After the Dow's worst week since October, two traders see some opportunity in the rubble.

Of last week's worst-performing stocks in the index, one name in particular stood out, Joule Financial Chief Investment Officer Quint Tatro told CNBC's "Trading Nation."

"You've got to go with the best bank in the world in JPMorgan," Tatro said Friday. JPMorgan shares fell by more than 8% last week to close at $147.92 on Friday. They were up about 0.5% in Monday's premarket.

After a successful year for financial stocks, those who missed out on the rally are finally getting a chance to buy at lower levels, he said.

"You've got to be patient. Now you're getting the pullback," Tatro said. "JPMorgan was trading well over two times book [value]. That's way too rich. Now we're around 1.8. I think anywhere in here, you start to nibble, pick up shares of JPMorgan. It's a bargain."

Blue Line Capital's Bill Baruch also likes JPMorgan and American Express, but the possibility of higher interest rates pushed him to look elsewhere for gains.

Money Report

"I do think that 1.25% is in the cards here for the 10-year yield, and in the near term, that could weigh on the financials. But I think there should be a tremendous buying opportunity on weakness," Baruch said in the same "Trading Nation" interview.

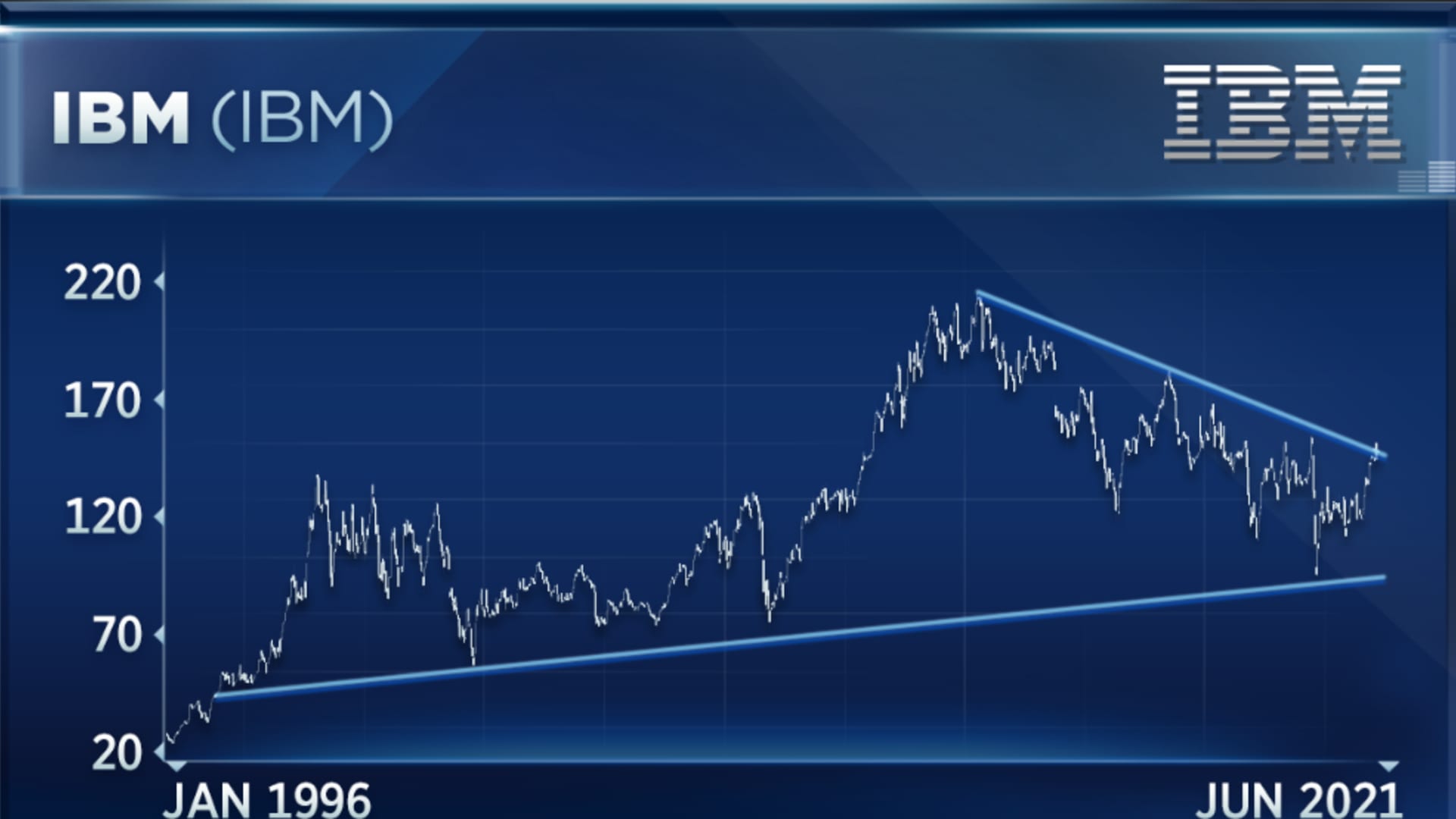

Instead, the Blue Line Capital founder and president found a lot to like in old-line tech juggernaut IBM, which lost nearly 6% in market value last week.

"IBM is not a darling in tech by any means. It really gets kind of swept aside," he said, highlighting the company's "tremendous strides forward in the past couple years for the cloud."

"Technically, it did break out of a near-decade-long downtrend last week, although it did fail here through this week," Baruch said Friday. "It's been this really good value at 141 and even more value at 137 if you can get it down there, not to mention a 4.5% dividend. This is a really great stock to own for the long term."

IBM shares ended trading at $143.12 on Friday and were up fractionally in Monday's premarket.

Disclosure: Blue Line Capital owns shares of JPMorgan and IBM. Joule Financial owns shares of JPMorgan.