-

Here's who qualifies for the home office deduction on this year's taxes

If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts.

-

IRS halts processing of pandemic-era tax credit amid fraudulent claims surge

A growing number of questionable claims are coming from small businesses who may or may not be aware that they aren’t eligible.

-

Time Is Running Out to Repay Covid-Era 401(K), IRA Withdrawals — and Claim a Tax Refund

The CARES Act let investors take up to $100,000 of “coronavirus-related distributions.” Savers who repay funds within three years could claim a tax refund.

-

Democratic Lawmakers Want to Give You Up to $1,500 to Buy an Electric Bike. Here's Why

According to a study, electric bikes are becoming increasingly popular around the world. In the U.S. alone, e-bike sales are outpacing electric and hybrid cars combined.

-

From Montana to Michigan: These States Are Giving Residents Tax Cuts Amid Cash Surpluses

Nationwide, states’ total financial balances reached a record $343 billion at the end of their 2022 fiscal years — up 42% from the previous year, according to a recent report by The Pew Charitable Trusts.

-

West Virginia Wants to Give Ex-Residents $25,000 to Move Back to the State

West Virginia’s Senate passed a bill Monday that would give $25,000 in tax credits to former residents who move back to the state to work.

-

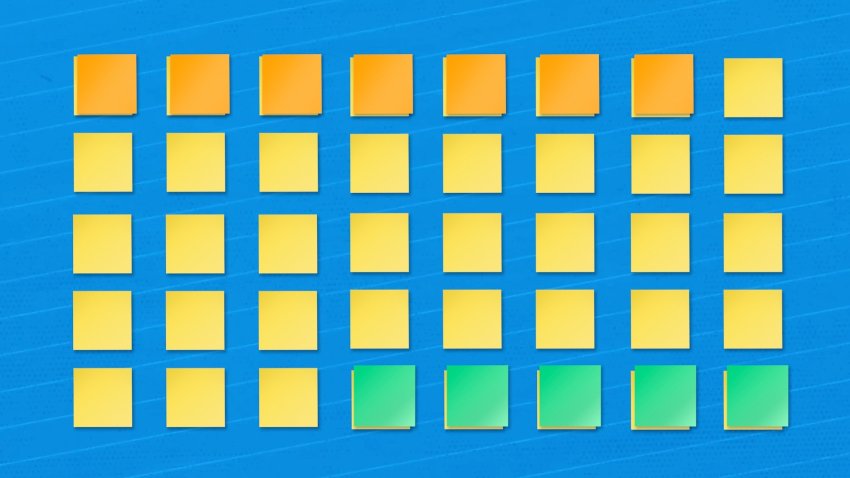

The Difference Between Tax Credits and Deductions Explained With Sticky Notes

Both tax credits and tax deductions can help taxpayers keep more of their money, but they do it in very different ways. Here’s how they work.