This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

On her walks to school as a child, Lu Wang dreamed about one day being able to afford a car of her very own, so that she would no longer have to schlep through rain, snow and other elements to get where she needed to go.

Wang, now 31, immigrated to the United States from China at age 5, joining her parents who had moved to College Park, Maryland, a few years earlier for better economic opportunities. At that time, her father was a PhD student and her mother worked minimum wage jobs to support the family.

The trio lived in student housing and didn't have enough money in those early years to afford more than one pair of shoes for Wang each year, nevermind a vehicle to drive her to school.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

She recalls repeatedly falling on a particularly slippery section of pavement near her school, as her classmates drove by her to be dropped off at the front door.

"One day I fell again and I said, 'I don't care what it takes, one day I'm going to be in that car somewhere warm,'" Wang tells CNBC Make It.

Now, Wang can afford a car — her Honda cost around $25,000, which she paid off in a single lump sum — and everything else she needs to live comfortably in San Diego, Calif. She earns around $157,000 per year as a dentist in the U.S. Navy, and knows her salary will continue to increase every few years, thanks to the military's pay scale.

Money Report

In fact, she's able to invest so much — over $6,000 a month — that she currently has a net worth of over $750,000 and is on track to retire by her early 40s.

"I'm more than comfortable right now," she says. "I have everything I want. I have everything I need."

Building a military career

Wang decided to pursue dentistry after learning about the literal fruits it could provide. As a child, she once went grocery shopping with her landlord, a fellow Chinese-American who also worked as a dentist and was a family friend. She watched in amazement as he filled his cart with whatever foods seemed to strike his fancy, not seeming to take cost into account.

"To me, that was the height of luxury," Wang says, explaining that she wasn't allowed to ask her parents for anything when they went food shopping. "He was probably the first example of somebody that I knew that achieved the American dream for himself."

Always a devoted student, Wang received a full academic scholarship to the University of Maryland, Baltimore County, where other scholarships and a part-time job paid for her books and living expenses, enabling her to graduate debt-free.

While there, the Navy gave a presentation to the dental association she was a member of, outlining the perks of joining, including travel and generous health and retirement benefits. On top of that, the Navy offered scholarship programs that would completely pay for dental school.

She joined the Navy shortly after while applying to dental school, and participated in the Health Services Collegiate Program, which gave her a monthly stipend that she used to paid tuition, books and other fees for dental school at the University of Maryland. In return, she committed to joining the Navy's active duty team as a commissioned officer for at least four years following graduation.

"I would highly recommend [this path] to anyone who's interested in financing their education without going into debt," she says.

Now in her ninth year in the Navy (her time in dental school counts toward her years of service), Wang plans to stick around until she's at least until 42, when she can retire with 20 years of active duty service under her belt and receive a monthly payment from the military for the rest of her life.

Her day-to-day looks like your typical dentist's, performing the routine checkups, cleanings and oral surgeries that civilian professionals do. The main difference: Her office is occasionally a warship.

She was stationed in Virginia and Japan before San Diego, and generally moves every few years. The Navy has also taken her to the Philippines, Hong Kong, Guam, South Korea and Australia, which she considers a perk of the job.

"Moving every two to three years definitely has its challenges, but overall I'm enjoying every move so far," she says. "Every new place presents with new challenges and opportunities to learn."

How she budgets her money

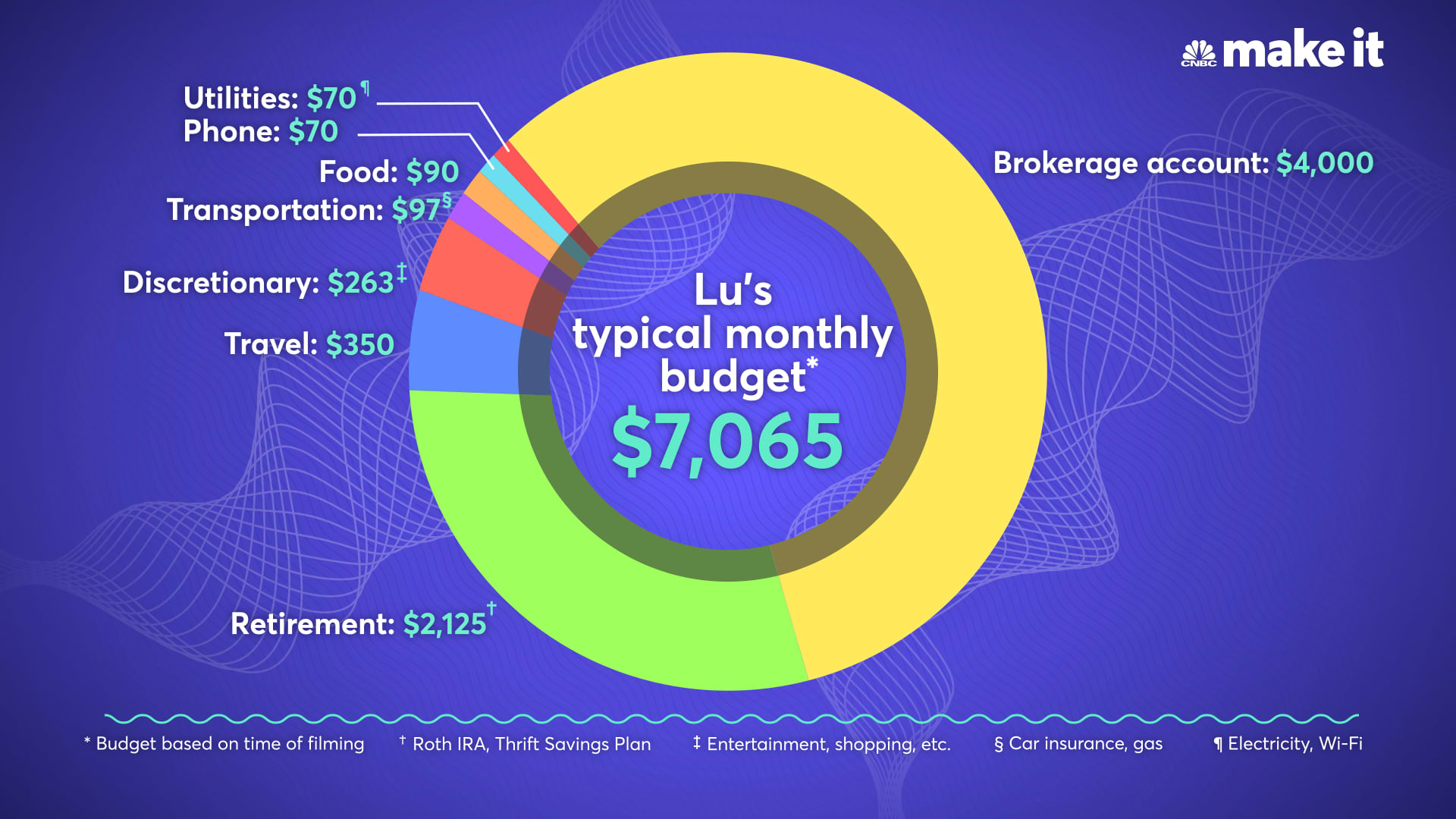

Here's a look at how Wang budgeted and spent her money in November 2021.

- Brokerage account: $4,000

- Retirement investments: $2,125 ($1,625 in Thrift Savings Account; $500 in Roth IRA)

- Travel: $350

- Discretionary: $263 ($200 for entertainment expenses; $50 for shopping; $13 for Dental Officer Association fee)

- Transportation: $97 ($57 for car insurance; $40 for gas)

- Food: $90

- Phone: $70

- Utilities: $70 ($45 for Wi-Fi; $25 for heat and electricity)

Because Wang receives a $3,102 monthly non-taxable housing allowance from the Navy as part of her salary, her $2,700-a-month rent for a one-bedroom apartment in San Diego doesn't cost her anything out-of-pocket. She even gets to bank the $402 difference each month. She also gets $266 per month in non-taxable food allowance, which reduces her grocery and take-out bills significantly.

With housing costs and some of her food taken care of, Wang is able to invest most of her take-home pay. She puts around $4,000 per month into a brokerage account, holding mostly index funds as well as some individual stocks and dogecoin.

Each year, she also maxes out her Roth IRA and contributes to her Thrift Savings Plan, the military's version of a 401(k), which earns her a 5% employer match.

"I don't live a very extravagant lifestyle, so I'm able to put away quite a bit without feeling like I'm depriving myself," she says.

Wang has around $6,000 in her checking account, which she considers her liquid savings. Adding more to that is not a priority at the moment. "I haven't been saving regularly since the market is down and it's a great time to buy," she says.

Aside from her investments, Wang prioritizes traveling and some splurges on quality food ("Food is one of the greatest loves of my life," she says), and keeps her expenses minimal. She doesn't own a television because she would rather spend her time doing activities she considers more enriching, like mentoring younger coworkers, reading about investment strategies and spending time with friends.

"I'm very selective with what I purchase and how I spend my time now," she says. "I don't think I've ever regretted not watching TV."

On the road to financial independence

When she was 22 and starting dental school, Wang's father suggested she start investing some of her military stipend. Her parents had always emphasized the importance of saving, but investing was a whole new world. She turned to sites like YouTube and Reddit to learn more about mastering her money.

It was during one of these deep dives into online personal finance content that she discovered financial independence, retire early, or FIRE, groups. Already a frugal person, the idea that her lifestyle could give her options she never had as a child was appealing.

"Time is our most valuable resource. Financial independence, to me, means I can afford to buy precious time and allocate that to however I see fit," she says.

Technically, Wang can retire from the Navy at 42. But she feels fulfilled by her work; rather than focusing on early retirement, it's the financial independence aspect of FIRE that she finds particularly appealing.

"I want to be able to spend my time doing the things that really bring me enjoyment in my life," she says. That includes "slow travel," or visiting different places for three to four months at a time before moving somewhere else, and eventually picking one of those locations to settle down in long term.

Ultimately, Wang believes adhering to FIRE principles will ensure that she never again feels how she did walking to school all those years ago, watching her classmates zoom past her in their shiny, new cars.

"We all are promised one life only," she says. "I plan on utilizing my time wisely and to live a full and enriching life of my choosing."

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: This 27-year-old makes $100,000 a year and paid off her mom's $28,000 mortgage