It's tempting to go on a post-pandemic shopping spree.

After a year of hunkering down, skipping vacations and restaurant dining, many Americans can't wait to start spending again.

Just over 50% of U.S. consumers plan to spend extra money splurging or treating themselves, according to a May survey by McKinsey & Company. The global management consulting firm polled 2,076 U.S. adults in February and weighted it to match the national general population.

While many Americans are still struggling financially, others are doing well. They cut down their debt and saved more money over the past year. While treating yourself may be well-deserved, tread carefully, experts warn.

More from Invest in You:

Before you start some post-pandemic spending, make these money moves

How to avoid overspending in this hot housing market

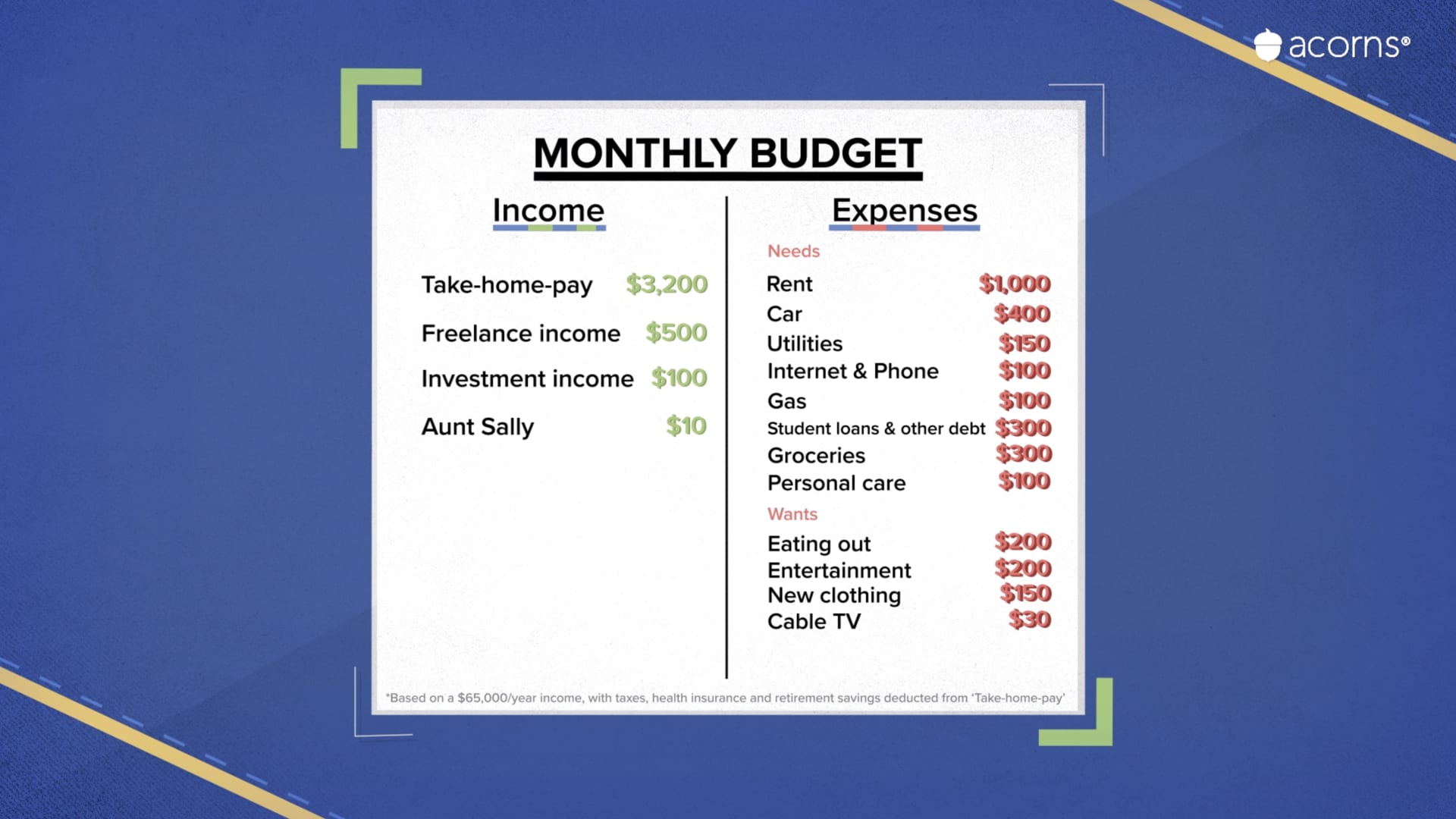

Here are some budget basics to brush up on

"We are all experiencing freedom, euphoria and relief post-Covid to varying degrees," said financial therapist and coach Carrie Rattle, CEO and founder of New York-based Behavioral Cents.

"It is easy to take that emotional release and translate it into shopping for material goods," she added. "In these instances, there may be overspending and definitely splurging."

Money Report

'Revenge spending' can backfire

The urge to splurge post-pandemic is being called "revenge spending."

Yet that could impact not only your finances but your happiness, if you wind up overspending, said researcher Elizabeth Dunn, PhD, chief science officer for financial technology firm Happy Money and author of "Happy Money: The Science of Happier Spending."

People who spend less money than they bring in reported about 17% higher levels of life satisfaction than those who outspend their income, Happy Money research shows. They have 14% more life satisfaction versus those spending the equivalent of their income.

"[By] going beyond the amount of money that you have coming in … you're ultimately not getting revenge on the pandemic, you're setting yourself up for lower happiness," she said.

Be analytical

Before you splurge, approach your purchase analytically before you even put it in your cart, Rattle said.

Ask yourself: "Do you already have one? How often will you be using it? Have you priced compared to ensure you're getting value for your money?"

Think ahead

Before you make a purchase, ask yourself if it will change the way you spend your time, advises Dunn, who is also a professor in the Department of Psychology at the University of British Columbia.

"This is a really simple question that people can ask themselves that can help them sometimes pull the items back out of the cart," she said. "This is not actually going to have any bearing on the way I spend my time."

Beware shopping breaks

We often take shopping breaks, either by picking up our phone or shifting away from a project on our computer. Instead, walk away and do something else to let your emotion subside, Rattle suggests.

Track your spending

When you buy something, write down what you bought and how much it was.

Keeping a real-time, running tally of your spending can help you see patterns, such as days when you spend, situations that drove you to spend and sites you spent a lot of time on, Rattle said.

"Often when we total the spend per week, it can have an incredible dampening effect on our urge to shop further," she explained.

How and when to treat yourself

There's nothing wrong with treating yourself, as long as you are smart about it.

Dunn recommends spending on experiences, since we've been deprived of them over the past year and they tend to make us happier, according to her research.

"Really actively anticipating a vacation can give you this sort of free source of pleasure, before the actual experience," she said. "So you're getting kind of a double dip in terms of happiness."

Just make sure your finances are in order.

If you have credit card debt you aren't paying off, have refinanced credit card debt into your mortgage and accumulated more, are falling short on savings goals and are spending more time shopping than interacting with friends and family, you are likely overspending to the detriment of your personal or financial health, Rattle said.

She looks at smart spending as purchasing items or experiences that add value to your life.

"Spending smartly means you can afford these items and experiences without going into debt, while saving for those compelling goals in your life," she said.

"If you're not yet clear on what those goals are you're probably overspending in all the wrong places."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: 4 content-creating side hustles that can produce passive income, with tips from the pros via Grow with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.