- Trump Media shares became publicly traded under the DJT ticker two weeks ago. Corporate filings by Trump Media detail the compensation and stock allocation to top executives and other insiders at the company.

- Trump Media owns the Truth Social app regularly used by former President Donald Trump, whose 78.75 million shares give him a stake of nearly 58% of the social media company's common stock.

The merger that led to Trump Media shares becoming publicly traded is also paying off for top executives and other insiders at the company, which owns the Truth Social app regularly used by former President Donald Trump.

Corporate filings from Trump Media — which reported a net loss of $58 million last year on revenue of just $4.1 million — detail the salaries, retention bonuses and stock allocations for CEO Devin Nunes and other executives.

Trump himself is by far the biggest shareholder, with 78.75 million shares that give him a stake of nearly 58% of the social media company's common stock.

The number of people financially rewarded in the early stages of the company is limited. Besides the former president, it includes the chief financial officer, chief operating officer, and several people close to Trump.

Trump Media began trading on the Nasdaq Stock Market under the ticker DJT — the former president's initials — on March 26 following its merger with the shell company Digital World Acquisition Corp.

Trump could receive another 36 million in so-called earnout shares over the next three years, provided that Trump Media's stock stays above certain benchmarks.

Money Report

Those thresholds for the share price are well below where Trump Media stock was trading on Monday, when it closed at $37.17, down more than 8%.

"It sounds like more of a contract that you give to an executive than to a controlling shareholder," said Kevin Murphy, a professor at the University of Southern California's business and law schools, in an interview.

"The former president is not an executive of the company," Murphy noted.

Murphy was also struck by details revealed in a 10-K filing with the Securities and Exchange Commission. The filing disclosed that Trump Media awarded company stock to Nunes, chief financial officer Phillip Juhan and chief operating officer Andrew Northwall.

Trump Media issued promissory notes, a type of legally binding IOUs, to the executives, at some point when it was still a privately held company, according to the filing. The total value of the notes issued was $6.25 million, broken up into $1.15 million for Nunes, $4.9 million for Juhan and $200,000 for Northwall.

After the merger with DWAC, the $6.25 million that the company owed the three men was "automatically converted ... into 625,000 shares of Company common stock."

Nunes got 115,000 shares, Juhan received 490,000 shares and Northwall got 20,000 shares, the SEC filing said.

Murphy said the allocation appears to reflect the opening $10 per share price of Digital World Acquisition Corp. on Oct. 1, 2021, the first day that DWAC was publicly traded.

At the time, DWAC was merely one of hundreds of empty special purpose acquisition companies, commonly known as SPACs, formed to go public, then seek a merger partner and take that partner public. Multiplying each man's share allocation by the par value for every new SPAC, $10, adds up to the face value of the promissory notes Trump Media had given them.

"I haven't seen it before," Murphy said, referring to the method of using promissory notes that convert to stock to give shares to executives. "I don't know why they structured it this way."

"We don't even know why these promissory notes were issued," he said, noting that the rationale for the notes was not disclosed in the company's SEC filing.

The three top executives, like Trump himself, are currently barred from selling any of their common stock in Trump Media for the next six months.

CNBC asked a spokeswoman for Trump Media why promissory notes were used to grant stock to the executives.

CNBC also asked the spokeswoman about other details in the 10-K filing, such as why Trump himself was given the opportunity to be awarded significantly more shares if the price benchmarks are met.

The spokeswoman did not answer these questions.

Instead, she replied: "Although we've only been a public company for about a week, we've already come to expect this buffet of false insinuations and outright lies from the politicized shills at CNBC."

While Trump Media's share price soared to nearly $80 right after the stock began public trading, it closed at $37.17 per share on Monday.

Murphy is among those who believe Trump Media's stock remains overvalued, given its meager revenue and relatively low numbers of Truth Social users compared to other, much bigger social media companies.

But Murphy is not alone.

Despite the fact that Trump Media stock is, by far, the most expensive U.S. stock to sell short, there was strong demand for the relatively few shares remaining available to borrow as part of a short sale, according to the financial data marketplace platform S3 Partners.

"What I'm hearing on the Street is that if [an amount] of stock becomes available, shorts are taking it down," Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners told CNBC last week.

The number of shares that the trio of executives received is fewer than the number of restricted stock units they were supposed to have gotten under their original employment agreements with Trump Media.

Those would have allocated 145,000 RSUs for Nunes, 520,000 RSUs for Juhan and 50,000 RSUs for Northwall, according to the filing.

However, after they each received a promissory note from the company, the original RSU grants were eliminated in subsequent employment agreements.

Murphy noted that in both scenarios, Juhan received much more stock than Nunes, his nominal boss, was granted.

"I don't understand why he gets so much more than the CEO," Murphy said of Juhan.

CNBC posed this question to Trump Media's spokeswoman, but she did not answer it.

Under new employment deals, each of the three executives will receive a $600,000 "retention bonus" payable within the next three weeks. Each "will be eligible to receive discretionary equity awards pursuant to the Equity Incentive Plan," the filing said.

The filing also noted that Trump Media now "intends on negotiating new employment agreements with Messrs. Nunes, Juhan and Northwall."

Nunes, a 50-year-old former Republican congressman from California, also received a salary of $750,000 in both 2023 and 2022, according to SEC filings.

In January, Nunes got a raise, lifting his annual base salary to $1 million, according to the filing.

Nunes' employment agreement also makes him eligible to participate in the company's "annual bonus plan, if any," the filing noted.

Any bonus would be subject to vesting and other terms determined by the board of directors of Trump Media, which as of late 2023 had just 36 employees.

Juhan, the 49-year-old CFO who previously held that same position at a fitness club company, had a base salary entering 2024 of $350,000 after starting at $300,000 nearly three years ago. But he is set to get a $15,000 raise as a result of the merger.

Northwall, who previously was chief architect at the social networking site Parler, had an annual salary of $365,000, and as of March 26 held 20,000 shares of company stock.

Murphy said the men's salaries do not appear excessive, and that it makes sense to pay them "relatively low salaries" while giving them stock to incentivize them to keep the share price high by building out Trump Media's business.

Bonus time

Kash Patel, a member of Trump Media's board who previously served in various posts in the Trump administration, last year received a total of $130,000 from the company pursuant to a consulting agreement it signed with his firm, Trishul LLC, in June 2022, the filing said. Patel holds no shares in the company, according to the filing.

Dan Scavino, a former Trump Media director, was paid $240,000 last year by the company pursuant to a consulting agreement with a company owned by him, Hudson Digital, according to the filing, which says that agreement began in August 2021.

The filing also says that Scavino, who previously served as director of social media in the Trump White House, received a promissory note in the amount of $2.2 million from Trump Media when the company was still privately held. The filing does not say if the note is convertible into stock for Scavino, or why it was issued to him.

Scavino also "will receive a retention bonus in the amount of $600,000, payable in a lump sum within 30 days after the Closing Date" of the merger, the filing says.

In addition to the trio of Nunes, Juhan and Northwall, who are identified as so-called named executive officers in the filing, Trump Media plans to give retention bonuses totaling $1.24 million to other executives, the filing said.

The filing does not identify by name or number those other executives who will receive retention bonuses, nor does it say how much each executive would receive.

However, the filing does identify several key employees who hold executive positions at Trump Media: Sandro De Moraes, the chief product officer; Vladimir Novachki, the chief technology officer; and Scott Glabe, who is general counsel.

Novachki has 45,000 shares of company stock, while Glabe has 20,000 shares, according to the filing.

De Moraes has just 45 shares, which she purchased on the open market, the filing says.

Trump Media board member Eric Swider, who served as CEO of Digital World Acquisition Corp. until last month, beneficially owns 153,153 shares, according to the filing.

However, a footnote in the filing says that more than 143,000 of those shares were issued to the corporate entity Renatus LLC. Swider is the managing partner of Renatus, which is why he may be deemed to share voting and disposition power over its shares. But he "expressly disclaims beneficial ownership of the shares held by Renatus," the footnote says, noting that Swider also owns the remaining 10,110 shares.

Legal battles

Besides Trump, the biggest shareholders in Trump Media are two corporate entities.

ARC Global Investments II LLC held nearly 9.55 million shares, or a 6.9% stake, as of the 10-K filing on April 1. United Atlantic Ventures reported owning 7.525 million shares, representing a 5.5% stake in the business.

Both entities are currently being sued by Trump Media.

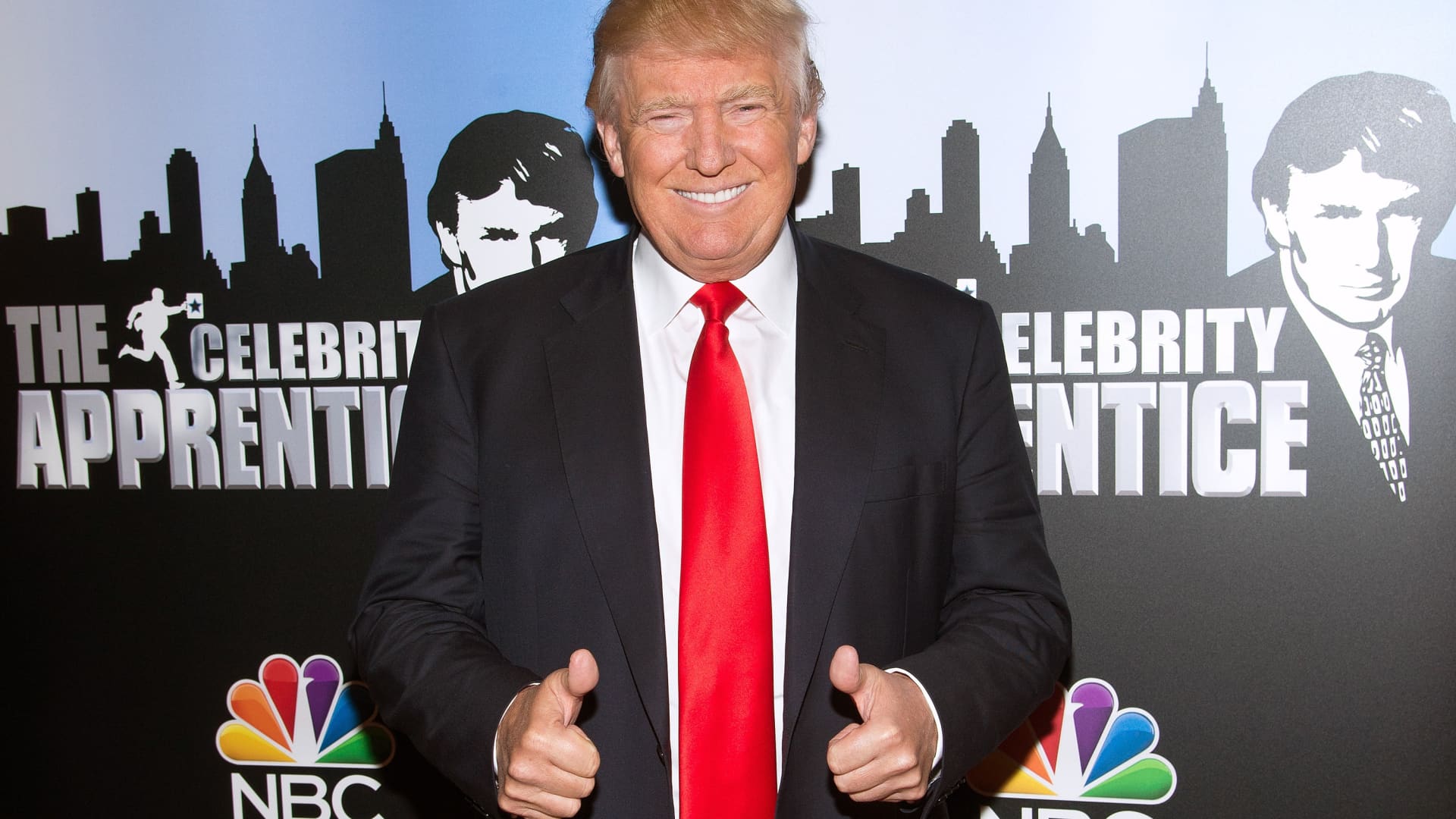

ARC Global was DWAC's sponsor. United Atlantic Ventures is a partnership of Andy Litinsky and Wes Moss, who initially pitched Trump the idea of creating Trump Media in February 2021, after the former president was banned from Twitter and Facebook following the deadly Jan. 6 Capitol riot. Both Litinsky and Moss were contestants on Trump's NBC hit reality show "The Apprentice."

On Thursday, Patrick Orlando, a managing member of ARC Global, reported in an SEC filing that the entity owned 13.3 million shares of Trump Media, representing a 9.8% stake in the company.

Orlando is the former CEO and chairman of the board of DWAC. He and his lawyers did not immediately respond to questions from CNBC about the increase in the shares. The Trump Media spokeswoman likewise did not reply to questions about it.

CNBC specifically asked if ARC Global's increased shares reflected the release of some of the 3.58 million shares from Trump Media that had been held in an escrow account since late March in connection with a lawsuit ARC Global filed against DWAC.

The suit, filed in Delaware Chancery Court three weeks before the merger, alleges that ARC Global was not allocated the correct number of shares as a result of the merger between DWAC and Trump Media.

Trump's company sued ARC Global and Orlando in Florida state court and accused them of trying to "obtain a windfall by way of extortion" by threatening to block or delay the merger.

DWAC proposed, and a Delaware Chancery judge agreed, to have the shell company place the 3.58 million shares in escrow to preclude the possibility that ARC Global would be harmed when the merger was completed.

The disputed shares were to be held pending the resolution of the Chancery case.

Trump Media and United Atlantic Ventures are also embroiled in dueling lawsuits over UAV's stake in the company.

UAV claims in a Delaware Chancery Court suit that it is entitled to an 8.6% stake in Trump Media, which is more than three percentage points greater than it has now.

Trump Media in a Florida state court lawsuit against UAV and its founders, Moss and Litinsky, seeks to strip them of their shares in Trump Media. Orlando is also named as a defendant in that suit for alleged breach of fiduciary duty.