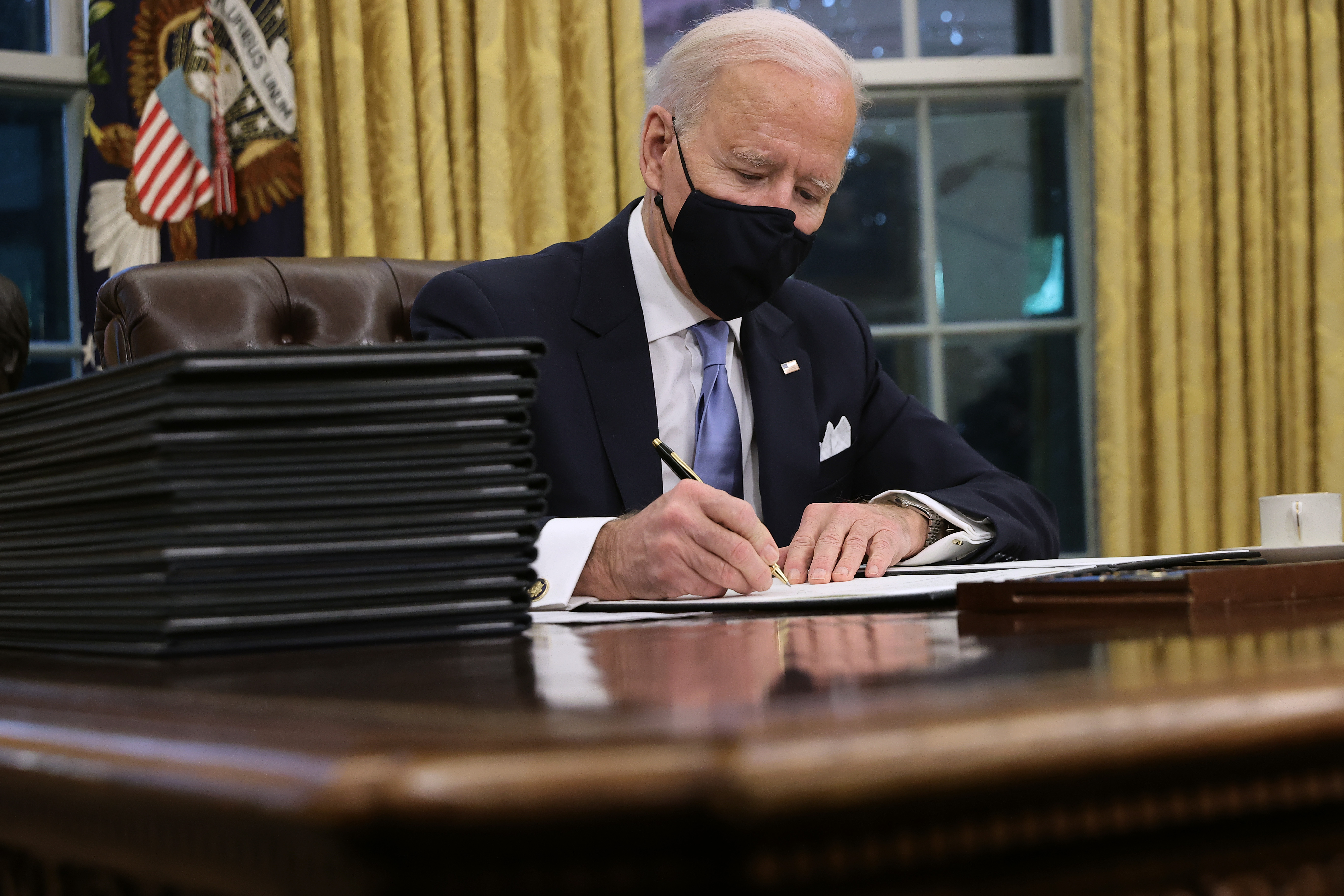

In one of his first orders of business, President Joe Biden issued an extension of the pause on federal student loan payments for eight more months.

It is a relief to many struggling borrowers.

"I ended up with $30,000 in federal student loans," says Jenny Rollins, a Boston University graduate.

Rollins is expecting her first baby next week and is relieved by the extension.

More on the Biden administration

"The fact that I don't have to worry about paying student loans right now, and instead, I can focus on paying some of the hospital bills and prepping for the baby to come, has been a lifesaver," Rollins said.

The loan pause is being extended through the end of September. If you have a federal student loan, you are not required to make any payments, no interest will accrue on your account and collections are paused.

But be aware that loan servicing companies can make mistakes, and those mistakes can impact your credit.

"There can be negative impacts to somebody's credit report if this federal loan forbearance isn't being followed properly," said Donald Kerr, senior manager of student lending with AAA Northeast. "Go online and visit your federal loan servicing company. You can create an online account and look at the status of your loan at any point in time to see if it is in repayment, when the next payment is due, if it is past due, you can see all of this online."

You can also check your credit report to see how your payment status is being reported on your student loans.

If you are listed as delinquent, contact your student loan servicer to get it corrected immediately.

"I've checked every single time there has been an extension to just make sure that everything is good, and it's been good to go," said Rolllins.

And if you do have the ability to continue making payments during this time, take advantage of the situation.

"It's a really great time where you can make payments, and you're going to see your payments go and reduce the principal really fast," said Kerr. "You can kind of kickstart getting your loans repaid, shorten your repayment term. If you can send extra, you're going to really see your principal balance go down very quickly, which will save you money in the long run."

That's the plan Dave Yelle of Wilbraham, Massachusetts, has for his daughter's loan.

"We're going to begin payment on my daughter's effective immediately to try to pay that down," said Yelle. "With the impact that the pandemic has had on the employment market, this is a major plus. I think anything we can do to try to assist any of them, when they hit the workforce, that they're not completely overwhelmed by the amount of student loan debt, is a major, major plus."

Through April, you can get your free credit report from each of the three credit bureaus once a week. Visit annualcreditreport.com to get started.