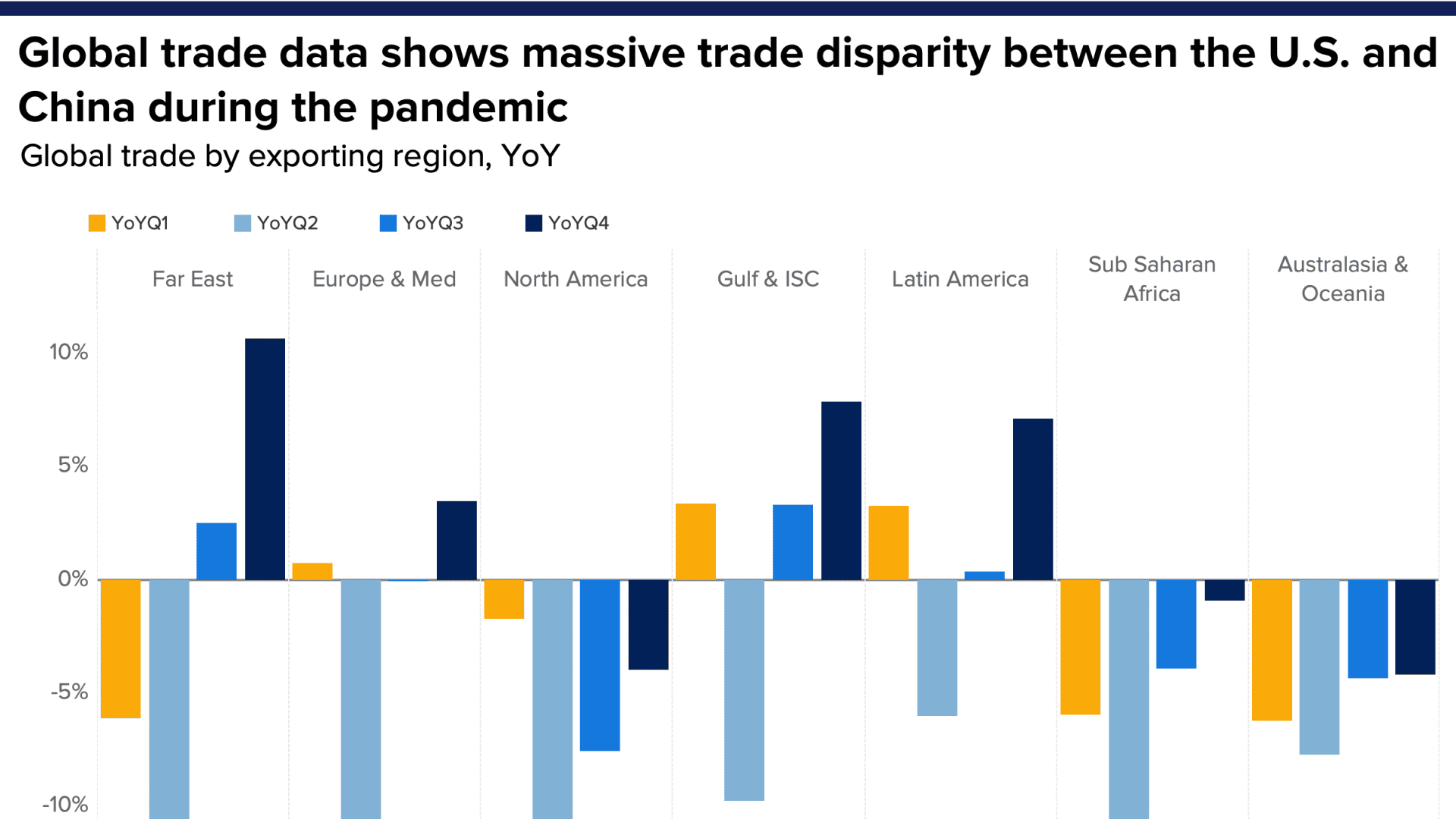

- Asia's share of global exports increased in the third and fourth quarters last year, due mainly to China, while the export share of North American nations didn't recover, according to new research.

- A big part of this disparity is due to the economic recovery in the United States and other wealthy nations.

- The data comes as the U.S. enacts new stimulus measures and the Biden administration seeks to reset relations with China.

The economic recovery in the United States and other wealthy nations helped China's exports bounce back in a big way last year, according to new research.

Asia's share of global exports increased in the third and fourth quarters last year, due mainly to China, while the export share of North American nations didn't recover, according to data from transport and logistics research firm MDS Transmodal.

A big part of this disparity is due to increased demand from wealthy countries, including the United States, for Chinese goods.

"The increase in global trade was mainly driven by China, which has not only retained the title of 'factory of the world,' but improved its position," said Antonella Teodoro, senior consultant at MDST.

MDST calculated that Chinese exports led the world with a year-over-year increase of 3.5% in the third quarter. The growth was even bigger in the fourth quarter: 14%.

Money Report

Trade with China is a key concern for global markets. While China did buy agriculture exports as it promised under the phase one trade deal with the Trump administration, the volumes of the agreed trade were never met.

The Biden administration, likewise, is looking to reset U.S.-China trade relations. China critic Katherine Tai will be Biden's U.S. trade representative. Secretary of State Antony Blinken and national security advisor Jake Sullivan will meet with Chinese officials Yang Jiechi and Wang Yi Thursday in Anchorage, Alaska.

Wealthy countries' stimulus efforts, designed to combat the economic fallout from the Covid-19 pandemic, also played a role in the export disparities in the second half of the year, Teodoro said.

"The increase has been supported by the emergency fiscal and monetary stimulus put in place by the wealthy economies," Teodoro said, noting that trade shipping from east to west drove growth. Meanwhile, she added, smaller stimulus efforts in developing nations probably explains much of the lower overall trade volumes.

"The shift in consumer spending from travel, vacation and entertainment events to physical goods, mainly bought online, has characterized all the major western economies, in particular the North American countries," Teodoro added.

Some of these pandemic buys included bicycles, ATVs and motorbike exports from China. According to MDST, imports of these items increased about 200% during the third and fourth quarters. Exports of kitchen appliances and home office electronic machines and equipment grew by 50% during the same time frame. Gym equipment also had a big surge last year.

"With consumers confined to their homes for much of 2020 amid coronavirus lockdown procedures, it comes as little surprise to see that the increase in Chinese exports in the final quarter of 2020 was driven largely by gym equipment which more than doubled," said Teodoro.

Based on the volumes of trade transported by SEKO US, there is a direct correlation to the stimulus checks and the surge in e-commerce spending.

Rick Lee, SEKO Logistics COO of North America, told CNBC they saw e-commerce orders increase by more than 100% after the first wave of stimulus checks. The company also saw order volumes increase after the second stimulus check.

"We are expecting similar consumer behavior with the third round of stimulus," Lee said.

U.S. exports rejected

The data about increased Chinese exports come as a CNBC analysis found that carriers rejected at least $1.3 billion in agricultural exports at U.S. ports in the second half of last year.

The Federal Maritime Commission is investigating whether carriers violated the U.S. Shipping Act by sending empty containers back to China instead of loading them with U.S. goods. The act prohibits nondiscriminatory regulatory processing by the carriers for the movement of goods by water.

The carrier's empty container preference is driven by economics. The price per container on the China to U.S. route ($4,571) is more profitable than the U.S. to China route ($715). Time is also a factor. Containers holding agriculture must be cleaned between loads.

"Q4 Far East imports from North America grew only marginally versus 2019, with declines to both Japan and South Korea," explained Mike Garratt, Chairman of MDS Transmodal.

The shift in containerized trade has some U.S. agriculture exporters moving more of their commodities to their Chinese customers by bulk container. Yet after strong bulk exports in the fall, U.S. soybean exports are dropping as China turns to Brazil for its soybean harvest.

U.S. corn bulk exports remain very strong, however.

"While soybean shipments show weakness, the corn coming out of the U.S. Gulf continue to show strength," said Jesper Buhl of grain markets analysis publication BullPositions.