Dow Jumps 500 Points to Break Four-Day Losing Streak as Regional Banks and Apple Shares Surge: Live Updates

Stocks popped on Friday as regional bank shares climbed off their lows and market-darling Apple jumped after posting better-than-expected quarterly earnings.

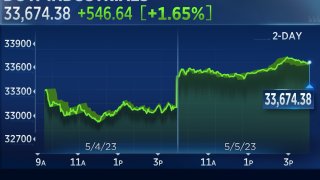

The Dow Jones Industrial Average added 546.64 points, or 1.65%, to close at 33,674.38. The S&P 500 climbed 1.85%, ending the day at 4,136.25. The Nasdaq Composite advanced 2.25% and closed at 12,235.41.

Despite Friday's rally, the Dow and the S&P 500 logged their worst week since March. The 30-stock Dow lost 1.24%, while the S&P 500 dropped 0.8%. The Nasdaq eked out a small weekly gain of 0.07%.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Stocks rose even as April's jobs numbers came in hotter than expected. The U.S. economy added 253,000 jobs in April. Wall Street had expected 180,000 new jobs, according to Dow Jones.

Late Thursday, Apple posted beats on the top and bottom lines for the fiscal second quarter, propelled by iPhone sales. Apple shares gained about 4.7%.

The rebound for regional bank stocks was boosted by a note from JPMorgan, which upgraded Western Alliance, Zions Bancorp and Comerica to overweight. The firm said those three banks appear "substantially mispriced" in part due to short-selling activity. The SPDR S&P Regional Banking ETF (KRE) advanced more than 6%. PacWest — which is down sharply this week on news it's considering strategic options that include a sale — popped 81.7%. Western Alliance also jumped 49.2%.

Money Report

Shares of regional banking companies have been under pressure this week, as traders fear other institutions could suffer the same fate as Silicon Valley Bank and Signature Bank. Both banks collapsed in March.

Liz Young, head of investment strategy at SoFi, doesn't believe the fallout in the regional banking sector is over despite Friday's rebound. "When the whole news cycle started, it was sort-of explained away … as a unique circumstance for certain institutions. The reality is that liquidity is a universal challenge," she said.

"The issue originally was that deposit flight was occurring. … But now that the pressure is no longer necessarily deposit flight. It's this mark to market of the securities on all their books," Young continued.

"So I don't think that this news cycle isn't necessarily over. … I also don't think it dies of natural causes in the sense [that] it heats up and then just kind of cools down with no effect," she added.

Stocks close higher Friday

U.S. stocks ended higher Friday.

The Dow Jones Industrial Average added 546.64 points, or 1.65%, to close at 33,674.38. It ended the week 1.24% lower.

The S&P 500 climbed 1.85%, ending the day at 4,136.25. The broad market index shed 0.8% week to date.

The Nasdaq Composite advanced 2.25%, closing at 12,235.41. The tech-heavy index inched up 0.07% week to date.

— Hakyung Kim

Oil prices end on losses week to date

WTI Crude (JUN) settled up 4.05% on Friday at $71.34 after hitting a high of $71.81 earlier on Friday. This was the highest level since May 2nd, when WTI traded as high as $71.42

Meanwhile, WTI Crude is lower -7.09% week to date for the 3rd straight negative week and the worst week since Mar. 17, when WTI Crude lost -12.96%

Brent settled up 3.86% at $75.30 hitting a high of $75.75. Brent closed down -5.33% WTD for the 3rd straight negative week .

Natural Gas (JUN) settled up 1.71% at $2.137 after hitting a low of $2.031. Nat gas closed down -11.33% week to date for the first negative week in 4 and the worst week since Mar. 10, when natural gas lost -19.24% Natural gas is down 52.25% in 2023.

— Hakyung Kim

Ether jumps as much as 6% driven by memecoins

Ether rose more than 6% at one point Friday and was hovering just below the key $2,000. Market participants put the move on attempts to bring meme mania back to crypto.

The newly created SpongeBob token (SPONGE) has surged almost 600% since and is trading at less than 1 cent per coin, according to CoinMarketCap. Pepecoin (PEPE) is up more than 120% over the past 24 hours.

"One of the main reasons ETH is up ... is down to a resurgence of memecoins," said Conor Ryder, research analyst at crypto data provider Kaiko. "Whatever your thoughts on memecoins, the facts are they drive users to transact on Ethereum, which helps the network earn more fees. Ethereum gas fees have been revived by the return of memecoins, just today hitting 1-year highs."

— Tanaya Macheel

Oakmark Funds' Bill Nygren scooped up this regional bank stock in the first quarter

Value investor Bill Nygren told CNBC on Friday that he bought this regional bank stock as turmoil descended on the sector in the first quarter.

"We think it's an extremely attractive long-term investment that will weather this short-term difficulty just fine," he said.

Nygren also commented on the role of short sellers in the recent banking turmoil.

Read more on his views toward the sector here.

— Samantha Subin

"I wouldn't buy into this rally," says Verdence Capital Advisors' chief investment officer

Megan Horneman, chief investment officer at Verdence Capital Advisors, says that Friday's market rally despite the stronger-than-expected jobs numbers for April will not last.

"I think there's a lot of confusion around really what is to health of the labor market, because the number we got today isn't really reflecting some of the stuff we started to hear from businesses as far as layoffs," Horneman said.

Hornmean believes Friday's rally may be a short "relief rally."

"I wouldn't buy into this rally. In fact, if it continues this way, I would sell into this because there is likely going to be a recession," Horneman said.

"If you look at the average hourly earnings data that we got today, you know, that ticked higher and on a monthly basis, it was higher than expected and ticked higher on a year-over-year basis. And that's not what the Fed wants to see. So this isn't really a great. It's not great news that would I think warrants such a rally in the equity market."

— Hakyung Kim

Goldman says job gains won't stop the Fed from pausing on rate hikes

April's mix of solid job growth and higher than expected wage increases likely won't deter the Federal Reserve from holding the line on interest rates at its June meeting, according to Goldman Sachs.

The Wall Street firm's economists think policymakers could look through the nonfarm payrolls report and instead focus on the 13-month run of interest rate hikes and the ramifications of the banking troubles.

"We continue to expect a pause at the June meeting because of tighter credit conditions, the restrictive level of the funds rate, and [Fed Chairman Jerome] Powell's view that the May FOMC statement represents a 'meaningful change,'" Goldman said in a client note.

Market pricing is pointing to a 91.5% chance of a hold in June, with just an 8.5% probability of a quarter percentage point increase, according to the CME Group. Markets also expect the Fed to cut by three quarters of a point from the current fed funds rate target range of 5%-5.25% later this year.

—Jeff Cox

Stocks making the biggest moves midday

Check out some of the companies making headlines in midday trading.

Apple – The tech giant advanced more than 4%. On Thursday, Apple reported better-than-expected earnings and revenue for its fiscal second quarter, according to Refinitiv, driven by stronger-than-anticipated iPhones sales. The company also flagged strength in emerging markets and improved supply.

Lyft – Stock in the rideshare giant fell 21% on Friday, after reporting quarterly results a day earlier. Weak forward guidance drove the stock lower and stoked investor worry. The company beat expectations on revenue.

Coinbase – Shares of the cryptocurrency platform rose 17% after Wedbush reiterated an outperform rating on the stock earlier on Friday. The company reported beats on quarterly results a day earlier, with a smaller-than-expected loss of 34 cents per share.

The full list can be found here.

— Brian Evans

Regional banking crisis keeping yields from going much higher, AmeriVet's Faranello says

The recent regional banking crisis — which has led to the collapse of Silicon Valley Bank and Signature bank, along with the JPMorgan Chase takeover of First Republic — has led traders to seek shelter in Treasuries, Gregory Faranello of AmeriVet Securities said.

"In terms of what we're seeing [in the bond market], it has more to do with the regional banking situation at this point," said the firm's head of U.S. rates trading. "The market's fearful that this situation is going to evolve and ultimately hit the real economy."

"I think, if we didn't have these event coming into the marketplace, in terms of the financial system, rates would probably be a lot higher than where they are now," he said.

Treasury yields popped across the curve Friday after the release of the latest U.S. jobs report. The 2-year rate popped 20 basis points to 3.928%. The 10-year gained 10 basis points to 3.452%.

— Fred Imbert

Strength of the economy still worrying for the Fed, says LPL Financial's Quincy Krosby

Friday's strong job markets report — which showed that unemployment numbers are at 3.4% — means that the Federal Reserve should still be concerned about the path of inflation, said LPL Financial's Quincy Krosby.

Krosby said that the U.S. hasn't seen such a powerful labor market "since the 1960s."

"At the same time, wages are claiming higher. ... Amid prices paid in manufacturing [and] prices paid even in the service sector climbing higher. The totality of this is an economy that's still strong enough for consumers to spend, again as long as the labor market remains intact," she said.

"You still have an economy that is solid enough for the Fed to be concerned about where inflation is headed. I say this because next week, those reports are the CPI which of course, is backward- looking, but nonetheless important. The PPI [numbers] are also going to be very important."

— Hakyung Kim

Stocks that meet Warren Buffett's buying criteria ahead of Berkshire Hathaway's annual meeting

Ahead of Warren Buffett's annual Berkshire Hathaway's meeting in Omaha on Saturday, CNBC Pro screened for stocks that meet his buying criteria.

In the past, Buffett has laid out his criteria for acquisitions, noting that he looks for companies with at least $75 million in pretax earnings. He also prefers those that have demonstrated consistent earnings power, as well as good returns on equity.

The "Oracle of Omaha" may also face questions at the meeting about potential acquisitions. His last big purchase was insurance company Alleghany for $11.6 billion, which closed in October.

Berkshire is currently sitting on $128.6 billion in cash, as of Dec. 31. While Buffett's next acquisition is anyone's guess, CNBC Pro sought to identify names that fit the criteria he looks for when buying a company, with slight tweaks.

CNBC Pro subscribers can see the list here.

— Hakyung Kim

PacWest jumps 70% as regional bank stocks claw back losses

The regional bank stocks are extending their Friday rebound, led by PacWest with a gain of more than 70%.

The stock still has a long way to go to recover all of its losses from this year, however. In fact, PacWest shares are still trading below where the closed on Wednesday.

— Jesse Pound

Food and beverage stocks touch fresh highs

A handful of S&P 500 stocks reached record levels on Friday, including these food and beverage names:

- General Mills traded at all-time highs back to when it began trading on the NYSE in 1928

- Monster Beverage hit all-time high levels back to its listing on the NASDAQ in 1992

- Pepsico reached all-time highs back to Pepsi-Cola's merger with Frito-Lay in 1965 to form Pepsico.

Elsewhere, DraftKings rose to a 52-week high following strong earnings and guidance. Teradata, Eagle Materials and Madison Square Garden Sports also hit 52-week highs.

— Chris Hayes, Tanaya Macheel

Regional bank execs put their own cash to work

Officers and board members at several regional banks have been buying the dip in their own stocks over the past week, according to VerityData.

Zions Bancorp President and COO Scott McLean had one of the biggest buys on the list, scooping about $1 million of the bank's stock last week.

Check out the full list on CNBC Pro.

— Jesse Pound

Wage inflation likely to 'continue to drive inflation itself,' says Allianz

While April's higher-than-expected jobs numbers made headlines on Friday, the wage inflation data stood out to Allianz Investment Management's head ETF market strategist Johan Grahn.

Wages grew 0.5% last month for employees on private nonfarm payrolls, according to the Bureau of Labor Statistics.

"If you make a bold assumption to say that if it's 0.5%, that's an annualized 6%, wage wage increase. And that also speaks to the fact that there's underlying inflation," Grahn said. "A lot of firms would try to hold off as long as they can, hoping perhaps that inflation was 'transitory,' [but] what they've learned is that it's painfully difficult to find enough people and find the right people. They're forced into raising the wages."

He added, "there is a significant time delay to that, and I think that will still go on as long as we see this pressure in the labor market. I think the wage inflation will continue to drive inflation itself, and that, of course, will then in turn, you know, compression on the margins of the firms."

— Hakyung Kim

PacWest jumps 70% as regional bank stocks claw back losses

The regional bank stocks are extending their Friday rebound, led by PacWest with a gain of more than 70%.

The stock still has a long way to go to recover all of its losses from this year, however. In fact, PacWest shares are still trading below where the closed on Wednesday.

— Jesse Pound

S&P 500 could see its first full week of down finishes since 2020

The S&P 500's rally in trading on Friday marks a turn from the first four sessions this week, during all of which the broad index ended down.

But if the S&P 500 turns and ends Friday's session in the red, it would be the first time the index finished every trading day in a complete week lower since late February 2020, according to data analyzed by Ryan Detrick, chief market strategist at Carson Group.

And it would be the first time that has happened in the month of May since 2012.

Here's how much the S&P 500 has lost in each session so far this week:

- Monday: -0.04%

- Tuesday: -1.16%

- Wednesday: -0.7%

- Thursday: -0.72%

— Alex Harring

JPMorgan upgrades three regional bank stocks

Analysts at JPMorgan upgraded three regional bank stocks to overweight on Friday, saying in a note to clients that Western Alliance, Zions Bancorp and Comerica all appear to be "substantially mispriced."

Entering Friday, Western Alliance was down 51% for the week. Shares of Zions and Comerica had each fallen by about 28%.

All three stocks were higher in premarket trading, led by Western Alliance gaining 26%.

— Jesse Pound

Deutsche Bank upgrades SolarEdge

Shares of SolarEdge Technologies gained almost 1% Friday after Deutsche Bank upgraded shares to a buy from hold rating, citing fading cost and margin concerns

"The 2Q guide demonstrates the company's ability to maintain and potentially further improve its gross margin profile, with management commentary sounding solid around the coming quarters," wrote analyst Corinne Blanchard.

Read more on the upgrade here.

— Samantha Subin

U.S. stocks jump higher Friday

U.S. stocks rose higher Friday morning.

The Dow Jones Industrial Average traded 347 points higher, or 1.1%. The S&P 500 climbed 1.1%, and the Nasdaq Composite advanced 1%.

— Hakyung Kim

Stocks making the biggest premarket moves

Here are some of the names making the biggest news in the premarket:

- Cigna — Cigna added 3% after beating top- and bottom-line estimates for its latest quarter and raising its full-year forecast. Cigna's results got a boost from strong growth at its health insurance unit and lower medical costs.

- Warner Bros. Discovery — The media company fell 4.7% in the premarket after reporting a quarterly loss. While its adjusted earnings fell slightly short of expectations, its streaming business did turn around previous losses and reported a quarterly profit.

- DraftKings — The sports betting company's stock surged 12.7% after DraftKings posted significantly higher than expected revenue for its latest quarter and increased its full-year outlook.

To see more stocks making moves in the premarket, read the full story here.

— Peter Schacknow

U.S. jobs grow by 253,000 in April

The U.S. economy added 253,000 jobs in April, the Labor Department said. Economists polled by Dow Jones expected 180,000 jobs were added. The report comes after the Federal Reserve hiked rates by 25 basis points Wednesday and signaled that a pause may be on the horizon.

— Jeff Cox, Fred Imbert

Analysts view ongoing regulatory fight a 'major roadblock' for Coinbase

Ongoing regulatory and legal battles at Coinbase Global are creating an uncertain outlook for the crypto exchange platform despite better-than-expected quarter results, according to many analysts.

The commentary from Wall Street comes after Coinbase reported a smaller-than-expected loss for the recent quarter, boosting shares nearly 9% in the premarket.

Wells Fargo's Jeff Cantwell called the regulatory backdrop a "major roadblock" for the company.

Read more on what lingers for Coinbase here.

— Samantha Subin

Apple results show signs of resilience in a tough environment, analysts say

Analysts on Wall Street view the latest results from Apple as yet another sign of the technology giant's ongoing resilience and defensive positioning.

According to Evercore ISI's Amit Daryanani, the findings underscore the company's diverse revenue streams and show the iPhone's "consumer staple nature."

The stock rose 2.7% in premarket trading.

Read more on what analysts are saying after Apple's results here.

— Samantha Subin

Regional bank selloff 'reaching point of hysteria,' Fundstrat's Tom Lee says

Fundstrat head of research Tom Lee thinks the selloff in regional banks may be getting out of hand.

"We are arguably reaching a point of hysteria," wrote Lee. "For instance, Pacific West Bancorp ($PWBK) had to issue a press release and on its website state that it is not PACW — and after falling -5%, managed to close the day higher. Similarly, Republic First Bancorp ($FRCB) had to issue notices that it is not First Republic ($FRC) and after seeing its shares fall -20% managed to close down only -5%."

"And there are some suggesting that 0DTE options and short term speculators are adding to pressures," Lee said.

Regional bank stocks rose broadly on Friday, with the SPDR S&P Regional Banking ETF (KRE) up more than 2% in the premarket.

— Fred Imbert

Adidas up 8% after resilient earnings, despite Yeezy issues

Adidas shares jumped 8% on Friday after the German sportswear giant beat first-quarter earnings expectations, despite a 400 million euro ($441.56 million) hit to sales from the termination of its Yeezy partnership.

"There were a number of encouraging signs in Adidas' Q1 print. The firm reported better than expected China performance, a sequential improvement in inventory reduction and a scaling up of its franchise, such as Gazelle, Samba and Campus, along with accelerating momentum within the performance business," said Mamta Valeccha, equity research analyst at Quilter Cheviot.

"Despite this, forward guidance is for negative high single digit growth, which may be disappointing to some. However, this is a marathon not a sprint for Adidas. The company has a number of issues to get through such as rebuilding relationships with suppliers, a growth plan for China and the need to get to a more normalised level of inventory which will put pressure on margins, especially in North America."

- Elliot Smith

HSBC shareholders to vote on whether to spin off Asia business

HSBC shareholders are set to vote on proposals at the bank's annual meeting Friday, including on whether to spin off its Asia business.

Resolution 17 and 18 on the agenda, tabled by a group of investors led by Ken Lui, call for a "strategic review" of the company, including the spinoff proposal and fixed dividends.

These have received support from HSBC's top shareholder Ping An Insurance, but HSBC advised investors to reject the two resolutions, a stance that was supported by investor advisory firms ISS and Glass Lewis.

As these are deemed "special resolutions," Lui's motions will need 75% of votes cast in favor to pass.

Read the full story here.

— Lim Hui Jie

Philippines inflation eases for third straight month to 6.6% in April

Headline inflation in the Philippines have eased for the third straight month to 6.6% year on year, down from 7.6% in March.

This was also lower than economists expectations of a 7% rise.

In a release, the country's statistics authority said the downtrend was mainly brought about by a lower inflation rate for food and non-alcoholic beverages, which recorded 7.9% compared to 9.3% in March.

Transport was the second-top contributor to the downtrend, with an inflation rate of 2.6% in April compared to 5.3% in March.

Inflation in the Philippines hit a 15-year high in January at 8.7%, its highest level since October 2008.

— Lim Hui Jie

Australia still sees 'further tightening' of monetary policy even after surprise rate hike

Australia's central bank still sees that "some further tightening of monetary policy" may be required to rein in inflation, the Reserve Bank of Australia said in its May Statement on Monetary Policy.

The central bank noted that this "will depend upon how the economy and inflation evolve."

This comes as the Reserve Bank of Australia surprised markets by raising rates by 25 basis points to 3.85% on Tuesday.

In its statement, the RBA lowered its near-term inflation and GDP forecasts, while saying that inflation is still not expected to return to upper end of 2-3% target range until the middle of 2025.

The central bank also foresees goods inflation to moderating further, while energy and services inflation is seen to remain elevated, with the services sector set to see growth in labor costs and rents.

— Lim Hui Jie

China's Caixin services purchasing managers index slips

China's Caixin/S&P Global services purchasing managers' index fell to 56.4 in April from 57.8 in the previous month.

The reading marked the second-highest figure recorded since November 2020 and the fourth consecutive months above the 50-mark that separates growth and contraction.

The survey showed expansion in services activity despite disappointing factory activity in Mainland China earlier this week.

The reading suggests that services activity is still "undergoing a fast recovery," according to Wang Zhe, Senior Economist at Caixin Insight Group.

— Jihye Lee

Apple's Asia suppliers mixed after earnings beat estimates

Shares of Apple's Asian suppliers were mixed after the company's latest earnings report delivered a better-than-expected quarter driven by iPhone sales.

Shares of Hon Hai Precision Industry Co., fell 0.5% in Taipei's morning trade while Taiwan Semiconductor Manufacturing Co. rose 0.3%. Taiwan's Largan Precision Co. rose 0.25%.

Hong Kong-listed lensmaker Sunny Optical Technology Group Co. also rose 0.7%.

South Korea and Japan's markets are closed for a holiday and will resume trading next week.

— Jihye Lee

Payrolls report due Friday morning

The next major catalyst for the market could be emerging in a matter of hours: April's big jobs report, due at 8:30 a.m. Friday.

Not only will investors be watching for the number of jobs added last month, but they will also keep an eye out for the unemployment rate and growth in hourly wages.

Federal Reserve Chair Jerome Powell, speaking to reporters on Wednesday, said that "it's possible we can continue to have a cooling in the labor market without the big increases in unemployment that have gone with many prior episodes."

Economists polled by Dow Jones are calling for payrolls to grow by 180,000 in April. They're also predicting that the unemployment rate ticked up to 3.6%. Meanwhile, average hourly wages are forecasted to have grown 4.2% from the prior year.

-Darla Mercado

Money market fund assets grow to $5.31 trillion

Investors poured cash into money market funds, as assets in these investments swelled to $5.31 trillion for the week ended May 3, according to the Investment Company Institute.

Total money market fund assets grew by $47.15 billion for the week ended Wednesday, with retail investors accounting for $26.44 billion.

In particular, retail investors flocked to government money market funds, pouring cash into those investments to the tune of $17.69 billion that week.

-Darla Mercado

Analysts weigh in on where the Dow Jones Industrial Average could head next after turning red for the year

Despite the Dow Jones Industrial Average turning red for the year, analysts say the index isn't likely to extend losses to multi-year lows.

"It's consistent with the range-bound action of the stock market for most of the year," Oppenheimer's Ari Wald said. "We're stuck between a bull and a bear."

The Dow is still 42% higher than its lowest close during the pandemic of 19,173.98 in March of 2020.

Still, downside risk remains, according to Roth MKM chief technical strategist JC O'Hara.

"If stocks can't move higher when you receive positive news, it tells me the market is in weak hands," he said.

Read the full story here.

— Brian Evans

Wall Street futures rise after Apple reports an earnings beat

Futures tied to the S&P 500, Nasdaq and Dow Jones Industrial Average ticked higher Thursday.

Apple reported an earnings beat on both the top and bottom line on strong iPhone sales, while investors weighed a fresh slate of quarterly results from fintech firm Block as well DoorDash and Expedia.

Still, all three major indexes closed lower during regular trading on Thursday.