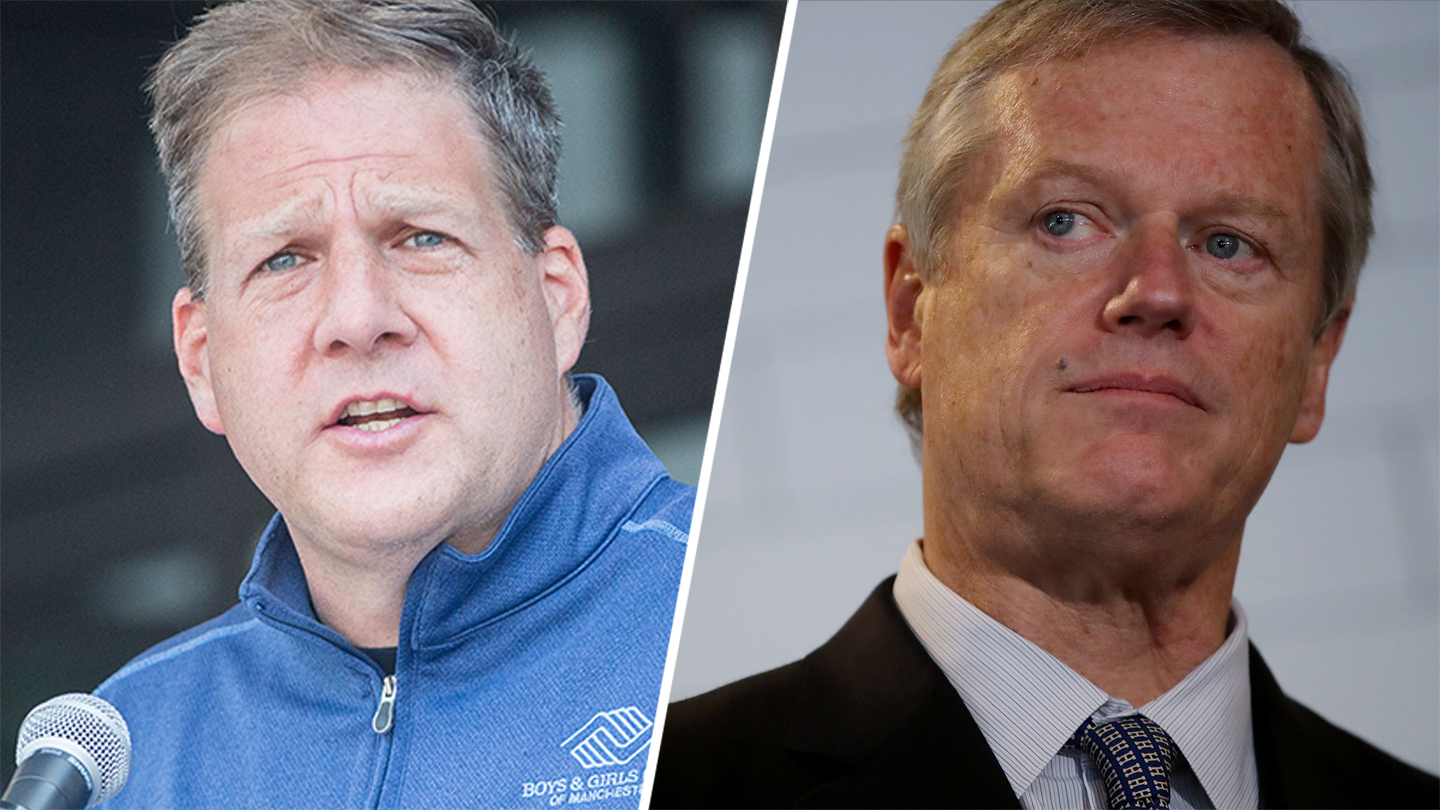

After the U.S. Supreme Court decided this week not to take up New Hampshire's lawsuit challenging Massachusetts's taxing of residents working remotely from other states during the pandemic, members of Congress from the Granite State and Connecticut filed a bill to prevent states from taxing out-of-state workers.

U.S. Reps. Jim Himes and Jahana Hayes of Connecticut, and Chris Pappas and Annie Kuster of New Hampshire this week proposed the "Multi-State Worker Tax Fairness Act" which would prohibit any state from taxing income that a non-resident earns when not physically in that state.

Last year, Massachusetts implemented a pandemic-era policy imposing its income tax on out-of-state residents working for Massachusetts businesses if they were physically working in Massachusetts before the pandemic and shifted to working remotely from another state. The U.S. Supreme Court opted this week not to allow the suit New Hampshire filed to proceed.

"The ability of Massachusetts or any other state to tax you should stop at the state line, and that's what this legislation will ensure," Pappas said. "For the nearly one in five Granite Staters employed by companies out of state, every dollar they can keep in their pockets makes a difference, especially as we recover from the pandemic."

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

Himes added, "If you wake up every morning in Connecticut, and walk downstairs to your home office in Connecticut, it only makes sense that you should be paying taxes to Connecticut, not to New York or whatever state your company's headquarters happens to be in."

A major credit rating agency earlier this year highlighted an analysis from a New Hampshire economic advisor that estimated that Massachusetts collects about $1.2 billion from New Hampshire residents who work remotely but are employed by an organization located in Massachusetts. S&P Global Ratings also said that Connecticut "estimates it will lose $339.0 million--$444.5 million of 2020 income tax revenue to New York State."