U.S. stocks slid on Wednesday, ending a winning streak for the market, as investors monitored developments in Ukraine and the bond market.

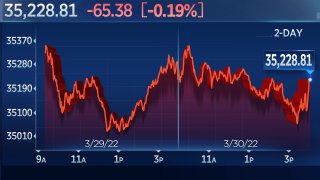

The S&P 500 fell 0.63% to 4,602.45, and Nasdaq Composite lost 1.21% to 14,442.27. The Dow Jones Industrial Average dropped 65.38 points, or 0.19%, to 35,228.81. The Dow and S&P 500 each snapped a four-day stretch of gains.

Crude prices, which have soared since the war in Ukraine began, climbed more than 3% to top $107 per barrel on Wednesday. Germany warned of potential rationing of natural gas due to disputes with Russia, and U.S. crude stockpiles fell.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

The energy market swings appeared to drive action in equities on Wednesday. Oil stocks moved higher, with Valero rising roughly 4% and Phillips 66 gaining about 4.8%.

Liz Ann Sonders, chief investment strategist at Charles Schwab, said the higher oil prices could be a bearish signal for the overall market even while it boosts energy stocks.

"We're already seeing signs of what I call a countercyclical inflation environment, sometimes called a cost-push inflation environment, where inflation gets so high that it starts putting pressure" on growth, Sonders said.

Money Report

Several retail stocks were under pressure on Wednesday after disappointing quarterly reports, including Five Below losing 6.5% and Chewy sliding 16%. RH fell 13% after the company's fourth-quarter revenue came in short of expectations. On the positive side, apparel stock Lululemon jumped more than 9% after issuing upbeat guidance and announcing a share buyback program.

Semiconductor stocks were another weak spot for the market, with Marvell Technology falling 4.1% and Nvidia shedding more than 3%. Micron fell 3.5% despite a stronger-than-expected earnings report.

Elsewhere, shares of Apple, which had risen for 11 consecutive sessions, slipped about 0.7%.

Investors also kept an eye on the bond market as the U.S. 5-year and 30-year Treasury yields inverted Monday for the first time since 2006, and the spread between the 2-year and the 10-year rate came close to inverting on Tuesday. Yield curve inversions are seen by some traders and economists as a recession indicator.

"The big talk right now is that at any given point in time, recession can be on the horizon," Stephanie Lang, chief investment officer at Homrich Berg, told CNBC. "Typically, you won't see a recession for an average of 20 months once a yield curve inverts. Our antennas are up that recession risk is heightened; that doesn't necessarily mean that there'll be one this year, though next year is more of a concern for us."

On Wednesday, the spread between the 2-year and 10-year held near 3 basis points, but regional bank stocks were under pressure. Shares of Zions Bancorp fell more than 3%, and Bank of New York Mellon shed 1.7%.

Wall Street was coming off strong two-week stretch, with the S&P 500 up roughly 10% since mid-March.

However, many investment professionals have been reluctant reluctant to call for the all-clear on a market rebound.

"Above 4,600 in the S&P 500, markets have now traded through most fundamental bounds of valuation, and for this rally to continue, we'll need to see real, actual positive events (not just events that aren't as bad as feared)," Tom Essaye of The Sevens Report said in a note to clients Wednesday.

Wednesday was also a busy day of economic data. The ADP payrolls report said private firms added 455,000 jobs in March. Economists surveyed by Dow Jones expected 450,000.

The release came ahead of the March jobs report from the Labor Department, due out Friday.

Correction: This story has been updated to reflect that the U.S. 5-year and 30-year Treasury yields inverted Monday for the first time since 2006.