- Transportation, trucking and railroad stocks, such as JB Hunt, Union Pacific and UPS, have been among the market's weaker performers in recent trading.

- Truck drivers in California are being laid off due to lack of container volumes.

- Overall ocean bookings for cargo headed to the U.S. are down.

- Movement of freight from warehouses to stores is slowing and this week's GDP report showed investment in inventory declined in Q1 as fewer firms restocked.

A common talking point from executives on logistics company earnings calls this quarter when discussing weak performance — a slowdown in freight volumes — is backed up by key economic data underlying the outlook for the trucking and rail sectors.

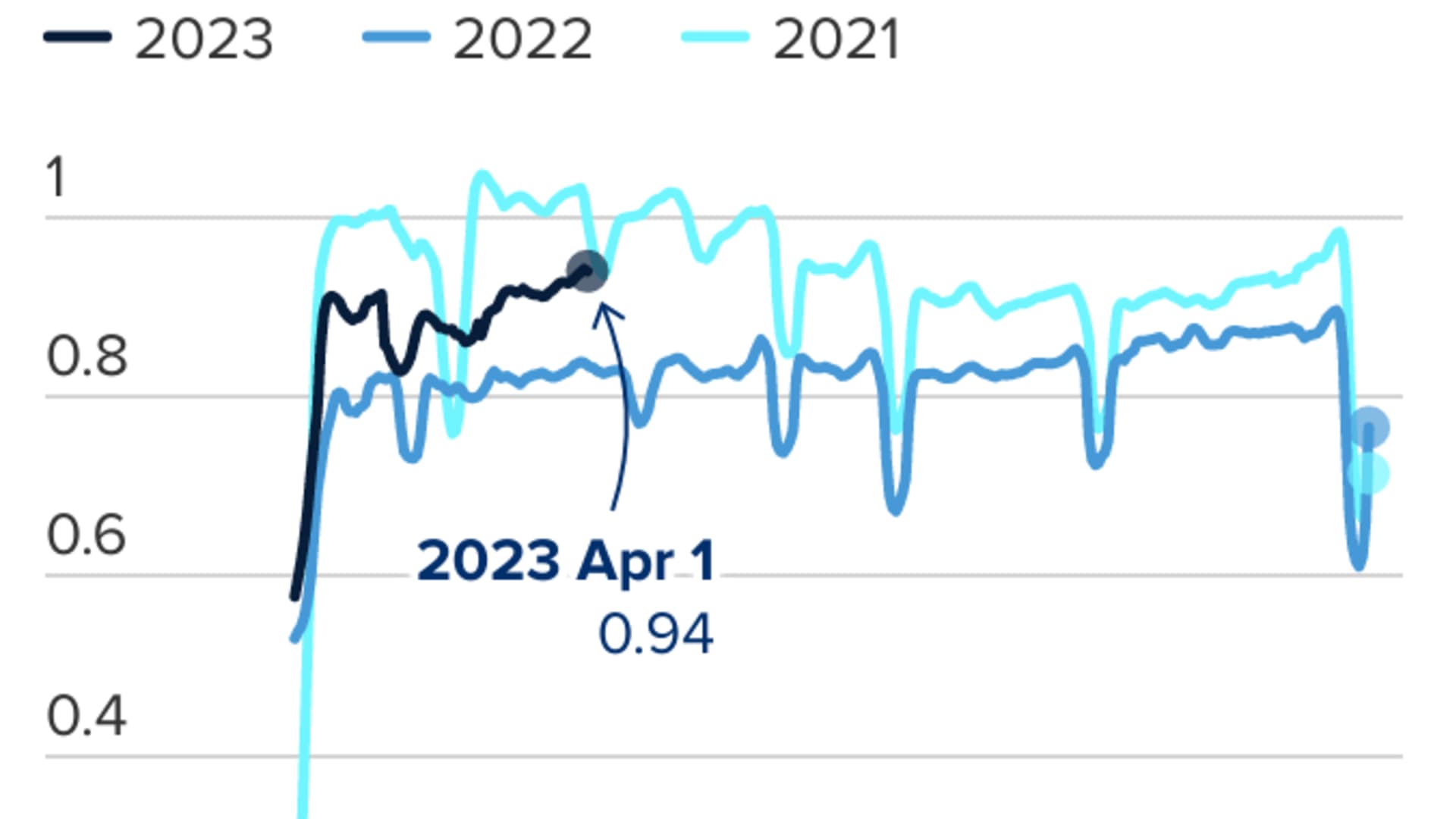

Trade trend analysis from CNBC Supply Chain Heat Map data providers has been signaling weakness in inbound freight for the last several months. The decrease negatively impacts earnings for both trucking and rail where revenue is generated by moving freight.

UPS CEO Carol Tome cited a deceleration in U.S. retail sales as a factor in lower than anticipated volume, and ongoing demand weakness in Asia. "Given current macro conditions, we expect volume to remain under pressure," she said.

J.B. Hunt Transport Services' president Shelley Simpson recently described current industry conditions as a "freight recession."

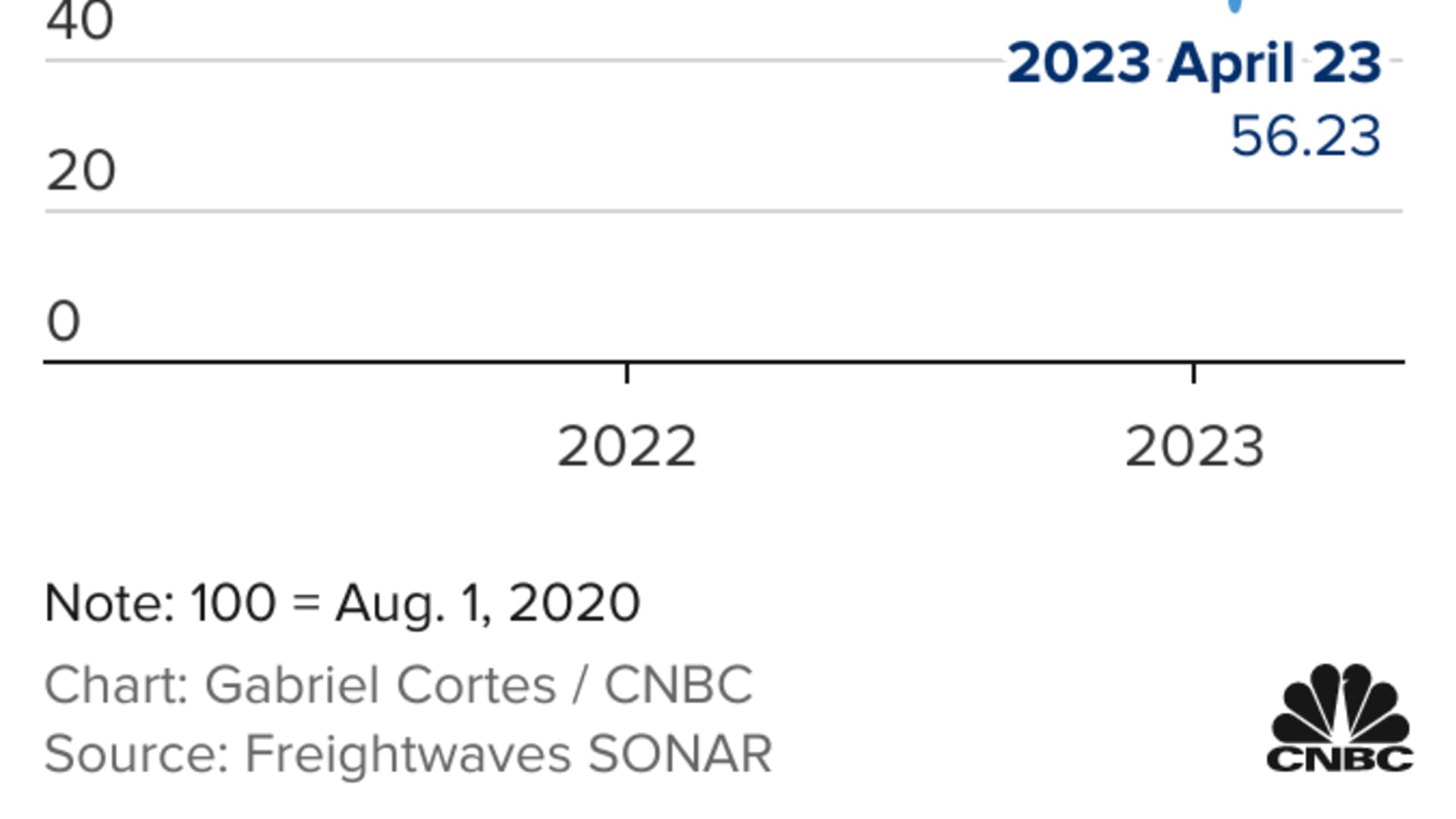

Ocean freight orders are a leading indicator of train and trucking earnings since 90% of the world's trade moves by water. With manufacturing orders trending down between 30-40% since June of last year, it should come as no surprise ocean bookings have declined. Fewer ocean orders mean less freight arriving into the United States to be moved by train or truck.

This is one of three key supply chain charts that are signaling more financial potholes for trucking and rail companies.

On the Union Pacific earnings call last week, CEO Lance Fritz cited inflation, high inventory levels, and weak consumer spending as near-term challenges. UNP receives freight from the West Coast and Gulf Coast ports. West Coast ports have been losing trade to both the East Coast ports and Gulf ports as a result of prolonged labor negotiations, though union representatives indicated last week a "tentative agreement" had been reached, but no details were provided.

Money Report

CSX beat earnings estimates as a result of increased volumes of merchandise freight and coal transports. Norfolk Southern also reported merchandise and coal strength. Both NSC and CSX receive freight from East Coast and Gulf Coast ports. But even with the earnings picture mixed, as a group the stocks have traded down by roughly 5% over the past week.

The biggest negative in Thursday's first quarter GDP report was a decline in private inventory investments even as consumer spending remained relatively strong, as firms discount more and restock less in anticipation of consumer weakness ahead. As the economy slows, the decline in goods moving by freight can also be seen in the big box retail activity.

In the 60-plus markets ITS Logistics serves in North America, average utilization in total trucking capacity is 75%.

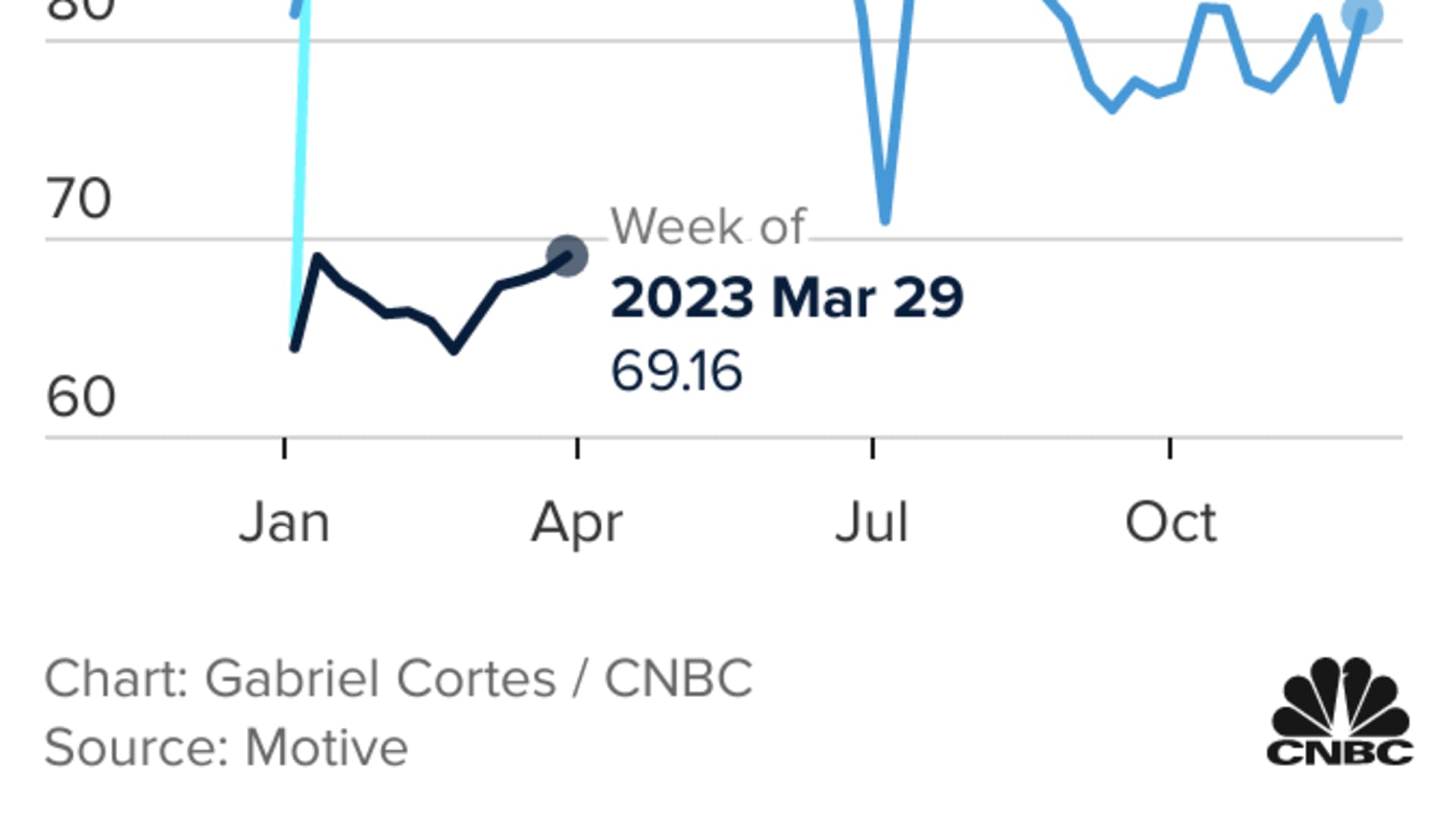

For some trucking companies, there is more work to do as the supply chain issues of the past few years further ease. In March, there was a 6% increase in truck utilization compared to February, according to data from Motive. "With delays in docking and discharging cargo at ports removed, combined with greater trucking capacity and a tighter cost environment, companies are being forced to use assets more efficiently," said Hamish Woodrow, Motive's lead data analyst.

He added it is important to note that the upward trend is partially due to the disparity between larger enterprise fleets with more overall freight volume versus smaller fleets that have been more adversely affected by volatility in fuel prices and demand over the past 8-12 months.

At the same time, the trucking industry is traveling further for work. The 7-day average mileage for trucking companies is up, according to Motive.

The decline in ocean bookings and longer-term shift away from California ports compounds the problems for the trucking industry.

Paul Brashier, vice president of drayage & intermodal at ITS Logistics, said one of the biggest challenges facing the industry right now is the location of trucking labor. Despite a long-term shortage of drivers for the trucking industry, labor is currently being reduced on the West Coast.

"We're re-balancing our driver workforce away from California because of the drop in freight volumes," Brashier said. "At the same time, we are actively hiring in Texas and the Midwest to respond to the increasing need to move containers coming into Houston, Southeast and Midwest. Trucking is needed for both container pick up at the ocean terminals and rail ramps. We've also seen an increase in containers traveling inland into Chicago, Dallas and Atlanta."

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; global maritime analytics provider MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight rate benchmarking and market analytics platform Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; DHL Global Forwarding; freight logistics provider Seko Logistics; Planet, provider of global, daily satellite imagery and geospatial solutions, ITS Logistics provides port and rail drayage services in 22 coastal ports and 30 rail ramps throughout North America, and Motive, Automated Operations Platform for vehicle and equipment tracking.