Gov. Maura Healey signed off on major tax relief legislation Wednesday, a law that's set to give tens of thousands of Massachusetts residents new tax credits.

Healey's office touted the $1 billion bill as "the first tax cuts in more than 20 years."

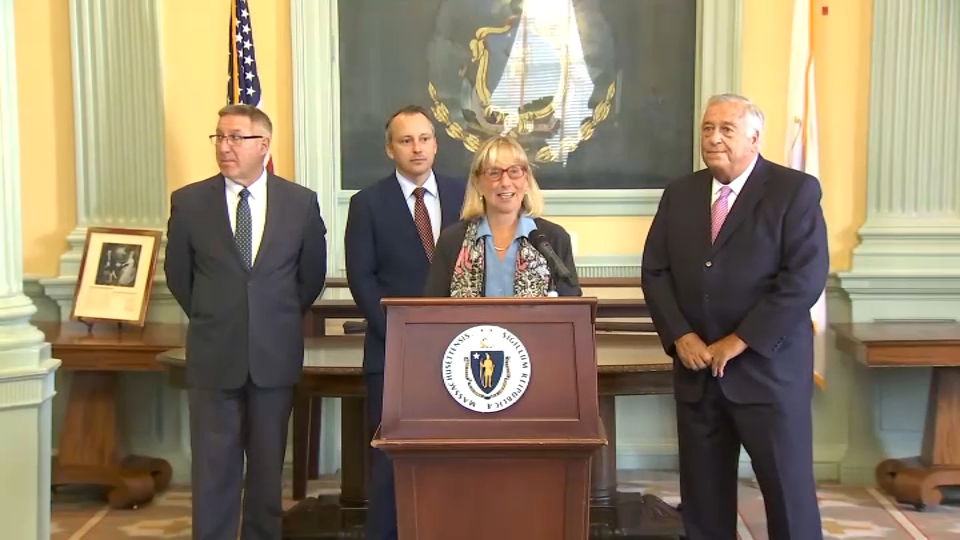

The bill signing was attended by many a large group of legislators including Lt. Gov. Kim Driscoll, Administration and Finance Secretary Matthew Gorzkowicz and top House and Senate Democrats.

The bill expands tax credits for parents and caregivers, boosts breaks for renters, seniors and low-income families, cuts the short-term capital gains tax rate, raises the threshold at which the estate tax kicks in, simplifies tax calculations for multistate businesses, and offers more incentives to encourage housing development.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

"People can’t realize their dreams until the nightmare of high costs ends," Healey said Wednesday. She added that making the Commonwealth more affordable is a key tenant of her campaign and that her administration has been driving that point home every day.

Healey noted that Massachusetts now has the most generous child and dependent care tax credit in the country.

"Today we delivered for Massachusetts,” Healey said. She said the plan was designed to help all residents - from recent college graduates, to families, to seniors - save money, and will make the state more affordable and more competitive.

It also tweaks a pair of voter-approved tax laws to change how automatic relief would work under the tax cap law known as Chapter 62F and to prevent high-earning couples from avoiding the new surtax on $1 million by filing separate tax returns.

Lawmakers sent Healey the bill last week, punctuating more than a year and a half of deliberations that began under former Gov. Charlie Baker and became a centerpiece of Healey's campaign.

Healey approved the entire package, which will carry a financial impact of about $561 million this fiscal year and more than $1 billion annually starting in fiscal year 2027.

Healey has repeatedly said Massachusetts needs to reform its tax code both to make life more affordable for families and to boost the state's economic competitiveness.