Tax season is here! How does a year of stimulus checks, unemployment payments and working from home play into things?

If you’re one of the millions of Americans who collected unemployment in 2020, it is taxable.

Richard Rothbell of Nashua, New Hampshire, did not withhold taxes from his benefits.

“I wanted to get as much money as I could out of the checks,” he said. “This year when I do my taxes I’m pretty sure I’m going to have to go into my emergency IRS savings tax fund and probably deplete the entire thing.”

Trish Gormican, a certified public accountant with Gormican PC in Wellesley, advises people who are currently collecting unemployment to make sure their taxes are being withheld to avoid a tax surprise next year.

“If you are on unemployment now and you have not taken out federal and state taxes, I would highly recommend that you go in now and adjust those amounts to a percentage -- even 10% federally and 5% state would cover the bare minimum of what you would owe come tax time,” Gormican said.

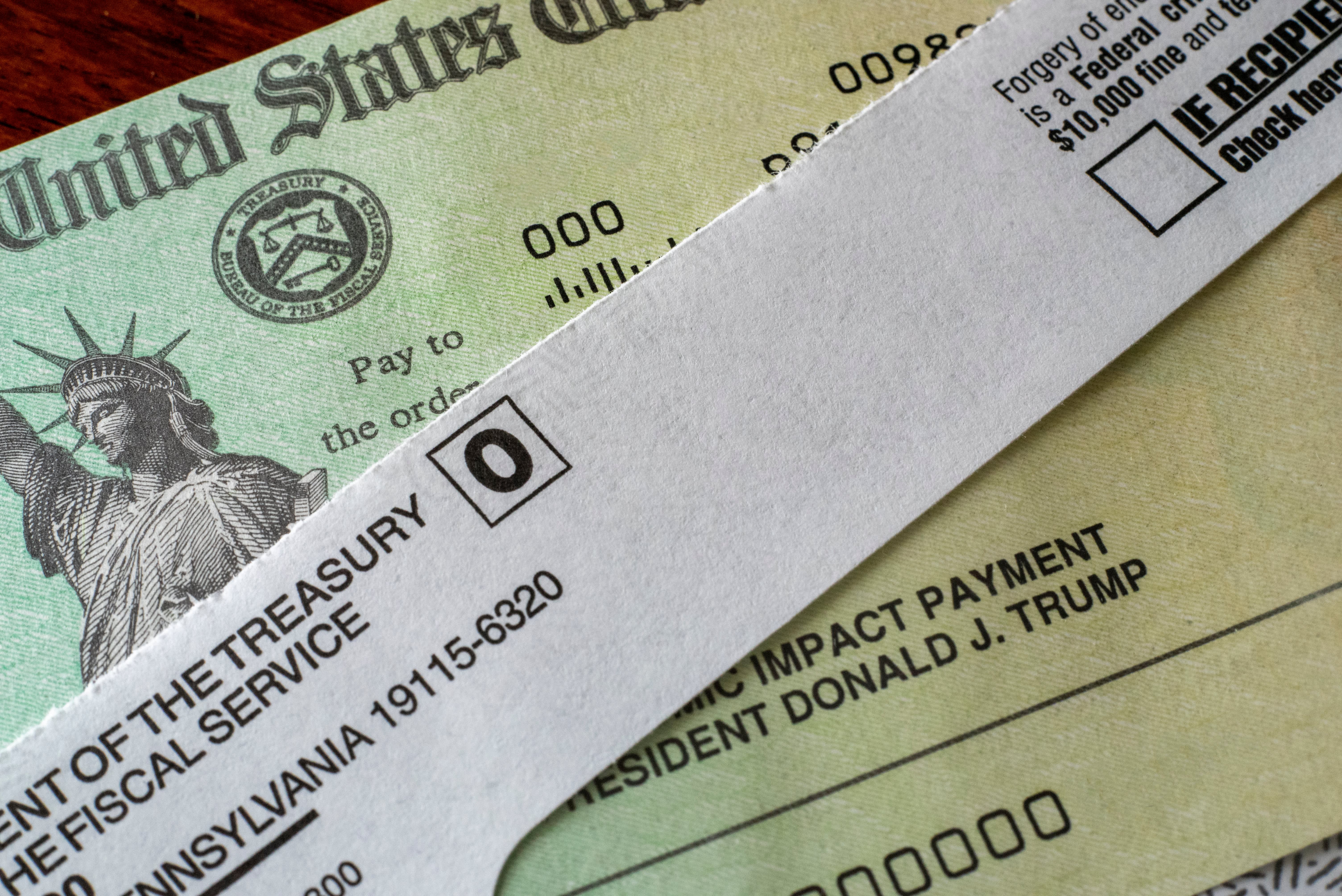

Some tax time good news: those pandemic stimulus payments are not taxable. If you didn’t receive your stimulus money last year, you can use the recovery rebate credit on line 30 of your tax form to claim it.

“If you did not receive the first round of stimulus checks or the second round of stimulus checks the catch up provision is in the 2020 tax return,” Gormican said. “You need to input those numbers into your 2020 tax return and those will go into the calculation for your 2020 payment or rebate and then you will essentially get that refund back that way.”

Did you invest in a home office last year? Leanne Foster of Worcester, Massachusetts, did.

“I did purchase a new laptop because my old one was just not sufficient anymore,” Foster said. “It would be nice to take that home office deduction for those weeks and months when I was working 40-plus hours from an office in my home. But I’m not optimistic.”

In most cases you can’t write off things like a new desk, printer ink or utility bills.

“You are allowed to take a deduction if you own your own business or you are an independent contractor,” Gormican said. “If you are an employee of a company you are not allowed to take that deduction anymore.”

How about those home upgrades and renovations you made during the pandemic? Is any of that deductible?

“The only thing that is really deductible on your tax return is if you installed, say, solar panels, energy efficient water heaters, external windows and doors -- those types of things may have an impact on your tax return and I would definitely advise you to give any sort of documentation like that to your tax professional,” Gormican said.

You may have also made more charitable donations last year. There is a special tax law change for 2020 to allow more people to claim an individual deduction of up to $300 in qualifying donations. Charitable donations could be made to a church or any sort of nonprofit like a food bank or animal shelter. The one thing that is not allowed are any sort of political donations, so if you made a donation to the Republican party or the Democratic party, those donations are disallowed by the IRS.

If you pay rent in Massachusetts, don’t forget to claim the rental deduction of up to $3,000 on your state return.

And if you commute to work and pay tolls through E-ZPass or buy MBTA, bus or commuter rail passes, you can claim up to $750 if you pay more than $150 a year.

And if you’re a parent, grandparent, aunt or uncle who contributed to a child’s 529 college savings plan last year, you can deduct up to $1,000.

The IRS filing deadline was extended last year due to the pandemic emergency, but the April 15 deadline holds this year.

If you need more time, you can apply for a tax extension, but remember that doesn’t grant you any extension of time to pay your taxes. You’ll need to estimate and pay any owed taxes by the regular deadline to avoid penalties.