- The Nasdaq is on a hot streak.

- Wells Fargo dramatically pulls back from the mortgage business.

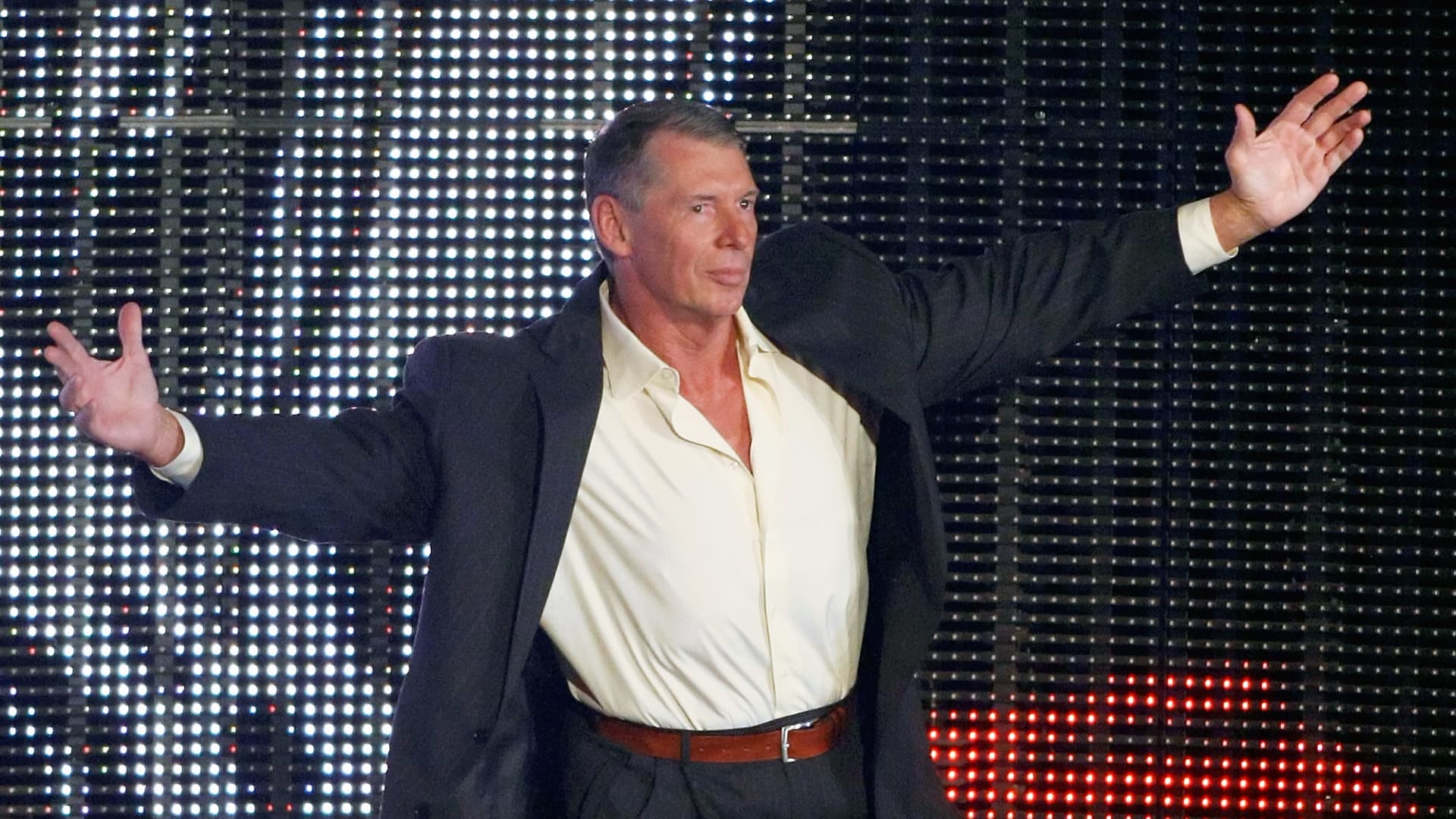

- Stephanie McMahon steps down at WWE as Vince McMahon returns.

Here are the most important news items that investors need to start their trading day:

1. The Nasdaq is warming up

There are still plenty of data dumps and reports ahead that could put the chill on stocks. But for now, U.S. equities markets are doing just fine in the early days of 2023. The Nasdaq, especially, is generating some heat, posting three winning sessions in a row. The tech-heavy index is coming off a bad 2022, falling much more than the broader S&P 500 and the blue-chip Dow, as rising interest rates spoiled many investors' appetites for risk. Still, rates aren't coming down any time soon, and the Federal Reserve is indeed expected to hike them further, so this rally may not have legs. Read live markets updates here.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

2. Wells Fargo scales back mortgage biz

Wells Fargo was the nation's top mortgage lender as of 2019. Now, as the big bank faces tighter regulatory scrutiny and higher interest rates, it's taking a huge step back from the housing market. This will put it more in line with rivals such as JPMorgan Chase and Bank of America, which reduced their share of the mortgage market following the 2008 financial crisis. "We are acutely aware of Wells Fargo's history since 2016 and the work we need to do to restore public confidence," Wells Fargo consumer lending chief Kleber Santos told CNBC's Hugh Son. "As part of that review, we determined that our home-lending business was too large, both in terms of overall size and its scope."

Money Report

3. Powell shakes off political pressure

The Federal Reserve is hearing it from all sides as its policymakers attempt to tame inflation by raising interest rates. The central bank's critics said it took too long to address the issue, as prices surged at the hottest clip in four decades. Now they're saying the Fed is doing too much to fix it, potentially putting the economy at risk of a recession. This is why, Chairman Jerome Powell said, it's a good thing that the Fed is politically independent. "The absence of direct political control over our decisions allows us to take these necessary measures without considering short-term political factors," he said Tuesday in prepared remarks to Sweden's Riksbank. The Fed's next rate-setting meeting is set to run Jan. 31 and Feb. 1.

4. The World Bank's warning

The World Bank has grown more pessimistic about the global economy, dramatically cutting its projections for growth. "Global growth has slowed to the extent that the global economy is perilously close to falling into recession," the institution said Tuesday. Overall, it said it now expects global economic growth to hit 1.7% this year, down from its previous call of 3%. The World Bank significantly cut its outlook for U.S. economic growth, as well: down to 0.5% from its earlier projection of 2.4%. If these projections come to fruition, they would represent the third-slowest pace of growth in about 30 years, trailing only the slowdowns triggered by the financial crisis and the Covid pandemic, the World Bank said.

5. High drama at WWE

The corporate drama playing out at World Wrestling Entertainment could be a pro wrestling story line in its own right. Vince McMahon, the company's controlling shareholder and a frequent participant in its scripted soap opera-style narratives, retired over the summer after a company investigation revealed that he had paid millions of dollars in hush money to women who made sexual misconduct claims against him. His daughter, Stephanie, took over as co-CEO alongside former president Nick Khan. But Vince McMahon didn't go quietly. He pushed his way back into the company last week, effectively crowning himself executive chairman as the WWE explores a possible sale. In turn, Stephanie McMahon stepped down as co-CEO on Tuesday, and sale rumors have picked up. After defying broader media stock trends by actually rising last year, WWE shares are already up a whopping 31% so far this year through Tuesday's close.

– CNBC's Hugh Son, Jeff Cox, Jihye Lee and Alex Sherman contributed to this report.

— Follow broader market action like a pro on CNBC Pro.