On Thursday, President Joe Biden signed into law the $1.9 trillion American Rescue Plan Act, which promises to provide a significant financial boost to millions of American families.

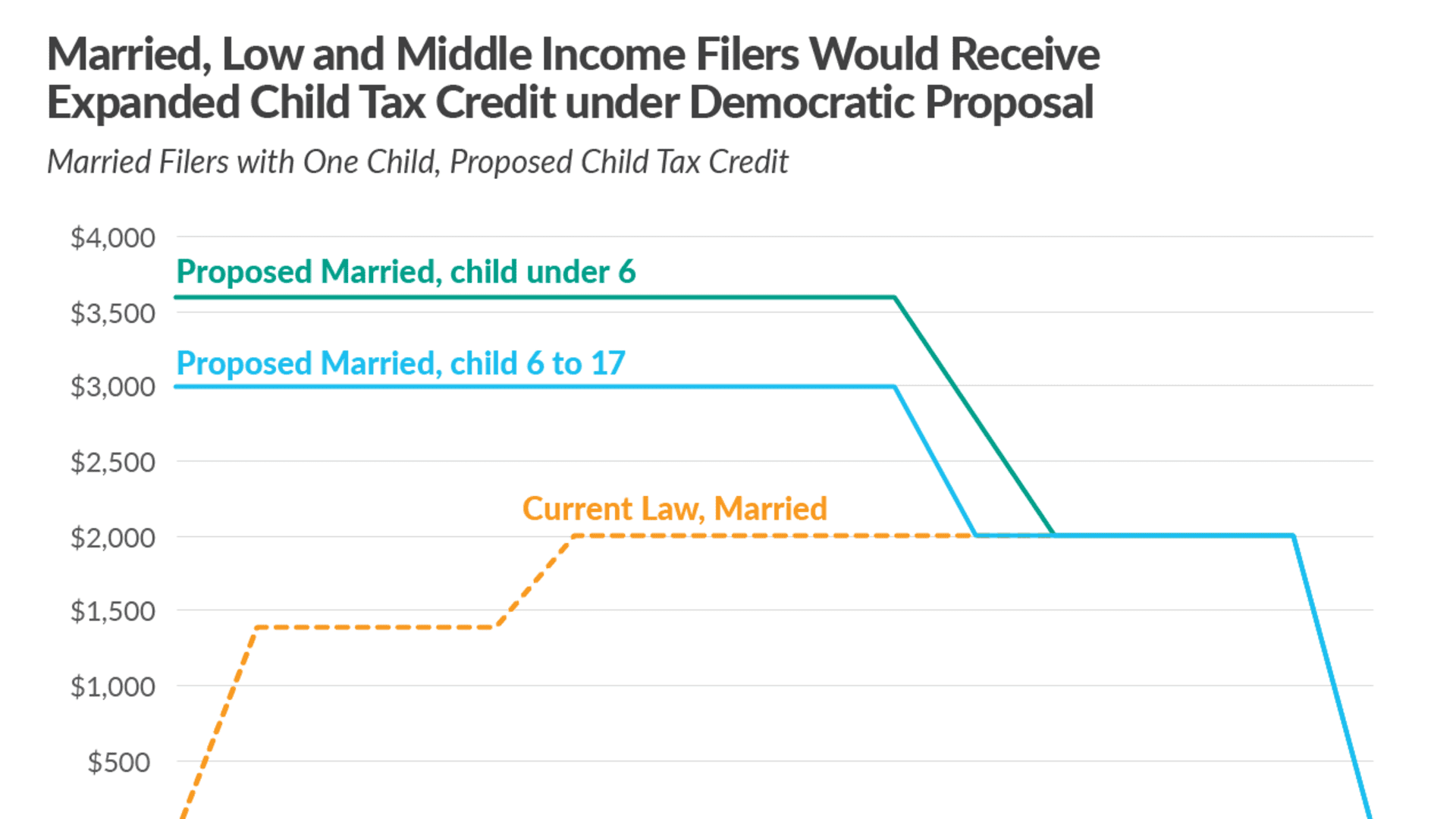

Along with $1,400 stimulus checks and enhanced unemployment benefits, the package includes updates to the current child tax credit. In the tax year 2021, under the new provisions, families are set to receive a $3,000 annual benefit per child ages 6 to 17 and $3,600 per child under 6. The credit will also be fully refundable.

So who's getting these new benefits? Millions more families. With this update, approximately 4.1 million children under 18 will be directly affected and lifted out of poverty and another 5.75 million children will move closer to the poverty line, according to calculations from the Center on Budget and Policy Priorities. Overall, about 27 million children, whether they're currently living in poverty or not, will benefit in some way from the credit becoming fully refundable.

Here's a look at who will qualify for the new credit.

Families with children under the age of 18

The child tax credit will be available to parents with children under the age of 18. This will be the first time those with children aged 17 will receive the tax credit. Families with children under 6 will receive a $3,600 credit per child, while those with school-aged children will receive $3,000 per child.

Parents making up to $75,000 a year ($150,000 for couples)

Money Report

The full child tax credit will be available to individuals who earn up to $75,000 and couples earning up to $150,000.

From there, the credit will be reduced by $50 for every additional $1,000 of adjusted gross income earned. That means, for example, the $3,000 credit provided to parents of a child aged 6 to 17 would be phased out completely for individuals earning $95,000 and those making $170,000 and filing jointly.

Families who are ineligible for the new $3,000 credit because they earn higher AGI are still able to claim the $2,000 per child tax credit, which is available to individuals making up to $200,000 ($400,000 for married couples filing jointly).

Parents who live in the U.S., including territories

The American Rescue Plan Act also extends the child tax credit to U.S. territories and allows families in Puerto Rico to file directly with the IRS to receive the credit.

What else to know about new child tax credit

It's fully refundable. What does that mean? Right now, if taxpayers' credit exceeds their taxes owed, they only can get up to $1,400 as a refund. Under the new rules, they could receive the full $3,000 or $3,600 per child, depending on the child's age.

You don't have to be employed to get it. The new provision allows households with no income to claim the credit. This is a major change, as previous rules limited the credit to those earning at least $2,500. In the past, families with very low incomes did not receive the full credit.

Americans could get a payment as soon as this summer. The IRS could start providing advances on the 2021 credit through periodic payments of $250 for school-aged children starting as early as July 2021, depending on what the Treasury Department determines is workable. Under the proposed schedule, which could be as frequent as monthly, families could receive half of their total 2021 child tax credit this year and claim the remaining amount on their 2021 tax returns.

It's only a temporary increase. The legislation signed by Biden on Thursday only guarantees the increase for the 2021 tax year. But some Democrats, including Senators Sherrod Brown, D-Ohio, and Michael Bennett, D-Colo., vowed to push Congress to make the increased child tax credit permanent.

"I believe that there is going to be broad support for it, and we'll have to find a way," Bennett said.

Check out: Use this calculator to see exactly how much your third coronavirus stimulus check could be worth