- Stocks could get a boost from a congressional stimulus vote in the week ahead, but it could be a negative if it sends interest rates higher and ignites inflation fears.

- Markets had a volatile day Friday after February's strong employment report, but the turnaround and surge in the Nasdaq was seen as a positive since it occurred while yields were rising.

- There is CPI consumer inflation data Wednesday. While it is expected to show little inflation, the next couple of reports could show inflation compared to the drop-off in prices when the economy was shut down last year.

The Covid-19 aid package is on track for final congressional approval in the week ahead — and it could be a double-edged sword for markets.

The legislation should be greeted by optimism around the powerful lift it could give the stock market and the economy, but it could also be met with concern about what a historically large stimulus package could do to inflation and interest rates.

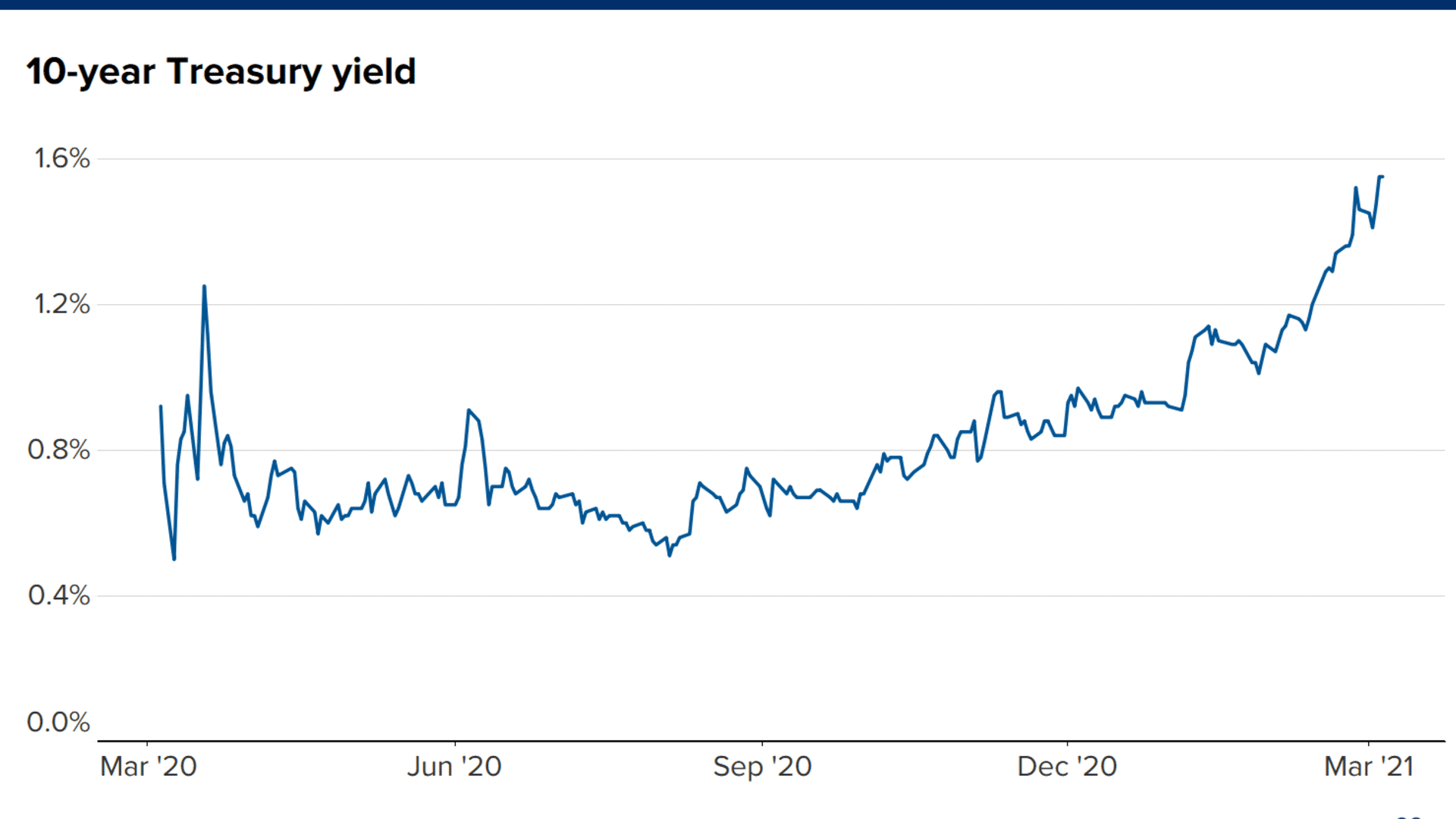

Stocks were mixed in the past week, with the Dow and S&P 500 higher, but the Nasdaq was dragged lower by interest rate-sensitive tech names. The benchmark 10-year Treasury yield has continued to press higher, revisiting its recent high of 1.61% on Friday, before trading at 1.54% in late trading. Yields move opposite price.

One wild card for stocks could be how interest rates behave around upcoming Treasury auctions.

There is a $38 billion 10-year auction on Wednesday and a $24 billion 30-year bond auction on Thursday.

Money Report

Traders are watching these closely, after a historically weak 7-year Treasury note auction in February sent rates higher, even for the 10-year.

"We're a little more cautious on them, just given what we saw in the 7-year and some Japanese selling pressure," said Ben Jeffery, strategist on the U.S. rates strategy team at BMO Capital Markets.

He said Japanese institutions could be less interested in participating before the end of their fiscal year on March 31.

Stimulus coming

The Senate approved a $1.9 trillion stimulus package Saturday, and it is expected to go to the House for a vote as early as Tuesday. Otherwise, the market is watching key inflation reports with the consumer price index expected Wednesday and the producer price index, scheduled for Friday.

"I think the markets will be watching closely the progress on the stimulus package," said Michael Arone, chief investment strategist at State Street Global Advisors. "I think they'll continue to watch the 10-year Treasury move and we're going to get CPI data. That's going to inform on those moves."

He expects stimulus to remain a factor that could sway markets.

Inflation has been a worry for markets, since rising inflation could crush margins and corrode earnings power. For bond investors, it would erode value and make interest payments worth less.

"As long as the rise in Treasury yields matches the pick-up in inflation, I think the market will be able to handle that. I think the challenge is when yields get notably above inflation...I like to see them closely matched," said Arone.

He said the market is concerned that the next stimulus package could overheat the economy and create inflation, particularly as it comes on the heels of the package approved in December.

"I think it lends to the conversation, 'do you really need another $1.9 trillion?' Arone said. "We're going to pour more gas on the fire, and with this $1.9 trillion that's what the market is concerned about."

Consumer inflation is expected to remain somewhat muted for February, after the 1.4% rise year-over-year in core CPI in January. But the pace of inflation is likely to pick up notably in March and April, since the comparisons to last year, when the economy was shut down, will likely look extreme.

Choppy to continue

Strategists expect the push-pull between interest rates and stocks to continue.

On Friday, rates were higher after a strong February jobs report and stocks were also higher. The economy added 379,000 jobs in February, about 160,000 more than expected.

"I don't think 1.5%, 1.6% on the 10-year is terribly troublesome for the market," said Liz Ann Sonders, chief investment strategist at Charles Schwab. She said the speed of the move was troubling.

The rotation out of tech and growth into more cyclical names in the financial, energy and industrial sectors continued in the past week.

Energy was up more than 10% with oil prices, which were at a near two-year high. Financials saw the next strongest move, gaining 4.3% for the week.

"I think we're in a choppy consolidation phase," said Sonders.

"You're seeing some extreme historical spreads between what energy and financials are doing recently versus tech and consumer discretionary," she said.

Sonders added that even if the consolidation phase is close to ending, that suggests there could be more downside for some frothy names. "The good news here is I think it's becoming a better environment for active stock pickers," she said.

The Nasdaq Composite was down more than 10%, as of Thursday from its Feb. 12 high. But on Friday, the index turned around, gaining about 1.6%. That's a positive sign for the market, particularly since it happened as rates moved higher.

The S&P 500 was up 0.8% for the week, and the Dow was up 1.8%. The Nasdaq, meanwhile, was down 2%.

"I think ultimately the higher quality segments that got hit in tech and communications probably did need to see a valuation reweighting," Sonders said. "Arguably, we had some micro bubbles in the market, and they may need to suffer more downside."

She said investors may want to adjust the allocation of their holdings regularly instead of waiting to adjustments around the calendar

"If you get a two three week, four five day surge in a particular sector, pare some back," Sonders said, nothing that's the opposite of what most people do.

Week ahead calendar

Monday

Earnings: Stitch Fix, Casey's General Store

10:a.m. Wholesale inventories

Tuesday

Earnings: H&R Block, Navistar, Thor Industries, Dick's Sporting Goods

6:00 a.m. NFIB small business survey

1:00 p.m. $58 billion 3-year note auction

Wednesday

Earnings: Campbell Soup, Oracle, Vera Bradley, Tupperware, United Natural Foods, Adidas, Cloudera, Bumble, Fossil, Lending Club, Express, AMC Entertainment

7:00 a.m. Mortgage applications

8:30 a.m. CPI

1:00 p.m. $38 billion 10-year note auction

2:00 p.m. Federal budget

Thursday

Earnings: Ulta Beauty, Vail Resorts, DocuSign, Poshmark, Gogo, Zumiez, JD.com, WPP, Party City

8:30 a.m. Jobless claims

10:00 a.m. JOLTs

1:00 p.m. $24 billion 30-year bond auction

Friday

Earnings: Buckle

8:30 a.m. PPI

10:00 a.m. Quarterly Services Survey

10:00 a.m. Consumer sentiment