This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Graham Zickefoose didn't always know what he wanted his career to look like, but he knew he wanted to be self-sufficient.

The son of an elementary school principal and stay-at-home-mom, Zickefoose had a "pretty solidly middle class" life growing up in Boise, Idaho. Though he's always been grateful to his parents for their support — including paying his rent during college — Zickefoose knew he didn't want to depend on them long-term.

In college, he admired friends who were "making their own way financially," he tells CNBC Make It. "And I thought, 'My goal one day is to be financially independent and make money for myself.'"

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

After earning his bachelor's degree from the University of Idaho in 2018, Zickefoose worked as a content writer for a print marketing company in Boise, earning around $40,000. The salary allowed him to pay his bills and start saving money, but he didn't feel called to marketing long-term and began looking for something new.

He discovered the field of city planning through YouTube, where he watched videos from the popular City Beautiful channel.

"I decided to look a little bit more into what it would take to become a city planner myself," he says. "Once I found out that I had that interest, then I had a reason to go back to school that I knew would lead me to a career that I wanted."

Money Report

Now 26, Zickefoose is a graduate student pursuing his master's degree in urban and regional planning at Eastern Washington University in Cheyney, Washington, near Spokane. And he's earning enough to fully support himself financially.

Because he's part of a graduate assistantship program, his tuition is paid for by the university. On top of that, he receives a $1,159.20 monthly stipend from the university as well as $875.97 per month in additional scholarships.

Those earnings, combined with his part-time work as a planning assistant in Spokane's Planning and Economic Development Department, brings his annual pay to about $32,000.

While he wants to earn more in the future, Zickefoose is happy for now being able to pay his way on his own.

"For where I'm at in my life, the money that I'm making is enough for me to pay all the bills that I need to pay and do a lot of the things that I want to do," he says. "I'm pretty content with where I'm at financially right now."

How he spends his money

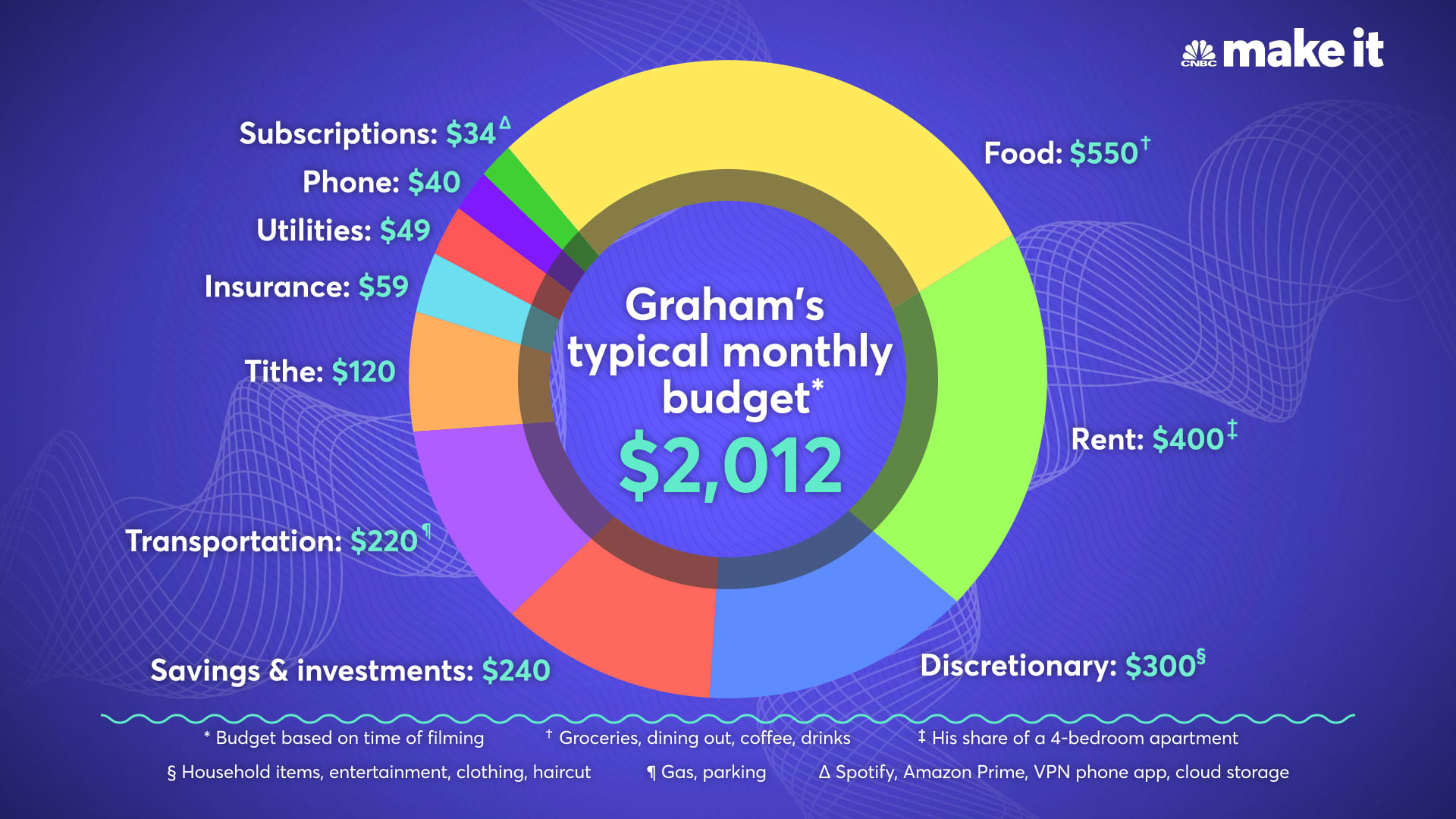

Here's how Zickefoose budgeted his money in June 2022.

- Food: $550 on groceries, dining out, coffee and drinks

- Rent: $400 for his share of a four-bedroom home

- Discretionary: $300 on entertainment, household items, clothes and haircuts

- Savings and investments: $240 split evenly between his savings account and Roth IRA

- Transportation: $220 on gas and parking costs

- Tithe: $120 to his local church

- Insurance: $59 for car and renters insurance

- Utilities: $49 for his share of the internet, heat and power bills

- Phone: $40

- Subscriptions: $34 for Spotify, Amazon Prime, a VPN phone app and cloud storage

Because he doesn't make a lot of money, Zickefoose is always careful to know how much he has in his accounts at any given time. Currently, he has a little under $10,000 in savings.

"The most important lesson for me is only spend what you have," he says. "Always be cognizant of exactly how much money you have [because] then you'll make a lot smarter financial decisions."

Zickefoose keeps "meticulous track" of his spending using a spreadsheet that tracks every time he makes a purchase or adds money to his savings. His two largest expenses are his rent — $400 covers his share of a four-bedroom apartment — and food. He spends around $550 a month on groceries and dining out.

The only thing Zickefoose is willing to splurge on is "social experiences" with his friends or girlfriend. "Whether that be seeing a movie or going to a concert, that's probably going to be something that I will at least consider spending money on," he says.

There's one area of his budget that Zickefoose doesn't need to worry about: car payments. He drives his dad's old 2004 Honda Pilot, which is fully paid off.

"That's been a huge blessing," he says. "But it's getting up there in miles. I'm just trying to take good care of it so that I'll have that car as long as I possibly can."

He also has $2,700 in student loan debt, but since payments and interest rates are currently frozen, he's set the debt aside for the time being. "I'm basically just waiting until I graduate and get into a career job, then I'll probably just quickly pay it off over the course of a few months," he says.

Zickefoose plans to graduate in the spring of 2023, and hopes to embark on a career as an urban planner, where he expects to earn between $50,000 and $60,000 a year. Eventually, he hopes to become a planning director, which will allow him to take a leadership role in improving living conditions in cities.

While he'd like to find time to travel, Zickefoose is happy with where his journey has taken him.

"I would love to get some chances to see the world," he says. "But for now, I'm OK just sticking around here, saving money and working toward the career that I want."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: 25-year-old TikTok creator with 7 million followers saves 50% of her income: 'I don't touch it'