This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Nearly 20 years ago, most of Lenny Pyrrhus' immediate family fled Haiti after his uncle, a popular musician known as Ti Pierre, was killed during a political protest against a repressive military-led government in 1991.

"All of my grandmother's kids, one by one, got their citizenship and brought their families to the [U.S.]," the 26-year-old tells CNBC Make It. "That's how we established ourselves here in America."

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Pyrrhus' aunt and grandparents were already settled in New Jersey when he arrived with his father in 2000, when Pyrrhus was four. His sister followed in 2003, when she was three. However, in the post-9/11 world, immigration restrictions meant that Pyrrhus was unable to see his mother for another 10 years.

"My family went through so much suffering before I was even born, and then for me to have gotten that kind of opportunity in America, I tried to figure out how to make the best of it," he says.

For Pyrrhus, that meant taking advantage of the educational opportunities found in the U.S., where his talent for math has led to a successful career. Today, he makes $130,000 as an infrastructure developer for JPMorgan Chase in Philadelphia.

Money Report

How he spends his money

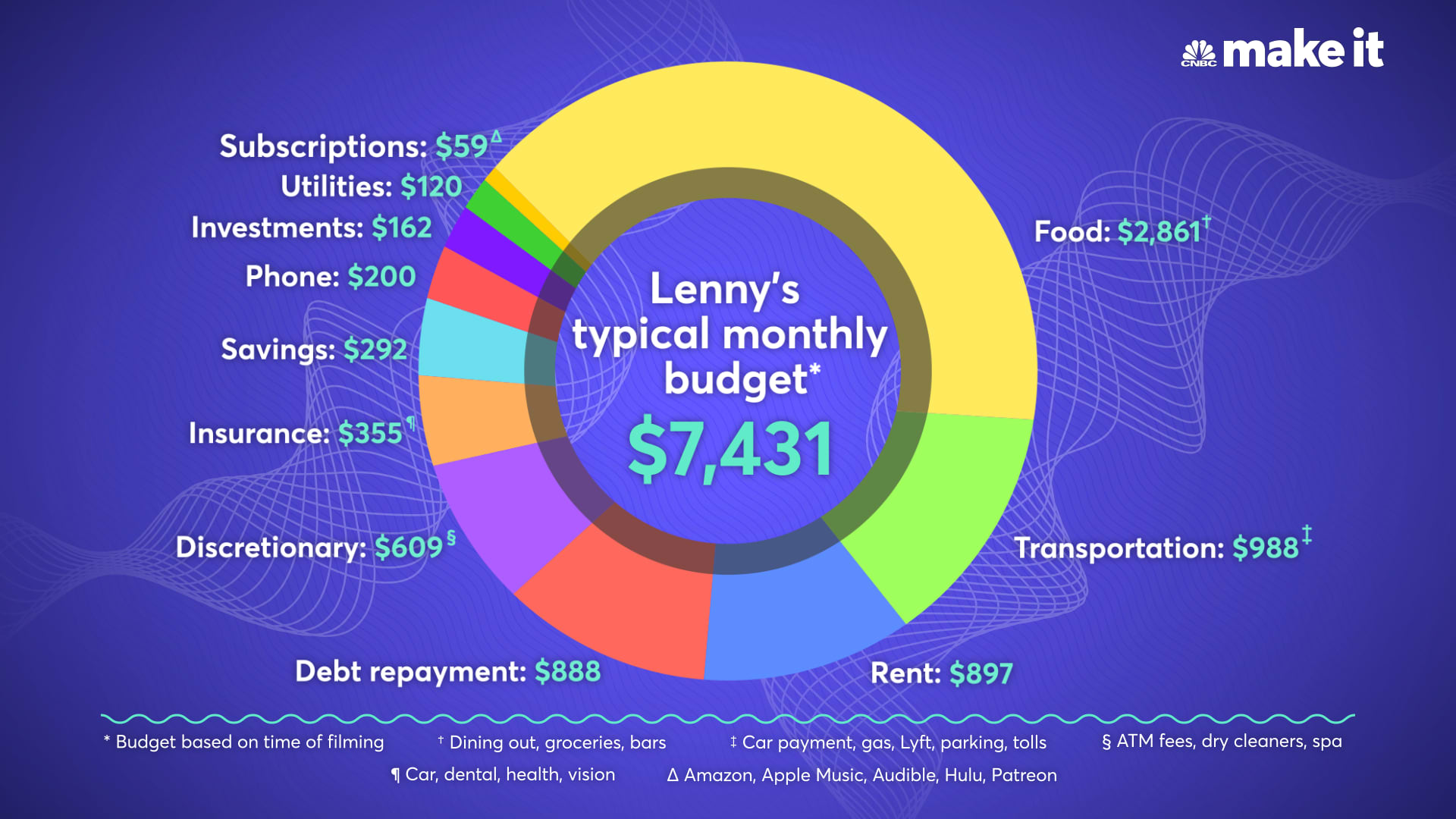

Here's how Pyrrhus spent his money in May 2022.

- Food: $2,861 on dining out, bars and groceries

- Transportation: $988 for his car payment, gas, parking, tolls and Lyft rides

- Rent: $897 for his share of a four-bedroom home

- Debt repayment: $888 for student loans and credit card debt

- Discretionary: $609 on entertainment, household items, clothes and haircuts

- Insurance: $355 for car and renters insurance

- Savings: $292 set aside in an emergency cash fund

- Phone: $200

- Investments: $162 paid into a 401(k)

- Utilities: $120 for Wi-Fi, heat and electricity

- Subscriptions: $49 for Amazon, Apple Music, Audible, Hulu and Patreon

Costing him nearly $3,000 a month, Pyrrhus' biggest extravagance is his food budget, particularly eating at restaurants. "I definitely spent a little bit too much last month on going out with friends," he says. "But it was well worth it."

That said, Pyrrhus has been trying to cut back on dining out, which he says is "100% related" to his work and school schedule taking up most of his day. But it's also been the easiest way for him to relax and socialize with friends.

Another big expense is his car, a used Mercedes-Benz C Class that he bought in 2022 for $26,000 with no money down. He purchased the car partly because his grandmother's name was Mercedes, and they had joked about him getting a car named after her when Pyrrhus was younger.

Pyrrhus often charges meals to his two credit cards, which have a total outstanding balance of nearly $7,000 combined. Throughout the pandemic, Pyrrhus says he was more focused on his career than his finances, so he let the credit card debt creep up. But paying it off is a priority; he's currently paying roughly $700 each month for debt payments on both cards.

Pyrrhus also puts roughly $200 a month toward his $30,109 worth of federal student loans, despite the pause on payments and interest. The tuition for the remainder of his master's degree will be reimbursed by JPMorgan Chase.

Finding an identity through education

Pyrrhus felt "thrust into a new world" when he arrived in the U.S. as a child. But both his father — a journalist and former school dean in Haiti — and grandmother encouraged him to make the most of his educational opportunities.

"I know it's true of a lot of immigrants, but in Haitian culture, they prioritize education and staying competitive," says Pyrrhus.

Pyrrhus says he was fortunate to be enrolled in a school that didn't hold back immigrant students by putting them in remedial classes. "I was put in the more advanced classes as soon as I came into America."

His teachers also encouraged him to pursue new opportunities. In high school, he remembers one teacher saying, "You're really good at science, and you really love solving problems. And you're always coming up with creative ways to do so. Maybe you should do engineering [in college]."

Pyrrhus took that advice. In 2018, he graduated with a bachelor's degree in industrial engineering from the New Jersey Institute of Technology in Newark, New Jersey.

Discovering his passion

Pyrrhus initially studied biomedical engineering in college so he could "help people," but switched to industrial after he realized he wanted to do something more "hands-on" and less focused on research.

In 2017, he did an internship at a semiconductor manufacturing plant. "I was working between the welders and the computer engineers, so I got exposure to that kind of work in a manufacturing setting," he says.

That experience helped him land a job as a computer engineer at Lockheed Martin in 2018, where he worked on weapon control systems, earning $69,000 per year. In this role, Pyrrhus developed an interest in cloud computing and software engineering.

"I fell in love with it, even though I didn't really do it as much in school," he says. "A software engineer has to not only be creative, but understand how operations work, too."

In 2021, Pyrrhus went back to school to earn a master's in applied data engineering at Syracuse University. He studies mostly at night, while working by day, and expects to graduate in 2024.

Wanting a career that combined industrial and software engineering, Pyrrhus took a position as an infrastructure engineer at JPMorgan Chase in January of 2022. He oversees web applications used by the company around the globe and likes that he gets to work on bigger projects than in his previous role.

Going forward, Pyrrhus wants to refine his skills as a developer and improve his finances by paying off his debt and ramping up how much money he puts into his investments.

"I want to definitely change my trajectory and [gain] some financial freedom," he says. "And upskilling changed my life because it brought me to where I am today."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: 25-year-old TikTok creator with 7 million followers saves 50% of her income: 'I don't touch it'