Shares of Digital World Acquisition Corp., the blank-check company poised to take Donald Trump's media venture public, fell in volatile trading on Monday after Twitter announced a take-private deal with Elon Musk.

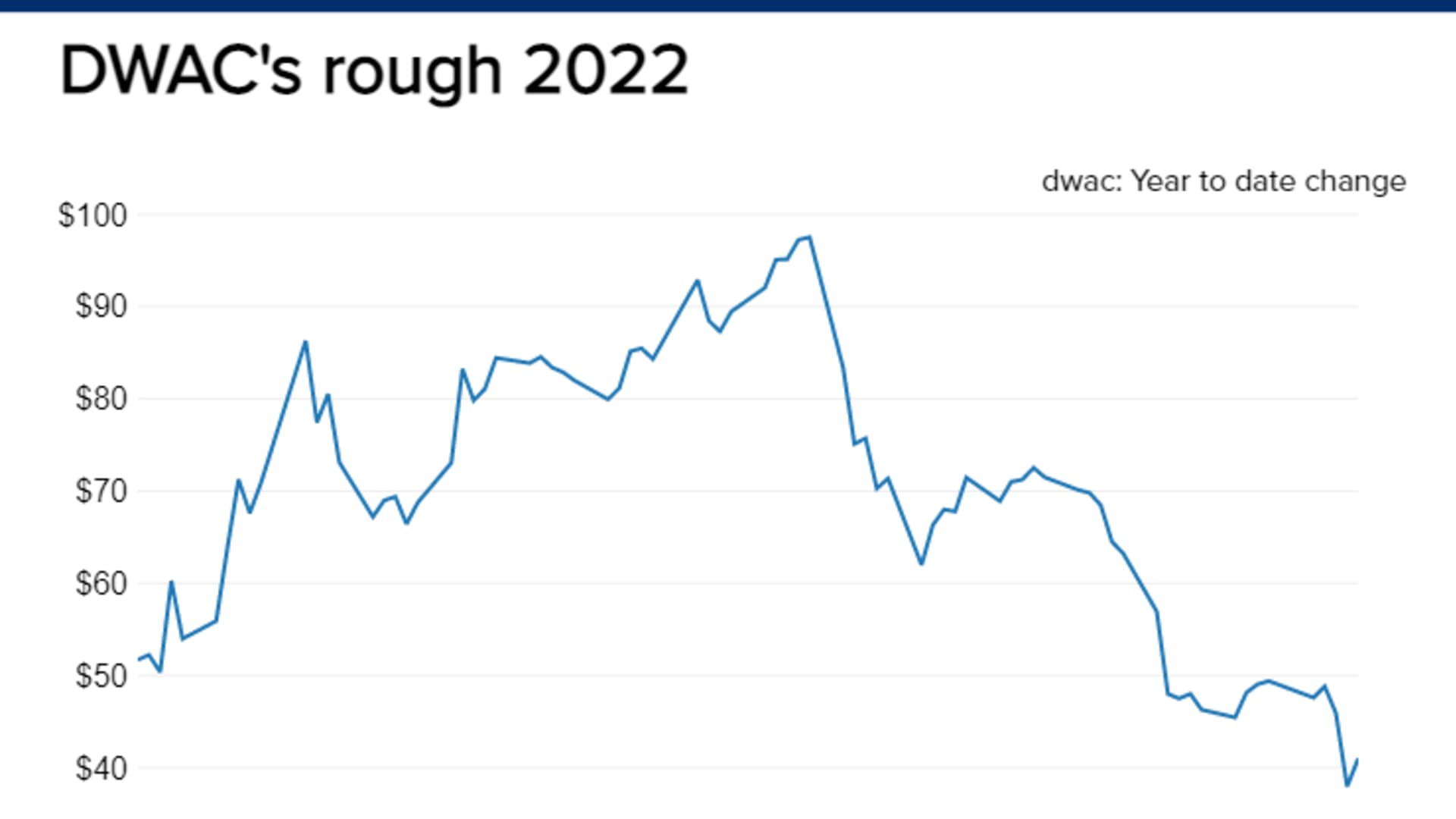

The stock had fallen 12.9% Monday, bringing its year-to-date losses to over 30%. The special purpose acquisition company is on track to merge with the former president's Trump Media & Technology Group.

The media venture includes a social media platform called Truth Social, which launched on the Apple App Store in February. Trump's company is being marketed as an alternative to social media giants Twitter and Facebook, both of which banned him on the grounds of inciting the Jan. 6, 2021, riot at the U.S. Capitol. But the new platform has had a choppy start, plagued by technical glitches and the departure of key executives.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

The sell-off in shares could be related to news that Twitter's board accepted Musk's offer to buy the social media company and take it private for $54.20 a share, or about $44 billion. Musk vowed to change the platform's policies on censorship, saying he will enhance the product with new features and the algorithms open source to increase trust.

Trump told Fox News Monday that he will not return to Twitter even if Musk's deal goes through, adding he will start using his own company's app. Trump only posted once on Truth Social since its launch.

Despite a weak 2022, shares of DWAC, which often trade in a volatile range, have more than tripled in value since its September launch at $10 apiece.

Money Report

DWAC is a so-called SPAC, which is an IPO alternative vehicle that brings companies to the public markets on a speedier timeline. SPACs are created to raise capital with a goal of identifying another company to merge with within two years and take it public.

There was a massive SPAC boom in 2021, with record issuance, but many have criticized this vehicle. Without the traditional IPO underwriting process, critics say immature companies with weak fundamentals are going public, exposing investors to great amounts of risk.

Earlier this month, Reuters reported that Truth Social's chiefs of technology and product development Josh Adams and Billy Boozer had resigned.

Meanwhile last week, hedge fund Kerrisdale Capital Management revealed it is shorting DWAC, saying in a tweet that it believes the SPAC will never secure regulatory approval to close its proposed merger.

Two financial regulators, the Securities and Exchange Commission and the Financial Industry Regulatory Authority, opened investigations into DWAC in December in regards to the stock trading and communications with Trump's firm before the merger was announced.