- As prices rise, Americans are racking up more and more credit card debt.

- Experts often recommend moving your balance from a high-rate credit card to one with a no-interest offer to reduce the amount you're paying.

- And yet, 37% of those with credit card debt don't know these balance transfer offers exist, according to a recent report.

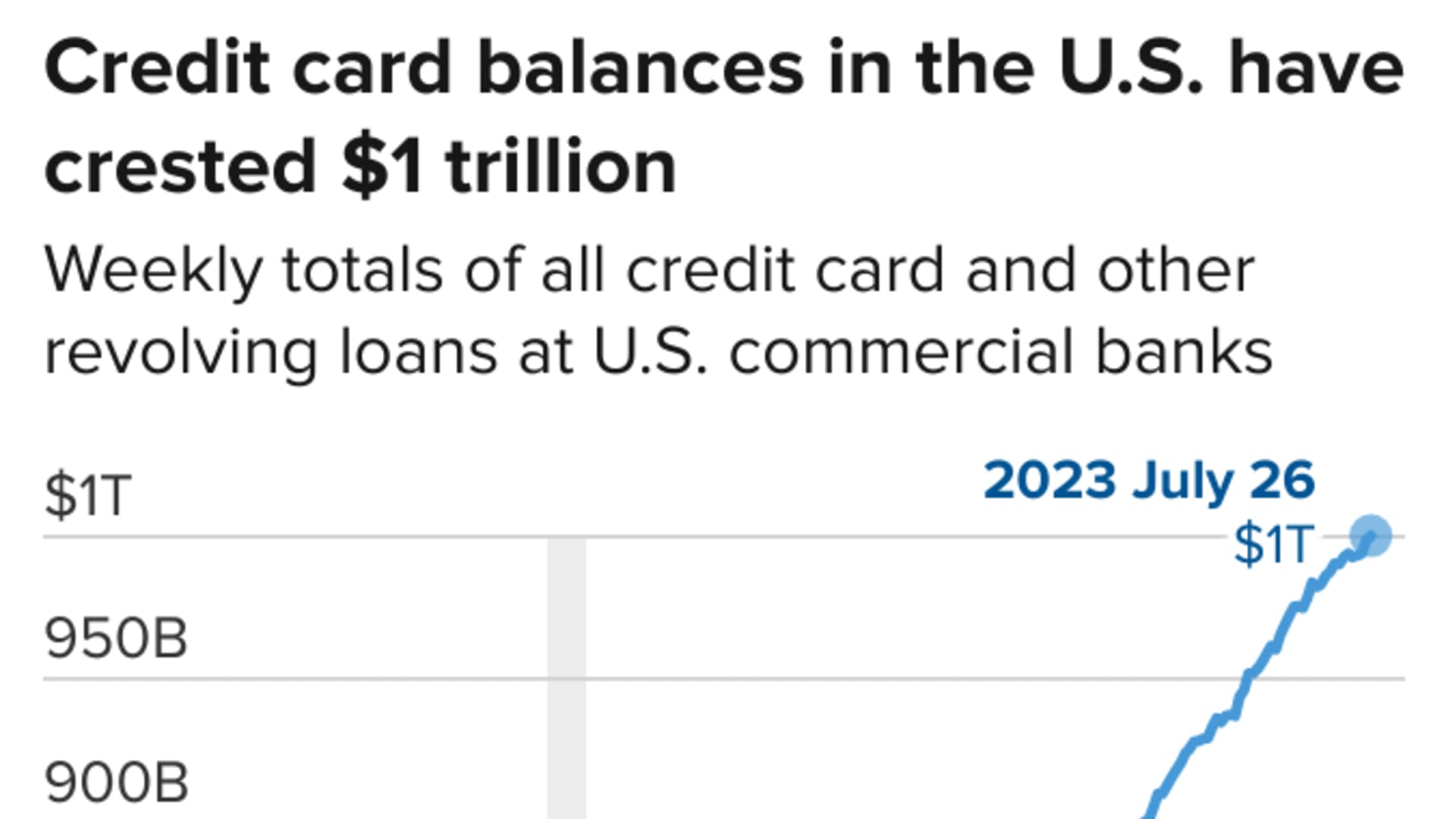

Collectively, Americans owe more on credit cards than ever before.

Thankfully, 0% balance transfer credit card offers — which are "one of the best weapons Americans have in the battle against credit card debt" — are even more plentiful than they were a year ago, said Matt Schulz, chief credit analyst at LendingTree.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Yet 37% of those with credit card debt don't know that balance transfer offers exist, according to a recent Bankrate report.

Here's how they work, and how to use them to your advantage.

Credit cards are one of the priciest ways to borrow

Money Report

At the end of 2022, total credit card debt hit a record $930.6 billion, a 18.5% spike from a year earlier, according to the latest report by TransUnion.

The average balance rose to $5,805 over that same period, TransUnion found.

From month to month, credit cards are one of the most expensive ways to borrow money. Card credit card annual percentage rates now stand near near 20%, on average, also an all-time high.

At nearly 20%, if you made minimum payments toward this average credit card balance, it would take you more than 17 years to pay off the debt and cost you more than $8,213 in interest, Bankrate calculated.

Still, many Americans continue to take on ever-increasing amounts of borrowing. And as credit card balances creep higher, Americans' confidence in their ability to pay their bills declines.

No- or low-interest balance transfers can help

Experts often recommend moving that balance from a high-rate credit card to one with a no-interest or low-interest balance transfer offer to reduce the amount of interest you're paying.

"A 0% balance transfer card is an excellent tool that can help you break the debt cycle," said Ted Rossman, senior industry analyst at Bankrate.

If you moved that same $5,805 balance to a 0% balance transfer card for 21 months, you could pay off your debt in less than two years with monthly payments of roughly $276, and without paying any interest, he calculated.

More from Personal Finance:

64% of Americans are living paycheck to paycheck

What is a 'rolling recession' and how does it impact you?

Almost half of Americans think we're already in a recession

How to make the most of a balance transfer offer

There could be a catch: Nearly half of consumers who take advantage of a balance transfer offer don't pay off the balance during the introductory period that comes with low or no interest, some studies show.

"These cards can be a really good tool, but people need to understand how to use them the best way," Schulz said.

If you don't pay the balance off during the initial period, the remaining balance will have a new annual percentage rate applied to it, which is generally about 23%, on average, in line with the rates for new credit.

Further, there can be limits on how much you can transfer and fees attached. Most cards have a one-time balance transfer fee, which is usually around 3% of the tab, but there can be an annual fee, as well.

One late payment can also negate your no-interest offer.

Making the best use of a balance transfer boils down to making those payments on time and aggressively paying down the balance during the introductory period.

Alternatively, Schulz advises cardholders burdened with high-interest debt to reach out to their issuer directly to request a break on interest rates.

Otherwise, borrowers may also be able to refinance into a lower-interest personal loan. Those rates have climbed recently, as well, but at 10%, on average, are still well below what you currently have on your credit card, according to Schulz.