows outside the S&P 500 included:

- Liberty Media SiriusXM Series A (LSXMA), lowest since May 2020

- Liberty Media SiriusXM Series C (LSXMK), lowest since May 2020

- Sirius XM (SIRI), lowest since 2016

- Elanco Animal Health (ELAN), all-time low back to 2018 IPO

- Royalty Pharma (RPRX), all-time low back to 2020 IPO

— Scott Schnipper, Christopher Hayes

Regional bank stocks are in a slump

Regional bank stocks are under pressure again on Tuesday, with the SPDR S&P Regional Bank ETF (KRE) on track for its sixth losing day in seven.

The fund is down about 2.8% for the session, extending its losses after Jerome Powell's Congressional testimony was released.

Shares of Zions Bancorp and Fifth-Third were each down about 4%.

— Jesse Pound, Gina Francolla

Powell is trying to prevent the market from doing what it wants to do, says Mariner Wealth Advisors' Lesko

All the market wants to do is go up, but don't be surprised if Federal Reserve Chair Jerome Powell does everything in his power to prevent that from happening, said Mariner Wealth Advisors' Tim Lesko.

"Equity markets seem to want to go up and he wants to keep a lid on things in a metered way," he said.

Lesko added that Powell's commentary before the Senate also served as a reminder to investors that inflation isn't done.

"The words today were really troubling for the equity market," he said. "They basically tell people that he's going to continue to talk rates up so that the market doesn't do what it wants to do."

— Samantha Subin

Dollar index hits high not seen in about 2 months

The dollar index has hit highs not seen since January.

The index, which measures the dollar against a basket of currencies, hit a high of 105.43 during Tuesday's session. That's the highest the index has reached since Jan. 6, when it notched 105.631.

— Alex Harring, Gina Francolla

Key part of the yield curve hasn't been this inverted since 1981

The gap between the 2-year Treasury yield and the 10-year Treasury rate widened to 100 basis points during Tuesday's trading. This spread has not settled at levels this wide since September 22, 1981.

The 2-year yield jumped to its highest since 2007 after Federal Reserve Chairman Jerome Powell said the central bank may need to increase the pace of interest rate hikes again.

The yield curve inversion is a phenomenon that for half a century has accurately signaled coming recessions.

— Yun Li

Commercial real estate requires 'a lot of monitoring,' Powell says

Fed Chair Jerome Powell said there are "pockets of concern" in the commercial debt market after the run-up in interest rates, and he went into further detail about the commercial real estate market.

"The occupancy of office space in many major cities is just remarkably low, and you wonder how that can be. Over time, some of that is going to be made into condominiums and things like that," Powell said.

Powell said that most large banks don't have much exposure to commercial real estate, lowering the risk to financial stability, but added that some smaller banks do.

"We agree that that is an area that requires a lot of monitoring. I would say we are on the case," Powell said.

— Jesse Pound

Market increases expectations for half-point Fed rate hike this month

Markets are now pricing in at least a 50-50 chance that the Federal Reserve raises its benchmark interest rate by half a percentage point later this month.

Following remarks Tuesday from Fed Chairman Jerome Powell, traders upped their bets that the central bank accelerates to a 50 basis point move at the March 21-22 meeting of the Federal Open Market Committee.

The probability of a half-point increase rose to 51.3% in late-morning trading, according to CME Group data. That's up sharply from 31.4% a day ago and just 9.2% a month ago.

Previously, markets had largely expected the Fed to hold to the quarter-point increase it adopted on Feb. 1. That marked a step down from more aggressive rate hikes in 2022.

Traders now expect the peak in the funds level — the "terminal" rate — to hit a range of 5.5%-5.75% by summer. Specifically, the October 2023 fed funds rate contract implies a terminal rate of 5.58%.

— Jeff Cox

Powell says the Fed is 'very far' from taming inflation

Federal Reserve Chairman Jerome Powell emphasized that the central bank still has some distance to cover before it can declare victory on inflation.

In Senate testimony, he noted that the labor market remains "extremely tight" despite the Fed's rate hikes and attempts to cool economic growth.

"We're very far from our price stability mandate, and in effect the economy is past most estimates of maximum employment," Powell said.

—Jeff Cox

All S&P 500 sectors are lower

All 11 major S&P 500 sector were in the red Tuesday after remarks from Federal Reserve Chair Jerome Powell signaled potentially higher rates for longer.

Materials was the worst-performing sector as of 11:03 a.m. EST, dragged down 1.5% by declines from Freeport-McMoRan, CF Industries, Albemarle and more.

Financials, utilities, real estate and energy, fell more than 1% each.

— Samantha Subin

Powell warns of 'extraordinarily adverse' consequences of default

Fed Chair Jerome Powell warned senators about the potential consequences of failing to raise the debt ceiling.

"We do not seek to play a role in policy issues, but at the end of the day there is only one solution to this problem and that is Congress ... really needs to raise the debt ceiling. That is the only way out," Powell said.

The U.S. has already hit its debt limit, and the Treasury has warned that Congress will need to authorize further borrowing before the late summer or early fall in order to avoid a default.

"And if we fail to do so, I think the consequences are hard to estimate, but they could be extraordinarily adverse and could do long-standing harm," Powell added.

— Jesse Pound

Stocks holding up pretty well. One chart analyst sees rally attempt

The stock market was holding up pretty well considering that Fed Chairman Jerome Powell confirmed many investors' worst fear in saying the central bank may have to speed up rate hikes again to fight inflation.

The S&P 500 was down less than 1% and was so far holding the 4,000 level, keeping it in the green by more than 4% for 2023 still.

Tech shares Meta and Nvidia even managed to stay in the green. Apple and Tesla were only down by small amounts. This is notable since technology has been the hardest hit sector during the Fed's rate-hiking campaign and Powell is indicating to Congress it is far from over.

"Our sense is that despite the big push lower, there will be an 'attempt' at a rally later today," wrote Jonathan Krinsky, chief market technician at BTIG. "It will be the extent of that rally, or lack thereof, however, that will be telling."

"Closing back under 4000 would likely confirm that the latest rally was counter-trend and we should then expect a test of that 3900 level later this week," Krinksy added.

— John Melloy

Powell comments put spotlight on Friday's jobs data

Fed Chairman Jerome Powell's comments about economic data suggests the already important February employment report Friday could be an even more significant factor in the Fed's rate hiking decision this month.

According to Dow Jones, economists expect 225,000 payrolls were added last month, down from the super hot 517,000 in January. The Fed has been expected to raise interest rates by a quarter point on March 22, but odds for a half point hike increased for both March and May in the futures market, after Powell's comments.

The consumer price index, expected March 14, will also be very important since inflation data has been running higher than expected.

In prepared testimony before the Senate Banking Committee, Powell highlighted the strength of recent data and said interest rates are likely to be higher than previously anticipated.

— Patti Domm

Wholesale inventory data comes in line with expectations

Wholesale inventories in the U.S. for January were exactly what economists expected.

Data from the Monthly Wholesale Trade Survey released Tuesday showed wholesale inventories slid 0.4% in January from December. Economists polled by Dow Jones had expected inventories to fall that much.

— Alex Harring

Cryptocurrencies briefly dip after Powell comments as dollar index hits session high

Cryptocurrencies fell on Tuesday morning after Federal Reserve Chairman Jerome Powell said the central bank may need to increase the pace of interest rate hikes again.

Just after 10 a.m. ET, bitcoin and ether each fell more than 1% but quickly recovered most of the loss, according to Coin Metrics. Bitcoin briefly dropped to as low as $21,584.07 but has recovered to the $22,000 level.

The move coincided with a jump in the dollar index, which hit its high of the session around the same time. The dollar index has an inverted relationship to bitcoin.

— Tanaya Macheel

Bond yields jump to 2007 level, Fed rate hike expectations rise after Powell comments

Bonds sold off, sending short-term rates sharply higher after Fed Chairman Jerome Powell said interest rates are likely to be higher than previously anticipated.

The 2-year Treasury yield rose to 4.968%, its highest level since July, 2007. The 10-year yield jumped back above 4%, a level it hit briefly last week for the first time since November.

Futures markets priced in a higher terminal rate, or end point for Fed rate hikes and higher odds of another half point hike following the release of prepared comments from Powell. According to Greg Faranello of AmeriVet Securities, the terminal rate edged higher to 5.6%.

"People need to keep this in perspective. What he's saying is if we need to do more , we're going to do more," said Faranello. He said odds of a half percentage point hike increased though most Fed watchers have been forecasting a quarter point hike for March 22.

Powell's comments were released at 10 a.m. ET, ahead of his testimony before the Senate Banking Committee.

— Patti Domm

Key Powell remarks for the market

There were two key quotes in the Congressional testimony of Federal Reserve Chairman Jerome Powell as far as markets were concerned.

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell said in prepared remarks.

This means the Fed may keep raising for longer than the market anticipated. Many wanted the Fed to stop hiking soon.

"If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Powell also said.

The Fed's last hike was just a quarter point as it slowed the pace. Powell is hinting here the Fed may need to speed back up, which is a big fear of the markets.

— John Melloy

Stocks sell off on Powell remarks

Stocks slid Tuesday after comments from Federal Reserve Chair Jerome Powell indicated that rates will likely remain elevated for longer.

The Dow Jones Industrial Average was last down 196 points, or 0.6%, while the S&P 500 traded 0.8% lower The Nasdaq Composite shed 0.9%.

— Samantha Subin

S&P 500 needs another move higher to earn "credibility," Cashin says

The stock market bounced upward off of some key technical indicators last week, but investors shouldn't fully buy into a new rally just yet, according to Art Cashin of UBS.

Cashin said on CNBC's "Squawk on the Street" that Salesforce's strong quarterly report last week muddied the waters for technical traders, meaning that market passing the technical test may have been "accidental."

The S&P 500, which was trading just below 4,050 after the market open on Tuesday, needs to take another leg higher to reinforce last week's move, Cashin said.

"You've got to get up above 4,085 to get some credibility," Cashin said.

— Jesse Pound

Stock open flat ahead of Powell testimony

Stocks opened flat on Tuesday as Wall Street awaited Federal Reserve Chari Jerome Powell's testimony.

The Dow Jones Industrial Average traded flat, while the S&P 500 dipped 0.06%. The Nasdaq Composite inched 0.04% higher.

— Samantha Subin

Costco shares could rally 16% from here, analyst says

Worn down by months of higher prices, consumers are shying away from buying discretionary items, said Northcoast analyst Chuck Cerankosky. Sounds bad, but he says Costco has been here before.

"At these times, its strong value proposition in consumables — from food to pharmacy and [health & beauty care] to household supplies to gasoline — not only allows it to retain its many loyal members, but attract new ones," he wrote in a research note.

Cerankosky sees Costco shares rallying nearly 16% from Monday's close as it starts to grab market share from competitors. His prediction is higher than Wall Street's average price target of $544.97, according to FactSet.

In addition to stock price acceleration, there could also be a special dividend ahead and possibly a pick-up in the pace of stock buybacks, he said. And that's all before, Costco makes an expected hike in membership fees, which isn't baked into his analysis yet.

— Christina Cheddar Berk

Stocks making the biggest premarket moves

Here are some of the names making the biggest moves in the premarket:

- Rivian — The electric-vehicle maker fell 5.7% following the announcement Monday that it plans to sell $1.3 billion worth of bonds. The funds will help the company launch its Rivian's R2 vehicles, a spokesperson told Reuters.

- Mineralys Therapeutics — The health-care company rose about 3% after Credit Suisse initiated coverage of the stock with an outperform rating. The Wall Street firm's $40 price target suggests upside of more than 100%.

- Joby Aviation — The electric-aircraft maker shed more than 3% after being downgraded by Deutsche Bank to sell from hold. The firm's analyst said he wonders if the design is "overly aggressive."

To see more companies making moves in the premarket, read the full story here.

— Michelle Fox

Joby Aviation falls after Deutsche Bank says investors may be overlooking risks

Joby Aviation may have risks that investors are overlooking, Deutsche Bank warned.

The company, known for its electric aircrafts, got downgraded to sell from hold by analyst Edison Yu. Yu also cut his price target by $2 to $4, meaning he thinks the stock could fall by 11.1% over the next year.

The stock fell more than 3% in premarket trading.

His downgrade comes amid concerns that the company may be making its aircrafts too heavy. The company also pushed back its approval timeline.

"Operationally, despite Joby being perceived as the leader in the industry, the developmental path of its [electric vertical takeoff and landing] aircraft seems increasingly challenging to us as we think the aircraft is dealing with weight management issues," Yu said in a Tuesday note to clients.

CNBC Pro subscribers can read the full story here.

— Alex Harring

Goldman sees big gains for Juniper Networks

Goldman Sachs initiated Juniper Networks with a buy and a price target that implies upside of nearly 25% from Monday's close.

"We expect core underlying demand for JNPR products to be supported by secular trends (e.g., 400G, metro, software-based management platforms) and a re-focused enterprise strategy, though we recognize that tough comps & macro-driven budget scrutiny will be headwinds in the near term," Analyst Michael Ng said in a note to clients.

— Alex Harring

Dick's Sporting Goods pops on strong holiday quarter

Shares of Dick's Sporting Goods jumped more than 5% before the bell after the company posted a strong holiday quarter that included better-than-expected same-store sales.

The sporting goods retailer said same-store sales grew 5.3% during the period, more than double Wall Street's estimate of 2.1%, according to StreetAccount.

Dick's Sporting Goods also posted a beat on the top and bottom lines, or adjusted earnings of $2.93 a share on revenues of $3.60 billion.

Guidance for 2023 came in above expectations, with management saying it now expects full-year EPS to range between $12.90 and $13.80. Analysts polled by Refinitiv had anticipated fiscal 2023 EPS of $12.

— Samantha Subin, Rebecca Picciotto

Meta stock rises following news of fresh layoffs

Meta is planning another round of layoffs that could affect thousands of workers as soon as this week, according to a Bloomberg News report published Monday evening.

The job cuts come after the company laid off 13% of its workforce in November as part of a major cost-cutting plan. CEO Mark Zuckerberg previously told investors that 2023 would be the "year of efficiency" for the company.

Meta shares gained 1.5% during premarket trading on Tuesday following the news.

— Hakyung Kim

Dovish news underpinning market in early trading, Vital Knowledge says

Adam Crisafulli of Vital Knowledge highlighted several pieces of "dovish news" to start the day.

"To start, the RBA delivered a 'dovish hike', signaling that this 25bp rate increase may be its final one of the cycle. Meanwhile, CPIs from Taiwan, Thailand, and the Philippines all undershot the St, while Japan's wage data also came in below plan. The latest ECB survey revealed a drop in inflation expectations," Crisafulli said.

Still, the "big focus today will be on Powell's testimony at 10amET before the Senate. ... Our bottom line: Powell's bar to sound "less hawkish than feared" is low."

— Fred Imbert, Michael Bloom

European markets: Here are the opening calls

European markets are heading for a mixed open Tuesday.

The U.K.'s FTSE 100 index is expected to open 19 points higher at 7,945, Germany's DAX 20 points higher at 15,669, France's CAC up 10 points at 7,383 and Italy's FTSE MIB down 16 points at 27,953, according to data from IG.

Data releases include Irish inflation data for February, while earnings come from Greggs, Reach, Man Utd, Nielsen, Zalando, Schaeffler, Henkel, and Lego and HelloFresh.

— Holly Ellyatt

Small caps' outperformance this year is a good sign, Paul Hickey says

Paul Hickey, co-founder of Bespoke Investment Group, said the strength of the small-cap stocks is a sign of market resilience despite the uncertainty of the Federal Reserve's tightening path. The Russell 2000 index is up nearly 8% this year, outperforming the S&P 500's 5.4% gain.

"There was some really strong underlying resiliency in the market in the face of tightening financial conditions," Hickey said on CNBC's "Closing Bell Overtime" Monday.

— Yun Li

January wholesale inventories, consumer credit data set to release Tuesday

The January wholesale inventories data is set to release Tuesday after the opening bell, giving investors insight into the consumer economy. Economists polled by Dow Jones expect a decline of 0.4%, compared to a rise of 0.1% in the prior reading.

Consumer credit data expected Tuesday afternoon is forecasted to show a rise of $22 billion in January, according to consensus estimates from Dow Jones. That would follow a $11.6 billion increase the prior month.

— Sarah Min

WW International shares pop after hours

WW International shares jumped more than 10% in extended trading.

The firm, which is also known as WeightWatchers, said it's acquiring Sequence, a subscription telehealth platform with a focus on chronic weight management, for a net purchase price of $106 million. The deal is expected to close during the second quarter of 2023.

Separately, WW International announced its fourth-quarter and full-year results.

— Sarah Min

Stock futures open flat

U.S. stock futures were little changed on Monday night as traders await Federal Reserve Chair Jerome Powell's latest comments on the state of the economy.

Dow Jones Industrial Average futures fell by 2 points, or 0.01%. Futures tied to the S&P 500 and Nasdaq 100 dipped 0.01% and 0.06%, respectively.

— Sarah Min