A few stocks tied to U.S. infrastructure could still build on their gains.

That's what two traders told CNBC on Tuesday as the Biden administration's plans for a sweeping infrastructure bill came into focus following a meeting of energy industry executives at the White House.

"We'd benefit from new bridges, roads, modernizing airports, things like that, but if you're looking at the industrials, a lot of that good news is already priced in," Strategic Wealth Partners President and CEO Mark Tepper told CNBC's "Trading Nation."

He pointed to the stock of industrial equipment giant Caterpillar, which he said would undoubtedly benefit from an infrastructure package but has already climbed nearly 130% from its March 2020 bottom.

"I would rather play this through a materials name," Tepper said. "I like Vulcan Materials."

The largest maker of construction aggregates in the country, Vulcan is "a versatile way to play this entire theme" given its sizable footprint and range of services, Tepper said.

Money Report

"The stock's only about 5% above its pre-Covid high," he said. "They benefit whether there's this big 'Rebuild America' package, but they also benefit if we're just in maintenance mode. ... Personally, I think there's a good amount of upside here."

Wireless connectivity is also likely to play a big role in a U.S. infrastructure revamp, said Todd Gordon, the founder of TradingAnalysis.com.

"Biden's infrastructure promised to modernize technology. That includes 5G, and if you have one of these new 5G phones, … it's pretty fun to watch how often you come in and out of 5G coverage," he said in the same interview. "These towers have a very short span, a very short reach. You need a lot of towers, so there's going to be a lot of future demand."

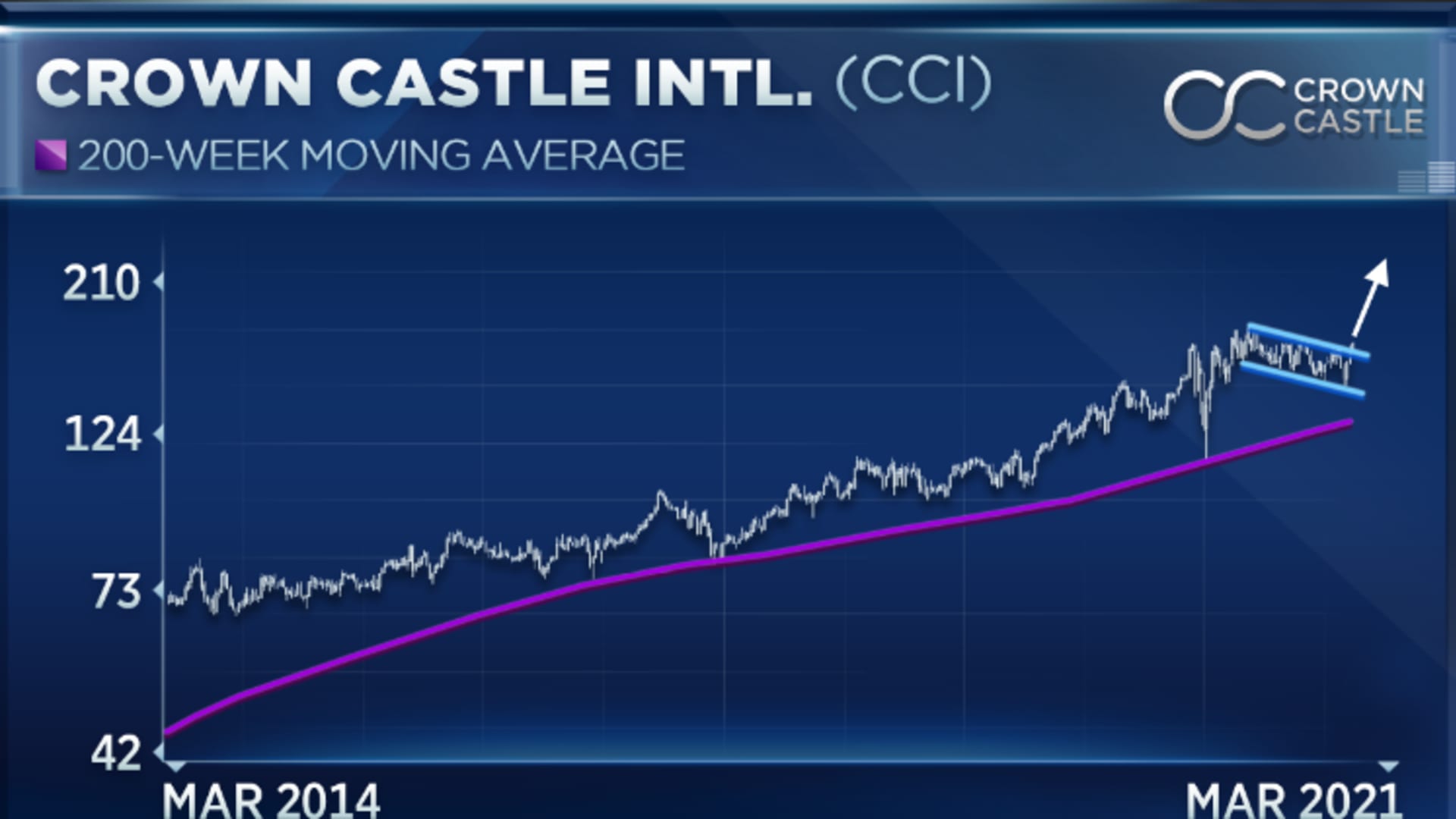

One key beneficiary could be Crown Castle International, a real estate investment trust focused on shared communications infrastructure, Gordon said.

Though its stock looks expensive at a multiple of more than 70 times next year's earnings estimates, it's still "pretty competitively priced" relative to its industry peers and pays a 3% yield, Gordon said.

"The chart is in consolidation. We have held above the 200-[week] moving average," he said.

It would be "very typical" to see this technical pattern play out with a move higher through the ceiling of that consolidation range, Gordon said.

"If we can push through 170, that would be the go-ahead," he said. "I might actually look to increase my exposure there."

Disclosure: Gordon owns shares of Caterpillar and Crown Castle International.