What to Know

- Gniadek has paid more than $58,000 on her student loans in eight years, but she still owes a balance of more than $47,000.

- During a forbearance, monthly payments are put on hold. However, interest continues to accrue, adding to the total amount borrowers owe.

- A federal case claims Navient “systematically and illegally failed borrowers at every stage of repayment.”

Allyssa Gniadek doesn’t know whether to laugh or cry when she pages through her pile of student loan financial documents.

“I mean, look at these,” she expresses with a loud sigh.

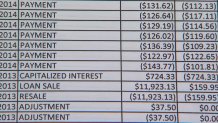

In the eight years since graduating college, the sales manager has paid more than $58,000 on her student loans. However, less than half of that has put a dent in the principal she owes, a balance that still looms at more than $47,000.

“I have so much regret about not educating myself more on what it was going to cost me in the long run to have a degree,” Gniadek said.

The 30-year-old thought she was making the affordable choice by pursuing a degree from an in-state school like UMass Amherst.

But shortly after donning the cap and gown, the bills for $76,000 in federal and private loans arrived. Before long, the monthly payment had ballooned to $1,100.

Gniadek, who is now married with a baby and living in Thompson, Conn., admits other dreams like a savings plan will have to wait.

“Those payments come fast and furious,” she explained. “You don’t realize the snowball effect this financial burden ends up having on your life.”

Gniadek believes that financial burden is worse than it had to be. As she struggled to make payments while bouncing from bartending to waitressing jobs, her student loan servicer, industry giant Navient, placed her in forbearance.

During a forbearance, monthly payments are put on hold. However, interest continues to accrue, adding to the total amount borrowers owe.

“I wish I would’ve known about something like an income-based repayment plan, but I feel like they gave me any other choices,” Gniadek recalled. “They really steered me in a way that was more financially beneficial to them.”

Allegations like that are central to lawsuits filed by five state attorneys general in California, Washington, Pennsylvania, Illinois and Mississippi.

In early 2017, the Consumer Financial Protection Bureau (CFPB) brought a federal case, which claimed Navient “systematically and illegally failed borrowers at every stage of repayment.”

Formerly part of Sallie Mae, Navient services the loans of more than 12 million borrowers, including an estimated 225,000 people in Massachusetts. Altogether, it handles more than $300 billion in federal and private student loans.

U.S. & World

Along with complaints about forbearance, the lawsuit also accused Navient of incorrectly processing payments, deceiving borrowers about requirements to release a co-signer, and harmed the credit of disabled borrowers.

The Delaware-based company has assembled its own online response to the allegations in the mounting lawsuits, refuting many of the key claims.

“The allegations are unfounded,” the response reads. “The suits improperly seek to impose penalties on Navient based on unannounced servicing standards applied retroactively. We will vigorously defend our record in court, and are confident we will prevail.”

A spokeswoman with the Massachusetts Attorney General tells the NBC10 Boston Investigators the office has its own investigation into Navient and wants to hear from other borrowers who have experienced issues.

Previous legal action against the servicer that handles loans for the state’s MEFA program resulted in restitution to borrowers who got a raw deal.

Note: Massachusetts borrowers who are looking for student loan help or information should visit the AG’s Student Loan Assistance page or call the Student Loan Assistance Unit Hotline at 1-888-830-6277.

Boston student loan attorney Adam Minsky has heard plenty of horror stories, including specific complaints about Navient.

“People who are put on the wrong repayment plan or there are calculation errors in the right repayment plan,” Minsky listed. “Borrowers who are given misleading information about the best programs available, which winds up steering people in the right direction.”

Regardless of the student loan servicer, Minsky recommends borrowers:

• Avoid high-interest private loans at all costs because payment options are limited

• Keep all financial records to dispute payment mistakes

• Reevaluate student loan payment plans annually

• Do homework on the different payment structure options available

“The servicer is not your counselor and the servicer is not there to look out for you,” Minsky said. “The servicer is there to collect your money.”

Despite a steady job and her 800 credit score, Gniadek struggled to refinance her loans without a co-signer. However, she finally scored an option with more favorable rates. Her goal is now to be debt-free in five years, instead of what would’ve been a 13-year struggle.

“I would be 43 by the time I pay off my student loans. How do you start a life that way?” Gniadek expressed. “I think that’s predatory and it’s why I wanted to shed more light on the situation because I’m not the only one.”

Ryan Kath can be reached at ryan.kath@nbcuni.com. You can also follow him on Twitter or connect on Facebook.