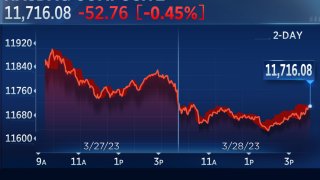

The Nasdaq Composite fell Tuesday as an uptick in rates put pressure on the tech-heavy index.

The tech-heavy Nasdaq shed 0.45% to close at 11,716.08. The S&P 500 fell 0.16%, ending at 3,971.27. The Dow Jones Industrial Average lost 37.83 points, or 0.12%, and closed at 32,394.25.

Bond yields rose, with the rate on the 2-year U.S. Treasury note climbing back above 4%, putting pressure on stocks and tech names in particular. Rising rates make future profits, like those promised by growth companies, less attractive.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

"For the second day in a row, interest rates are rising, and the markets are being led by the more economically sensitive sectors, such as energy and industrials," said Brian Levitt, global market strategist for Invesco.

"Technology stocks are among the laggards, which is often the case as interest rates rise," he added. "For the time being, investors seem to be looking beyond the challenges in the financial sector and recognizing that U.S. economic growth continues to be resilient."

Worries about the crisis among U.S. regional banks have been assuaged thanks in part to policymakers' efforts to alleviate the challenges. Investors' fear that higher rates could push the economy into a recession came back into focus.

Money Report

However, bank stocks slipped on Tuesday following a contentious hearing at the Senate Banking Committee. Three top regulators each said they favor more stringent rules for banks with more than $100 billion in assets.

The moves follow a mixed session on Monday. Investors fought to extend last week's gains, but tech shares came under pressure. The Dow Jones Industrial Average added 194.55 points, or 0.6%, while the S&P 500 gained 0.16%. The Nasdaq Composite dipped 0.47% as tech stocks moved lower.

Lea la cobertura del mercado de hoy en español aquí.

Stocks close lower on Tuesday

The major averages ended the day lower on Tuesday.

- The Dow Jones Industrial Average shed 0.45% to close at 11,716.08.

- The S&P 500 lost 0.16%, ending at 3,971.27.

- The Nasdaq Composite fell 0.12%, and closed at 32,394.25.

— Tanaya Macheel

RBC Capital Markets remains overweight in technology

RBC Capital Markets reiterated on Tuesday that it remains overweight on the technology sector, as the recent comeback in technology stocks is beginning to fade.

The tech sector is beginning to experience slightly positive revisions on earnings-per-share and revenue forecasts, the firm said in a note to clients, adding that the sector's relative P/E ratio is "only modestly" above average.

"A lot of the move in Tech so far this year appears to be about interest rates and Fed expectations that have been falling. Tech has historically been the best performing sector after both final hikes and first cuts. But our valuation and earnings revisions work suggests there's more to the story," RBC's head of U.S. equity strategy Lori Calvasina wrote in the note. "We remain overweight, though our call may take a breather if money flows into Banks and Small Caps return."

On Tuesday, technology stocks were among the laggards of the broader market, which typically happens during periods of higher interest rates. So far this month, the tech-heavy Nasdaq Composite has added nearly 1.9% and the S&P 500 Information Technology Sector has gained about 5.2%.

— Pia Singh

Signature, SVB trade for pennies in over-the-counter market

Shares of Signature Bank and SVB Financial began trading again over the counter on Tuesday, at small fractions of their previous values.

The stocks had been halted for trading after they were seized by regulators earlier this month.

SVB Financial, which has filed for bankruptcy, is now trading at just 27 cents per share. It closed at $106 per share on March 9, before the bank was closed.

Signature Bank was trading around 10 cents per share, down from $70 before its closure.

— Jesse Pound

UBS says dividend stocks are safe picks during recessions

Dividend stocks may be the way to go for investors as a recession becomes more likely, according to UBS.

The bank said that dividend stocks, on average, outperformed the market by 4.5% during the 2001, 2008 and 2020 recessions.

Investing strategies focusing on dividend growth "have been significantly less volatile" than others focusing on earnings and buyback growth, U.S. equity product manager Joseph Parkhill wrote in a Monday note. "Dividend stocks can provide a margin of safety during uncertain times."

CNBC Pro subscribers can see which dividend stocks UBS says have the biggest upside here.

— Hakyung Kim

The S&P 500 doesn't find a 'low' before a recession, says Canaccord Genuity

With a recession likely on the horizon and more volatility expected in the market, stocks may not have hit their "low" yet, according to Canaccord Genuity analyst Tony Dwyer.

"As a reminder, the current levels of (1) U.S. Treasury Yield Curve Inversions, (2) Conference Board of Leading Economic Indicators, and (3) Commercial & Industrial Lending Standards are all at levels associated with being in/near recession," he said.

"In addition, since 1957 the SPX has never made 'the' low before a recession even began," he added. "Our game plan remains the same: stay lighter in exposure and slightly defensive in sector allocation and stand ready to take advantage of any weakness if/when bad news becomes bad news and the market moves back to/below the October low."

— Tanaya Macheel

Light trading volume heading into the final hour of trading

Stocks may be lower Tuesday, but there doesn't appear to be much conviction to the downside.

Volume on the SPDR S&P 500 ETF Trust (SPY), a widely traded ETF that tracks the S&P 500, was just 41.9 million shares as of 2:56 p.m. ET. That's well below its 30-day average volume of 104.01 million.

— Fred Imbert

Communication services stocks drag on S&P 500 as rate fears weigh on tech

Communication services stocks led the S&P 500 down as an uptick in bond yields put pressure on technology and other growth names.

The sector dropped 1.3%, followed by information technology at 1.1% down. Both sectors pulled on the broader index, which lost just 0.5%.

Fox and Match Group led the communication services sector down with drops of more than 2% each. Big tech's Alphabet and Meta followed, with each sliding more than 1%.

— Alex Harring

Bank stocks pull down market following Senate hearing

Banks led the stock market lower Tuesday afternoon, following a hearing in which three regulators said they would favor more stringent regulations in smaller institutions.

Federal Reserve Vice Chair Michael Barr, FDIC Chair Martin Gruenberg and Nellie Liang, the Treasury Department's undersecretary for domestic finance, each said they would back tougher requirements for banks with more than $100 billion assets.

The remarks came during a Senate Banking Committee hearing on the recent failure of three regional banks. Sen Elizabeth Warren (D-Mass.) asked each if they would favor tougher rules for banks other than those identified as systemically important and if they would support reversing deregulatory changes made in 2018.

"I certainly think it's appropriate for us to go back and review those actions in light of the recent episode and consider what changes should be made," Gruenberg said.

The SPDR Regional Banking and the SPDR Bank ETFs dropped more than 1% each in afternoon trade.

—Jeff Cox

Economist Paul McCulley sees the Fed cutting rates in wake of banking crisis

The Federal Reserve can and should start cutting interest rates at its next meeting, economist Paul McCulley told CNBC on Tuesday.

"I think it will be a cut and I think they can point to the stress in the banking system and the fact that it's a disinflationary impulse," McCulley said during a "Squawk on the Street" interview. "They can also point to the fact that inflation is coming down."

McCulley, the former Pimco managing director and now senior fellow at Cornell Law School, added that "the direction of the impact of the banking shock is down" which "gives you the justification for not only stopping but easing."

Markets were evenly split Tuesday morning on whether the Fed will hold its funds rate in a target range between 4.75%-5%, or enact one last quarter percentage point hike. Futures pricing indicates that regardless of what the central bank does at its May 2-3 policy meeting, it will begin cutting rates shortly thereafter.

"Whatever interest rate forecast you thought was necessary to deal with the inflation problem before the shock is lower now," McCulley said. "We know the direction, and good, forward-looking monetary policy will look at the direction of the shock as opposed to navel-gazing about one tick one way or the other on the" consumer price index.

—Jeff Cox

Dow turns red as bank stocks fall

The Dow dipped into negative territory in afternoon trading as bank stocks lost steam.

The SPDR S&P Regional Bank ETF (KRE) was last down about 1%. JPMorgan, Goldman Sachs and Citigroup were all down less than 1%.

—Jesse Pound

Lithium stocks climb

Lithium stocks and ETFs are moving higher after Australia's Liontown Resources rebuffed a takeover offer from Albemarle Corp.

The Australian shares of Liontown surged more than 60% on the news, which investors appear to be taking as a sign that the company should be valued above Albemarle's offer.

"We see the offer as bullish for lithium signaling that the largest producer is keen to secure more supply with low jurisdictional risk," Citi analyst Kate McCutcheon said in a note to clients.

The Global X Lithium & Battery Tech ETF (LIT) climbed 1.6%, and the Amplify Lithium & Battery Technology ETF (BATT) rose 1.3%. The smaller Sprott Lithium Miners ETF (LITP) jumped 10%.

Albemarle was up less than 1% despite its offer being declined.

—Jesse Pound, Michael Bloom

Paramount climbs further after Bank of America upgrade

Shares of legacy media giant Paramount added 3.47% in midday trading after climbing more than 5% at the opening bell. Paramount received a lift after Bank of America upgraded the stock to buy from neutral on Tuesday morning.

BofA analyst Jessica Reif Ehrlich noted that Paramount is sitting on a roster of strong assets that could help the company price itself at a premium if the business ever decided to sell, although Chair Shari Redstone remains opposed to the notion.

— Brian Evans

Alibaba jumps 11% after tech firm announces split

Alibaba jumped more than 11% during midday trading Tuesday after the e-commerce giant said it will split its company into six business groups.

It's the most significant restructuring in Alibaba's history, with each of the six firms set to be managed by its own CEO and board of directors.

The move is "designed to unlock shareholder value and foster market competitiveness," according to a company statement.

Separately, Morgan Stanley named it a research tactical idea following the announcement, saying the "share price will rise in absolute terms over the next 60 days."

— Arjun Kharpal, Sarah Min

Affirm drops 4% as Apple announces pay-later service

Buy-now-pay-later service Affirm tumbled more than 4% after Apple introduced a competing service.

The technology giant announced Apple Pay Later on Tuesday, which will allow users to split purchases into four payments over six weeks.

Apple was down less than 1% in midday trading.

Despite the slide, Affirm is still up about 1% since the start of this year. But that's a small gain compared to the stock's loss of 90.4% in 2022.

In other words, the stock ended 2022 trading at under $10 per share after finishing 2021 above $100. And it's still trading at less than $10 per share.

— Alex Harring

Buffett’s Berkshire buys more Occidental

Occidental Petroleum shares jumped 3% after a regulatory filing showed Warren Buffett's Berkshire Hathaway purchased an additional 3.7 million shares for $216 million on Monday and last Thursday. The purchase boosted the conglomerate's stake in the Houston-based energy producer to 23.5%.

TD Cowen upgraded Occidental to outperform from market perform following the news. On top of Occidental's strong fundamentals, the Wall Street firm said the "captive buying support from Berkshire Hathaway" is a catalyst for the stock.

— Yun Li

Regulators speak in favor of tighter rules for regional banks

All three regulators testifying before the Senate Banking Committee on Tuesday said rules need to be toughened for regional banks.

"I anticipate the need to strengthen capital and liquidity standards for firms over $100 billion," said Michael Barr, the Federal Reserve's vice chair for supervision, in response to questions from Sen. Elizabeth Warren (D-Mass.).

Barr's fellow authorities echoed his sentiments as they spoke about the recent failures of Silicon Valley Bank, Signature Bank and Silvergate Bank.

FDIC Chair Martin Gruenberg noted that he voted against deregulatory moves in 2018 and said, "My views haven't changed."

Nellie Liang, the undersecretary for domestic finance, said she agrees "that we need to prevent these types of banking failures."

Bank stocks were slightly higher following the exchange.

—Jeff Cox

The few new S&P 500 52-week highs are again dominated by food stocks

Tuesday's six new 52-week highs in the S&P is again dominated by food companies (4 of 6), of one stripe or another:

- Darden, highest since Nov. 2021

- Hershey, all-time high

- Mondelez, all-time high

- Monster Beverage (formerly Hansen Natural), all-time high back to 1992 initial Nasdaq listing

- CBOE Global Markets, highest since Dec. 2021

- Copart, highest since Jan. 2022

Other notable highs outside the S&P 500:

- Deckers Outdoor, all-time high back 1993 IPO

- First Citizens BancShares, all-time high

- Signify Health, highest since July 2021; CVS acquisition set to close Wednesday

Notable 52-week lows outside S&P 500:

- Plug Power, lowest since Aug. 2020

- WeWork, record low going back to SPAC merger in Oct. 2021

— Scott Schnipper, Christopher Hayes

Housing price gains outlook at historic low, rents to rise, Fed survey shows

Expectations for home price increases plunged while the rent outlook remained high, according to a New York Federal Reserve survey released Tuesday.

The central bank branch's annual Survey of Consumer Expectations housing outlook showed respondents expect home prices are likely to grow just 2.6% over the next year. That's the lowest outlook ever for data that goes back to 2014. However, the five-year outlook sees prices rising 2.8%, slightly higher than a year ago.

At the same time, rents are projected to rise 8.2% over the next year. That's down from 11.5% from February 2022, though well above the five-year outlook for growth of 5%.

Homeowners also expect mortgage rates to continue to rise — to 8.4% next year and 8.8% in three years. As rates rise, the expectations for refinancing slumped to 4.4%, down from 7.7% last year and another data series low.

—Jeff Cox

Consumer confidence index rises more than expected

The consumer outlook brightened a bit in March, despite the crisis in banking, according to a Conference Board index released Tuesday.

The board's Consumer Confidence Index edged higher to 104.2, from 103.4 in February and ahead of the 100.7 Dow Jones estimate.

In addition, the expectations index, which measures the short-term outlook, rose to 73, from 70.4. However, the index remains below the 80 level that is consistent with recessions. The inflation index also remained elevated, at 6.3% for the outlook over the next 12 months.

—Jeff Cox

Natural gas on pace for worse quarter ever

Natural gas continued to slide in Tuesday's session, shedding more than 1%. That dip has helped put the commodity on track for its worst quarter ever.

With just a few sessions left in the quarter, natural gas is slated to end down 53.85%. Not only would that mean the price more than halved in the quarter, but it would be the worst quarter ever — all the way back to the start of the contract in 1990.

— Gina Francolla, Alex Harring

S&P 500 and Nasdaq open lower

The S&P 500 opened lower on Tuesday as higher rates pressured the market.

The broad market index opened 0.1% lower at 3,974.13. The Nasdaq Composite fell the same amount and opened at 11,752.76.

The Dow Jones Industrial Average opened flat at 32,434.85.

— Tanaya Macheel

Salesforce could be a $10 earnings story in 2025, says Jeffries

Salesforce has a path towards boosting earnings in the coming years, according to Jeffries.

"We see CRM as a $10-12 earnings story in CY'25 and CY'26, implying a $200-$240 stock at 20x," analyst Brent Thill said in a note Tuesday.

The business software company can sustain top-line double-digit top-line growth by continuing to gain market share and capturing 50% more annual recurring revenue by driving multi-cloud adoption within its install base, Thill said.

He also believes Salesforce can grow margins to the low- to mid- 30s, slightly below large-cap peers, from 22.5% in 2022. There are opportunities for cost reductions, including through headcount reductions and downsizing office space, Thill said. He also expects share buybacks to likely be higher than management's guidance of 30% to 40% of free cash flow.

Salesforce's adjusted earnings per share for fiscal year 2023 was $5.24. The stock, which closed at $191.26 on Monday, is up 44.25% so far this year.

— Michelle Fox

Stocks making the biggest premarket moves

These are some of the stocks making the biggest moves before the bell:

- Lyft — The ride-sharing company added 5% after announcing its cofounders, CEO Logan Green and President John Zimmer, will soon step down from their day-to-day roles. Former Amazon executive David Risher will take the helm April 17.

- First Republic Bank — The closely followed regional bank gained 3.6%. That follows an 11.8% rally in Monday's session as investors bought back into the stock after selling off last week. Investors were contemplating if a $30 billion rescue plan from a group of banks would be enough to shore up its liquidity.

- Walgreens Boots Alliance — The pharmacy stock advanced 1.7% after the company posted better-than-expected fiscal second-quarter results. Adjusted earnings per share came in at $1.16, above the $1.10 anticipated by analysts, per Refinitiv. Meanwhile, the company reported revenue at $34.86 billion, beating the $33.53 billion expected by Wall Street.

— Alex Harring

Alibaba pops 9% in premarket after announcing split

E-commerce giant Alibaba jumped more than 9% in the premarket after the company announced it would split into six different businesses as part of the most significant reorganization in company history.

Each of the companies will have their own CEO and board of directors. The companies can also raise outside funding and go public.

The move comes amid years of challenges for the company's stock after trading above $300 in 2021. Shares have slipped 2.2% since 2023 began. The stock tumbled nearly 49% and 26% in 2021 and 2022, respectively.

— Alex Harring, Arjun Kharpal

Investors pour money into stocks at 5-month high despite banking woes

A rally last week in the S&P 500 helped pull in the most investor cash since October, according to Bank of America.

The bank's strategists reported that clients put a net $3.7 billion into stocks stocks and ETFs, the fourth consecutive week of inflows despite jangled nerves over the banking tumult. That came during a week when the large-cap stock index rose 1.4%.

Buying occurred over the full range of sources, including hedge funds, private clients and institutional investors.'

From a sector perspective, tech ($808 million) and health care ($758 million) drew the biggest interest, with the latter having the highest inflows since December 2021. Financials ($731 million) and consumer discretionary ($441 million) also continued to pull in cash. Investors drained a net $254 million from energy stocks after the sector saw record inflows of nearly $1.2 billion the previous week.

For the year, tech by far has seen the greatest net inflows at $9.6 billion. Industrials has been the lone sector with net outflows, at $2.3 billion.

—Jeff Cox

European stocks open higher

European stocks were higher early Monday, with the Stoxx 600 index up 0.5% at 8:20 a.m. London time.

Oil and gas stocks climbed 1.44%, mining stocks were up 1.36% and banks continued to regain some positive momentum, up 1.2%.

— Jenni Reid

Japan, U.S. announce trade deal on EV battery minerals

The U.S. and Japan announced a trade deal on electric vehicle battery minerals that would grant Japanese automakers access to the Biden administration's $7,500 EV tax credit scheme as part of the Inflation Reduction Act.

The announcement added that the two countries share a common interested in raising "resilience against threats such as economic coercion and non-market policies."

The IRA states plug-in electric vehicles much be produced in North America to qualify for the tax incentives.

"This is a welcome moment as the United States continues to work with our allies and partners to strengthen supply chains for critical minerals, including through the Inflation Reduction Act," U.S. Trade Representative Katherine Tai said in a statement.

She added that the announcement is "proof" of the U.S. government's "commitment to building resilient and secure supply chains."

South Korean officials have also been engaging in discussions to adjust regulations to work around the eliminated tax credits for EVs made outside of North America.

– Jihye Lee, Michael Wayland

Asia-Pacific financials, banks rise as SVB deal offers relief on Wall Street

Shares of banks in the Asia-Pacific rose, tracking Wall Street's moves overnight after First Citizens bought a large chunk of failed Silicon Valley Bank.

Australia's Macquarie Group rose 1.5% in Asia's morning trade, alongside Westpac, National Australia Bank and Commonwealth Bank of Australia all up roughly 1%.

South Korea's financials also rose – Shinhan Financial Group rose 3.44%, KB Financial Group climbed 3.53% and Woori Financial Group gained more than 2%.

In Japan, Mizuho Financial Group also gained 3.15%, Mitsubishi UFJ Financial Group rose 2.42% and Sumitomo Mitsui Financial Group rose more than 3%.

— Jihye Lee

Bitcoin, ether fall after Binance's founder named in U.S. complaint

Prices of bitcoin and ether fell roughly 3% in Asia's morning trade, according to Coin Metrics – after U.S. officials filed a complaint against crypto exchange Binance and its co-founder Changpeng Zhao.

The filing alleged that the firm actively solicited U.S. users and subverted the exchanges own "ineffective compliance program."

Bitcoin fell 3.09% in the past 24 hours, according to Coin Metrics, and traded at $27,003 – while ether also fell 2.95% to $1,712.

Bitcoin is up roughly 63% quarter-to-date and on pace to mark the best quarter since the first quarter of 2021, when bitcoin gained 103.73%. It is also on pace to see the third consecutive month of gains.

Ether is also up 41.3% quarter-to-date and on pace for the best quarter since the first quarter of 2021, when the cryptocurrency gained over 150%.

– Rohan Goswami, Gina Francolla, Jihye Lee

PVH shares pop on earnings

Shares of the Calvin Klein owner jumped more than 12% after the bell on a strong earnings report.

PVH Corp. topped earnings expectations by 71 cents a share, while revenue came in a $2.49 billion and above a Refinitiv estimate of $2.37 billion.

The retail company also shares better-than-expected guidance for the first quarter and full year.

— Samantha Subin

Yale's Robert Shiller says home prices might get a 'little cheaper' after six months

Robert J. Shiller, the economics professor at Yale University and co-founder of the Case-Shiller Index, said home prices might start to come down later this year.

"Home prices are very, very high," Shiller said Monday on CNBC's "Closing Bell: Overtime."

"I'm going to extrapolate the downturn somewhat is going to continue. Maybe if you have a chance to delay your purchase, it might be a good, good time to do it. It might get a little cheaper after another six months," Shiller added.

— Sarah Min

Lyft shares rise as company announces new CEO, cofounders step down

Lyft shares gained nearly 4% in extended trading after the ridesharing company announced a new CEO and said its cofounders would step down from their current positions.

Former Amazon executive David Risher will begin as CEO on April 17 as Logan Green steps down from the position to serve as chair on the board. John Zimmer will serve as vice chair on the board, transitioning out of his president role on June 30.

— Samantha Subin, Rohan Goswami

Stock futures inch higher

Stock futures inched higher on Monday evening,

Futures tied to the Dow Jones Industrial Average rose 38 points, or 0.12%. Meanwhile, S&P 500 and Nasdaq 100 futures added 0.14% and 0.15%, respectively.

— Samantha Subin