- Simplebet CEO Chris Bevilacqua told CNBC the firm is also in discussions with another top tier sports gambling provider for its micro-betting product.

- Simplebet has now raised $50 million, with investors including Jim Murren, the former MGM Resorts International CEO.

Simplebet has raised $15 million in its latest financing round as the software company looks to enhance its sports betting products.

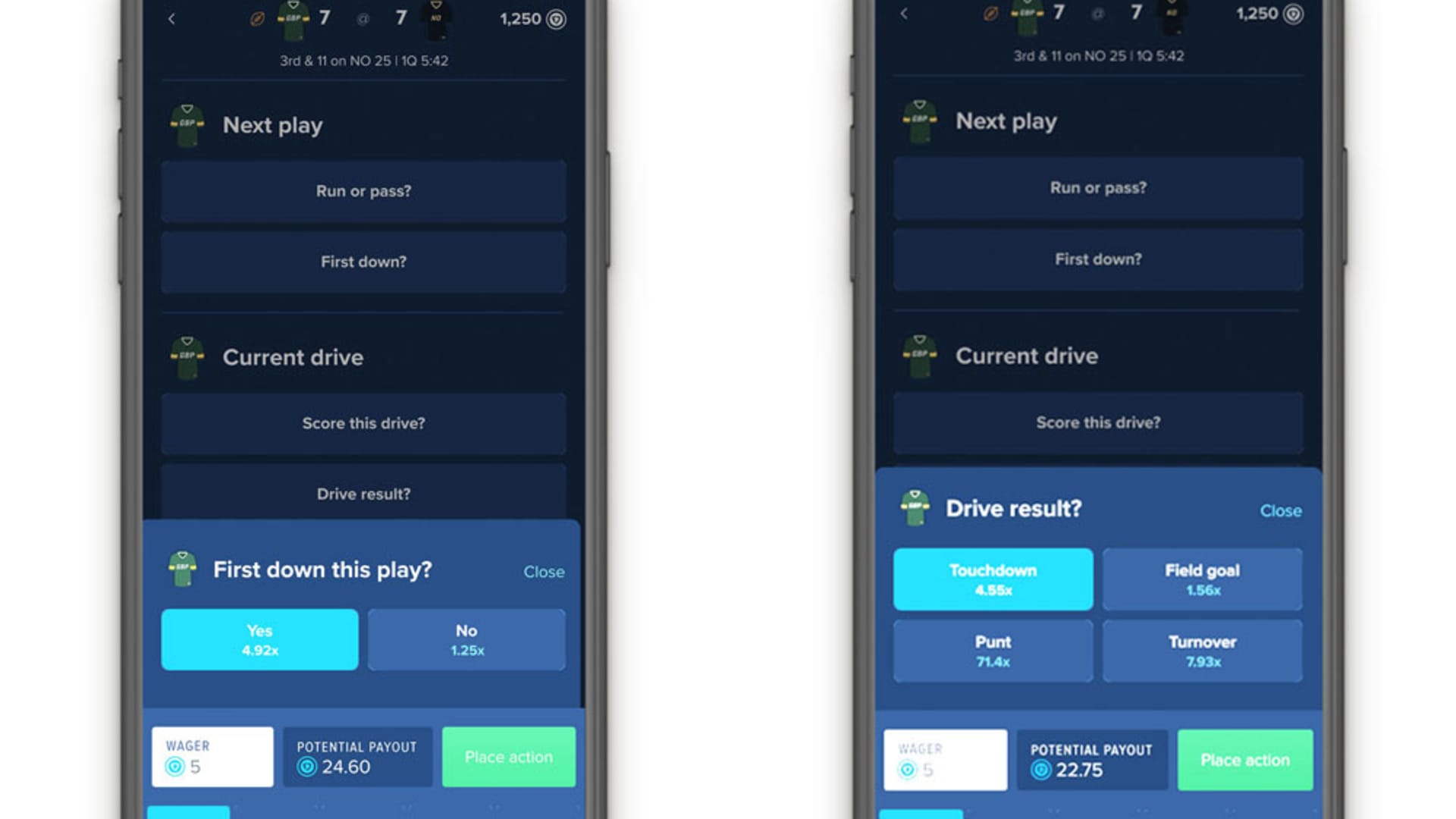

Simplebet's software allows users to wager on quick odds, like which player will make the next catch in football or if the next call is a passing or running play. It's used by apps like FanDuel.

Simplebet CEO Chris Bevilacqua told CNBC that investors were attracted to the company after a strong showing around free-to-play games on FanDuel and real money bets on Greece-based gaming company Intralot. The firm will use the funds to roll out Scripts, an extension of its micro-betting service.

Bevilacqua said Scripts would give bettors more options with in-play wagers around live sports.

"We have the future operating system of all in-play betting," Bevilacqua said. "And we think in-play betting is going to be the way the vast majority of sports fans are going to bet."

Simplebet has raised $50 million, and investors in this round include former MGM Resorts International CEO Jim Murren. Former National Football League team executive Joe Banner is also an investor.

Money Report

"It goes beyond drives and plays but expands into correlated bets," Bevilacqua said. "So you can bet not only on the next play but if the next play will result in a touchdown from a pass on the third play of the drive."

Simplebet unveiled its product on FanDuel for the National Football League's 2020 season, teaching consumers about the micro-betting via its free-to-play model, "PlayAction." Bevilacqua said the software saw over 100,000 unique users place over 8 million free-to-play bets during the 2020 NFL season on PlayAction.

In January, Intralot, which has betting licenses in Washington, D.C., and Montana, used Simplebet for bets during the NFL's postseason and Super Bowl. Bevilacqua said nearly 25% of all Intralot's play in NFL bets in January were from its micro-bet offerings from the two regions.

"Once the investment community saw those results, we started to get a lot of interest," Bevilacqua said. "We wanted to capitalize the company in the long term and use that investment into our engineering and product."

"There was a lot of sticky user behavior that created a lot of bet velocity," Bevilacqua added. "You had users that were engaging throughout each quarter and that bet velocity — it takes live sports and turns into a slot machine experience where you know whether you've won or lost in a matter of minutes of seconds."

What's next for Simplebet

With U.S. sports betting revenue forecast to reach $2.5 billion in 2021 and $8 billion by 2025, Simplebet is gaining position in the sector.

The firm has partnerships with sports gambling company PointsBet and provides real-time betting data for Major League Baseball's Rally mobile app. Bevilacqua said it's also in discussions with another top tier gambling operator, but he declined to reveal the company.

"You're going to start to see the product rolling out in a lot more markets and a lot more jurisdictions and not just on the real money betting side," he said. "We're in conversations with a bunch of media companies who are looking at the fan engagement aspect."

Last month, the National Basketball Association granted Simplebet the rights to provide odds for its "NBA InPlay" product that it debuted in 2016. FanDuel relaunched InPlay and integrated Simplebet's software. It now offers micro-bets. Simplebet will let people bet on the NBA using Intralot in April.

"(The NBA) sees this as a great test lab for in-play betting that we want to enhance together working with FanDuel over time," Bevilacqua said.

Disclosure: CNBC parent Comcast and NBC Sports are investors in FanDuel.