About two-thirds of the second round of $600 stimulus payments have already hit Americans' bank accounts. For the majority of recipients, that money will go toward keeping a roof over their heads and putting food on the table.

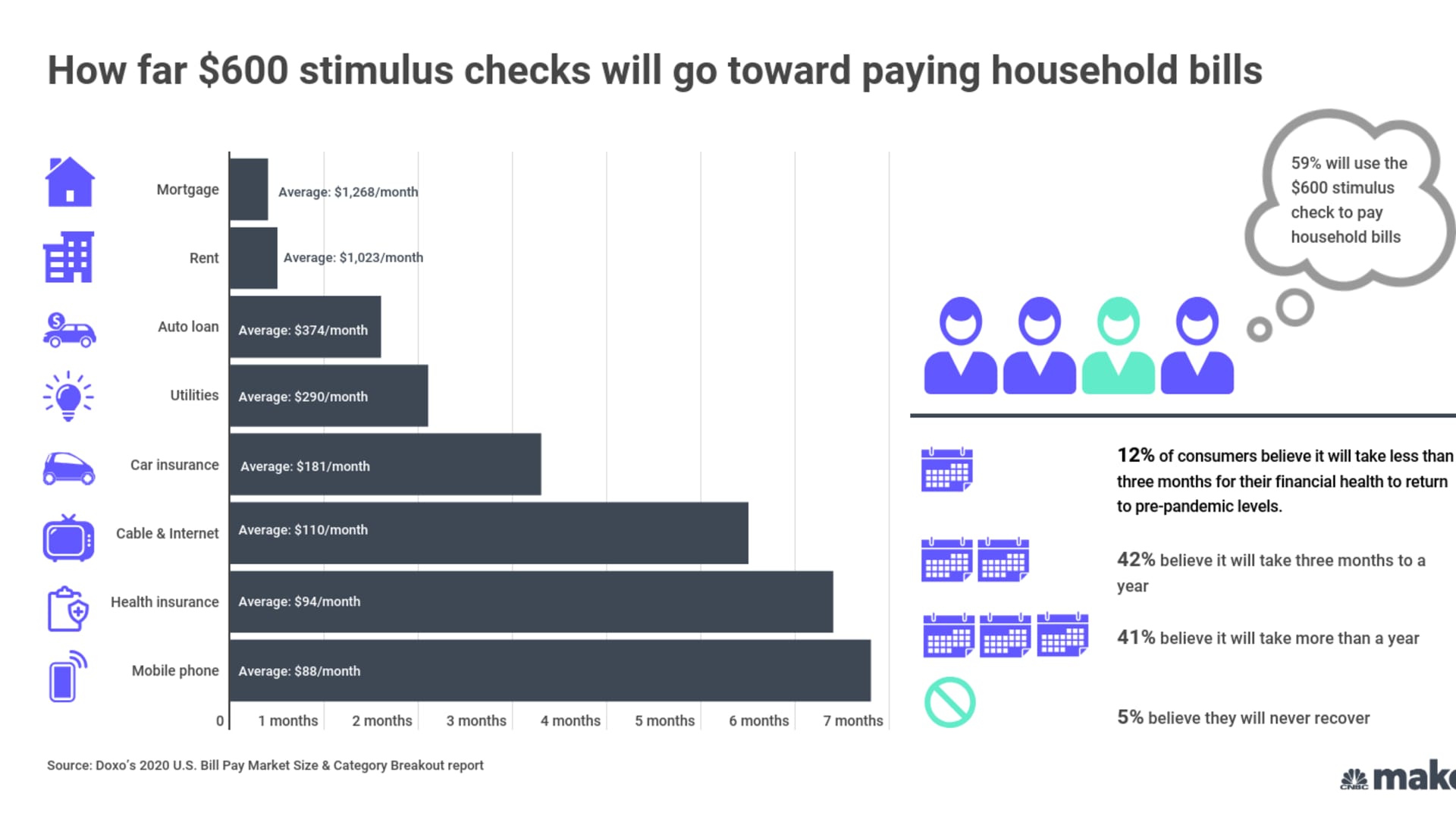

Nearly 6 out of 10 Americans, or 59%, say that as soon as they receive their stimulus check, they're using the money to pay household bills, according to a recent survey from bill pay service doxo of over 1,000 U.S. adults that ran from December 23rd to January 4th. Another 11% report the stimulus payment will be used to keep their families fed.

"Unfortunately, the $600 checks won't get them very far," says Jim Kreyenhagen, doxo's vice president of marketing and consumer services. That's because the average U.S. household spends $21,378 per year on bills, or about $1,782 on expenses each month, according to doxo's latest research.

The largest chunk of that spending is on housing: The average American spends about $1,268 a month on mortgage payments or $1,023 on rent, according to doxo. The $600 stimulus payment comes nowhere close to covering those expenses for many Americans.

That said, the stimulus payments will cover some expenses for at least a month, and some household bills even longer. The average car payment, for instance, is about $374 a month, while utilities tend to average about $290 a month, according to doxo.

While the majority of Americans are planning to use their stimulus payments immediately on household expenses, about 1 in 5 plan to put that money to work for longer-term goals. About 10% plan to use the funds to pay off credit card debt and 11% say they'll dump the money into their savings.

Money Report

Despite the second round of stimulus payments only being worth $600, most Americans believe the U.S. is on the road to recovery. About 83% of those surveyed by doxo believe it will take 10 months or more for the U.S. economy to recover.

When it comes to their own finances, about 12% say it will take less than three months for their financial health to return to pre-pandemic levels. On the other hand, 41% estimate it will take over a year.

"It is very encouraging to see that nearly all U.S. consumers believe that the government's latest round of stimulus checks will help them improve their own financial health in the coming year," Kreyenhagen says.

Check out: 5 common stimulus check scams experts are warning consumers to watch for

Don't miss: The best credit cards for building credit of 2021