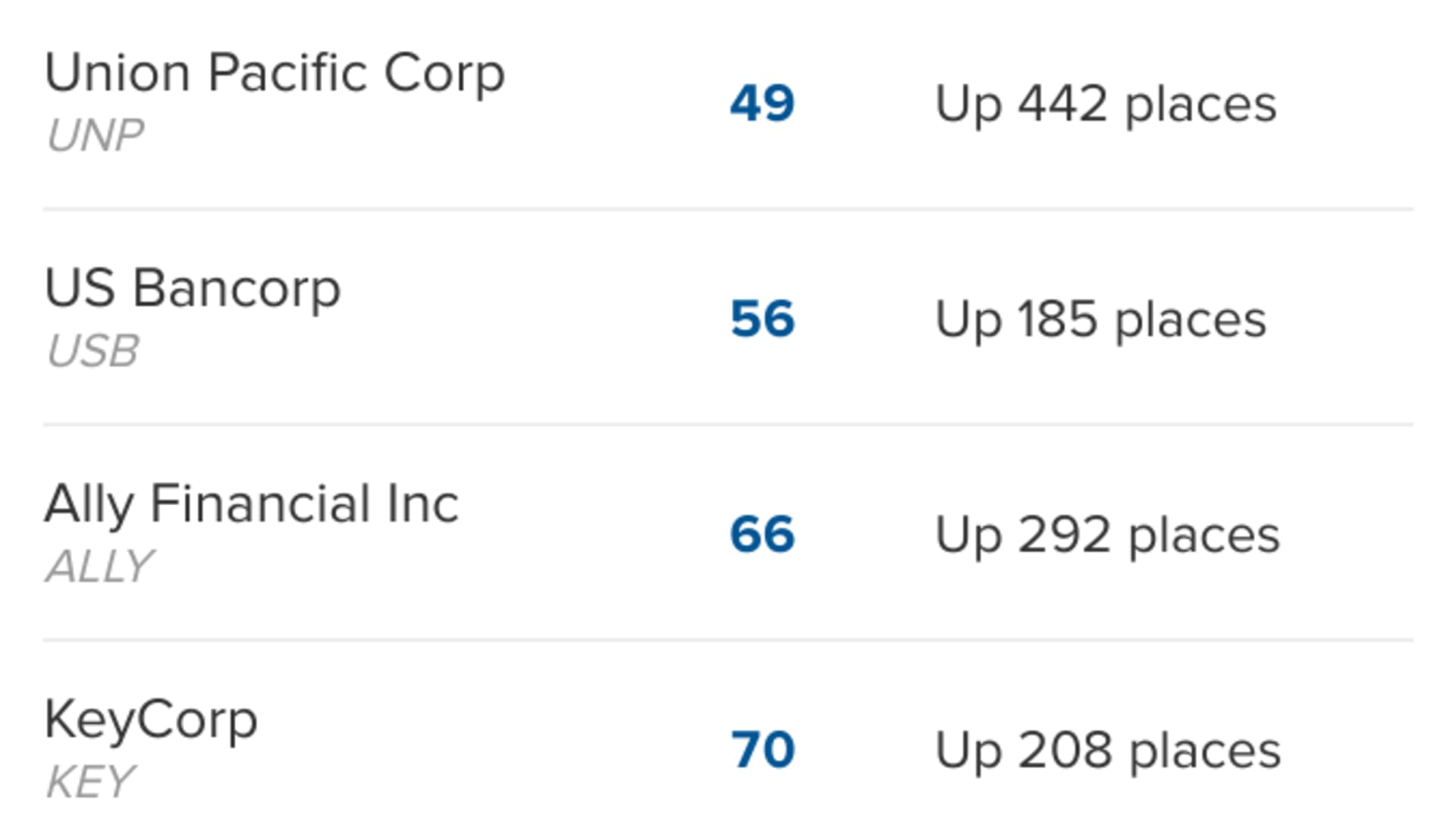

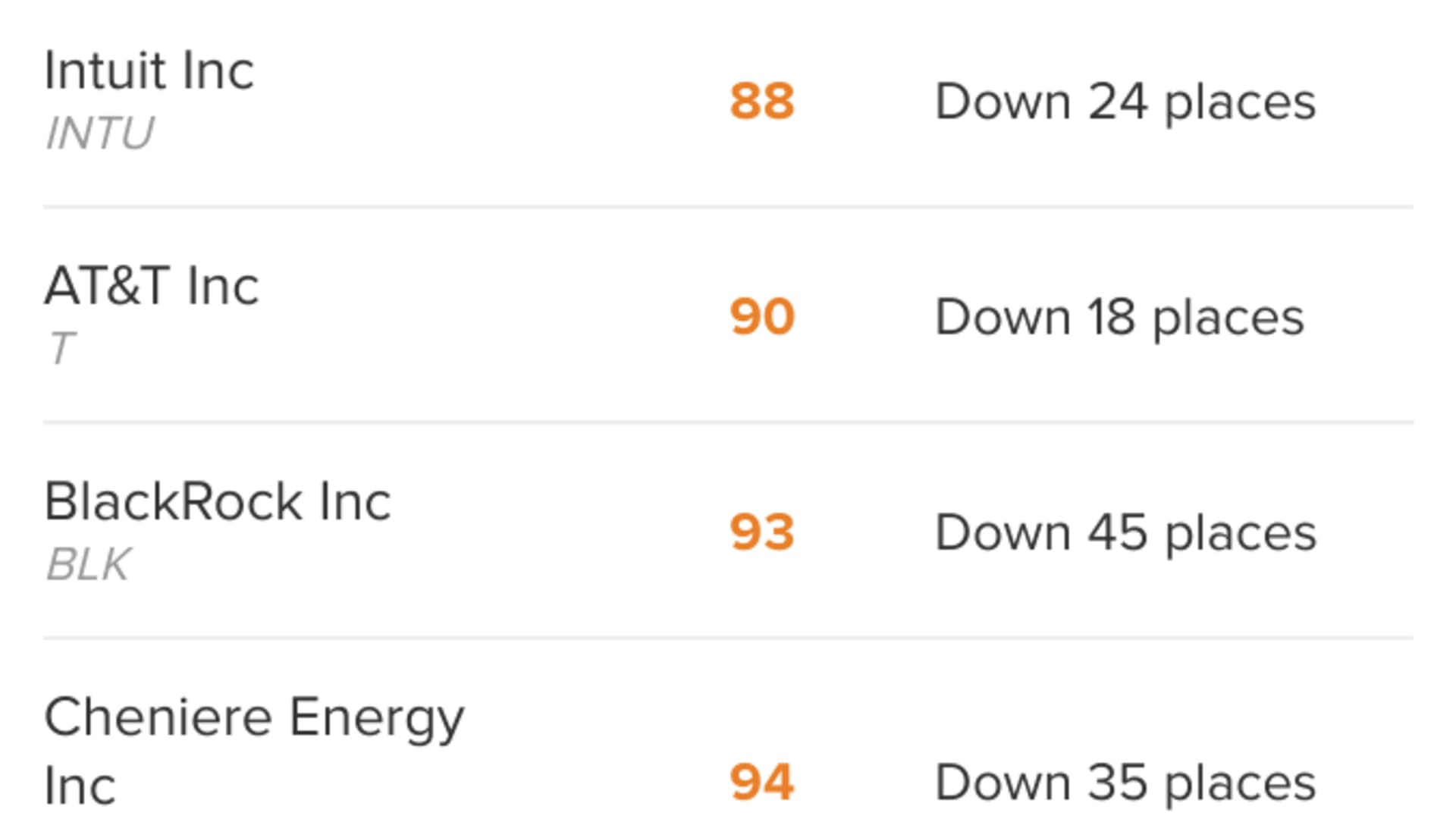

- Banks made the most impressive progress on the 2023 Just 100 list, but across the total 951 companies scored, there were other notable moves.

- Tesla continues to improve its performance on some key issues of importance to the American public, though it remains far from being a leader.

- New research on gig economy workers led to a big decline for Uber, but despite highly public unionization battles, Amazon and Starbucks got high marks in worker categories.

Elon Musk is no fan of environmental, social and governance analysis, and ESG analysis has not always been a big fan of Tesla in its relatively short history. But things are changing.

Not so much Musk's view — and the way he went about layoffs at Twitter won't do him any favors in the key worker category that falls under social rankings — but Tesla has moved up in the annual Just 100 list for 2023 from nonprofit Just Capital, founded by billionaire hedge fund manager Paul Tudor Jones, among others.

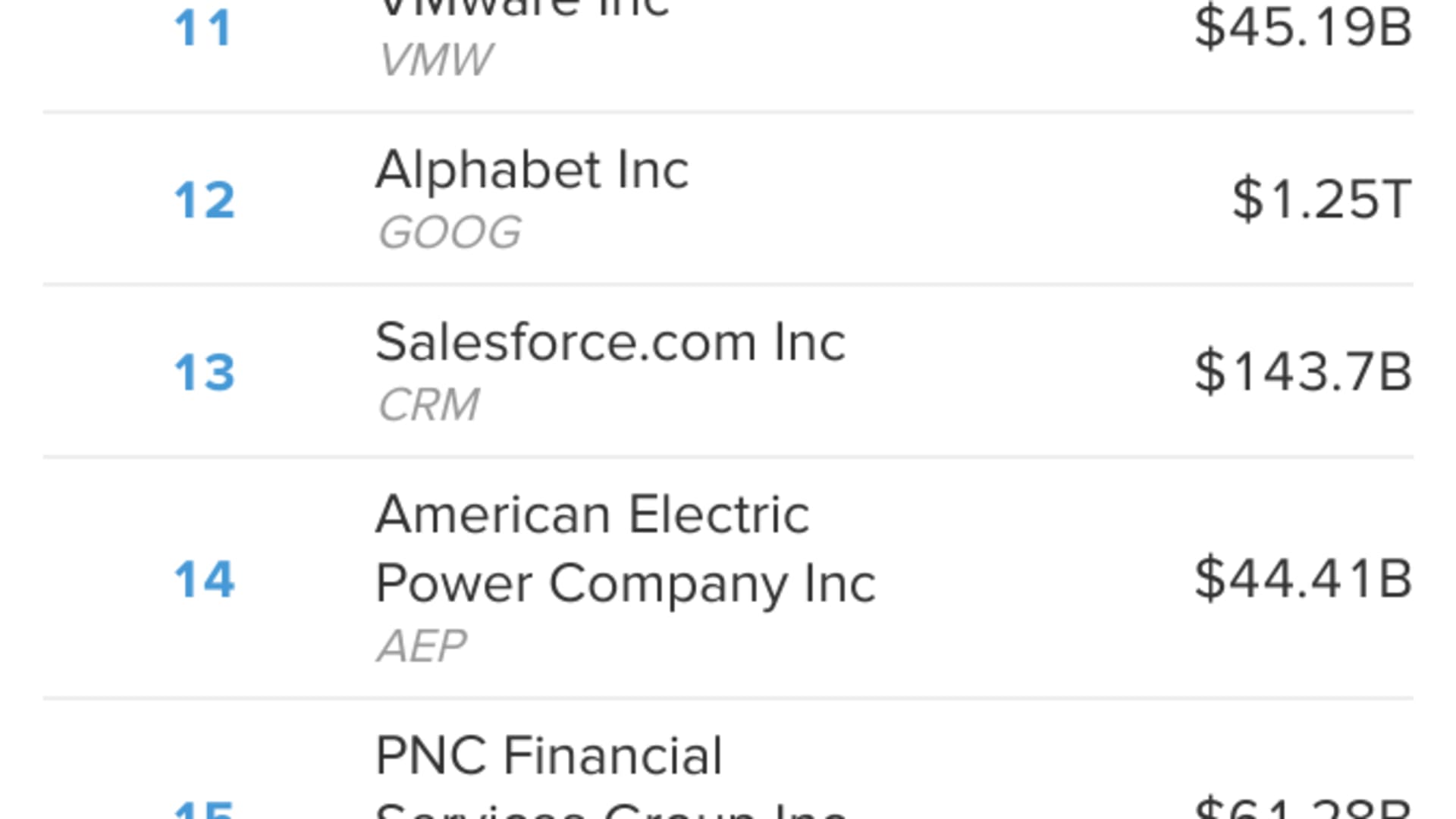

The company at the top of the 2023 Just 100 list was the biggest surprise, with Bank of America ending the tech sector's dominance of this annual list. But that was far from the only surprise in the rankings that assessed the performance of 951 companies with the Russell 1000 universe on environmental, social and governance issues.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Disney fell from No. 72 on the 2022 Just 100 list to No. 198 this year, a net loss of 208 spots. While former CEO Bob Chapek embroiled the company in a battle with Florida over LGBTQ+ policies earlier this year and gave Florida Governor Ron DeSantis an opening to drive a wedge further into ESG issues, that was not a factor in its ranking. Poor performance on local job creation, the second most important issue according to polling of the American public which Just Capital uses as the basis for the weightings in its annual ranking, was the reason. Specifically, Disney ranked 940 for the number of U.S. jobs created metric, down an estimated 38,152 jobs, roughly 22%, from 2017 (estimated 176,294 jobs) to 2021 (estimated 138,142 jobs).

"The real thing that dragged them down is not DeSantis or all the rest of that," said Martin Whittaker, founding CEO of Just Capital. While he said Disney does well in some worker areas, "It's the jobs." Just Capital is not the only influential voice in corporate research who has called out Disney over worker issues.

Here are some of the other biggest moves up and down, both inside the Just 100 and across the entire universe of 951 companies evaluated by Just Capital.

Money Report

Tesla: Better, but nowhere near great

Tesla ranked No. 536 overall and seventh among auto sector companies. It was No. 608 last year.

The move up 72 spots on the Just 100 list is worth noting, said Whittaker. For the four years prior, Tesla was ranked in the bottom 10% of Just annual rankings, and has continued to increase in rank over the last two years.

Tesla has not been included in the JULCD Index/JUST ETF representing the top 50% of companies in the rankings by industry, however, it inched closer this year finishing seventh among 13 autos.

Where does it continue to post mixed performance: significantly lower worker scores than other companies, and importantly, than other auto companies. But high scores on local job creation, second in the auto sector and within the top 200 companies overall.

Tesla also received above average scores on most environmental issues, but continues to receive below average scores on climate change because it is not transparent on its emissions goals or plans, or how to reach them. That has been a bone of contention for many investors on both sides of the issue, some who say the most influential EV company is the leader on climate, while others say without proper disclosure to analyze, it deserves its low scores.

Not surprisingly for a CEO who has often wielded power with negative headline consequences, Tesla received lower scores on governance issues as well as protecting worker health and safety, supporting workforce retention, and cultivating diversity, equity and inclusion.

In May 2022, Just Capital outlined six public recommendations for Tesla to improve performance.

"Tesla definitely made progress this year. They always do well on the environment and job creation, but it is very difficult for them to really make a move without more data and transparency around workers, and we haven't seen it. It's not that complex for them to get there," Whittaker said. "But there is clear improvement and we recognize that, and Tesla almost made it into the large cap index." He added, "I'm not sure what's to be gained by an unwillingness to provide the market with more information on climate leadership."

Uber: A very big drop

In 2022, Just Capital placed Uber, Lyft, and Doordash under review because of the challenges in assessing how these companies treat their entire workforce based on the publicly available data on gig economy workers versus, say, professional staff in white-collar Uber corporate positions. The data is in this year, and it has led to a big drop for Uber.

Just Capital reached out to these companies and requested public company sources with information about the proportion of gig workers in their workforces and any benefits accessible to these workers. It then proportionately discounted the scores of the "gig economy" companies across the data points within its worker metrics where there was no evidence that gig workers are covered by the benefits or workplace policies assessed in the Just 100.

Overall, Uber fell from No. 41 overall to No. 505, well out of the Just 100 rankings.

Uber's living wage rank, the No. 1 issue in the rankings, dropped to No. 871, down from No. 570. Its worker health & safety -ranking fell from No. 33 to No. 643. Its benefits & work-life balance ranking dropped from No. 117 to No. 623.

"We try to give companies the benefit of the doubt and last year it was impossible to know how many were gig workers and what their experience was," Whittaker said. "We figured it out to our satisfaction this year ... and it wouldn't surprise you that the vast majority of gig workers did not receive benefits."

Whittaker said there is more work to be done in future years on gig worker issues and the polling of the American public on this issue as an area of importance. "The gig economy is not going away," he said, adding that there is no perfect answer yet to the question, "Do they have to be treated the same, or are there other things companies can do?"

"We will be asking in 2023," he said.

"Market forces will drive them to offer gig workers more," he said, and in fact they already are. "We don't want to pretend it's easy or we've figured it out, but it's a first step in that direction and we didn't want to take a pass again this year."

Starbucks and Amazon and unionization

Amazon and Starbucks were both outside of the Just 100 rankings in 2022. This year, both are back in.

For a list focused on worker issues above all others, that may seem surprising given the headlines about unionization drives. But as Whittaker noted, Just Capital does not take a position on unionization. Its worker metrics are focused on data that can be disclosed and reviewed, such as pay and benefits. Measuring a company's approach to unionization is difficult, because there's very little comparable data on it. Just Capital does examine any controversies relating to active opposition to unions through its controversy measurement approach.

"In the case of both Amazon and Starbucks, we've seen efforts to oppose their workers' choice to join a union that have been flagged as controversial. However, given the number of workers currently organizing, and the breadth of other issues, the controversy data did not have an outsized impact on overall performance," the nonprofit said in this year's Just 100 review.

That allowed Amazon to rank No. 51 overall after being just out of the Just 100 last year, at No. 105. Last year was the only year in the past five in which Amazon did not make the top 100.

"Despite unionization controversies, Amazon received high scores in the workers stakeholder group relative to its peers for disclosing a minimum wage rate, and for carrying out and reporting results of both a gender- and race-based pay analyses," Just stated. Amazon received its lowest scores in worker stakeholder on worker health & safety, and benefits & work-life balance.

While it's cutting jobs now, Amazon had the highest sum total of U.S. jobs in the rankings, estimated at 1,074,708, which has grown over 300% since 2017, and that's the second-biggest metric in the rankings.

Starbucks ranked No. 46 overall this year and No. 1 in the restaurant sector. That's up from No. 140 last year, with investments in local job creation, disclosing minimum wage rates, releasing the results of annual pay equity analysis, and a strong commitment to DEI among the metrics where it outperformed. However, it did receive a low score specifically on the living wage metric, ranking No. 885 overall.

Like Amazon, Starbucks was penalized for three separate worker and anti-union related controversies over the course of this year's rankings, but that did not have an outsized impact on its rank.

"We are all about the issues and relationship between management and labor and how a company moves forward," Whittaker said. "Unionization is more a symptom of financial anxiety and feeling of worker wanting more of stake, and that will intensify."