Gains in technology helped the Nasdaq Composite skirt losses on Monday as traders added to bets that inflation may be easing.

The Nasdaq was the only major index to end the day up as it got boosted by a nearly 6% rally in Tesla shares. The tech-heavy index gained 66.36 points, or 0.6%, to end at 10,635.65 points.

The Dow Jones Industrial Average dropped 112.96 points, or 0.3%, to end at 33,517.65 as defensive drug stocks like Merck and Johnson & Johnson weighed on the average. The S&P 500 lost 0.1%, or 2.99 points, to close at 3,892.09, but the information technology sector's 1.1% gain help pare the index's losses.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

"The market, at least for 2023, seems a lot more optimistic than how we ended in 2022," said Chris Zaccarelli, chief investing officer at the Independent Advisor Alliance. "Today is another one of those days where you're really seeing growth outperform value, and you're seeing a return to optimism in terms of what might happen for the stock market this year."

Monday's moves follow a winning, shortened week for the three major indexes, with the Dow and S&P 500 posting their best weeks since November. A chunk of those gains came Friday on the back of the labor and service sector data that spurred hopes the economy was contracting enough to appease the Federal Reserve.

Money Report

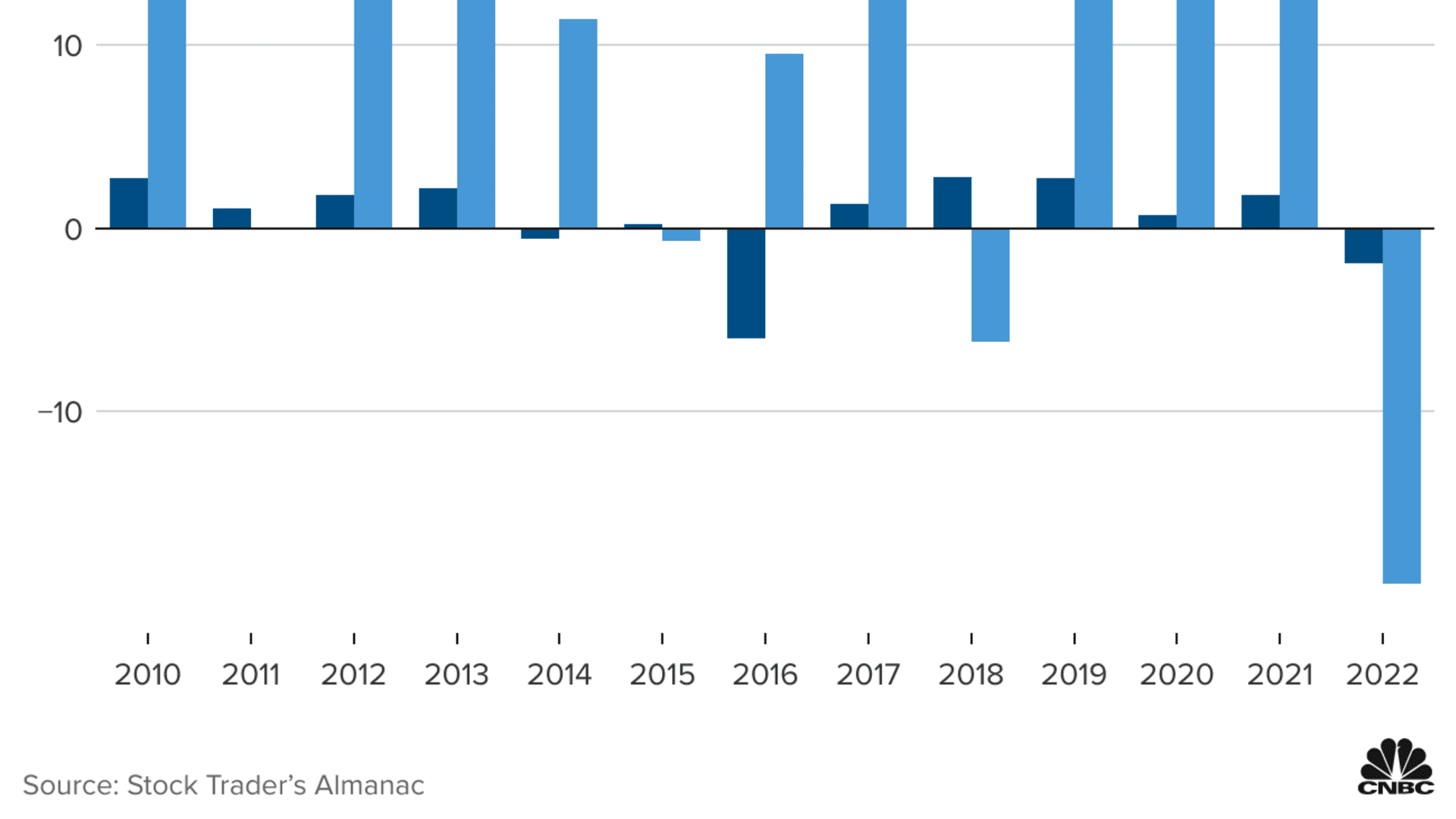

And Monday marked the fifth trading day of 2023, reminding investors of a classic Wall Street rule that suggests the market will end the year up if stocks perform well in the first five sessions. The S&P 500 has ended the year positive 83% of the times it finished the first five trading sessions up — and with an average gain of 14%, according to the Stock Trader's Almanac. The broad index gained 1.1% over the first five trading days in 2023.

Later in the week, investors will watch for December's consumer price index report coming Thursday and big bank earnings scheduled for Friday.

Dow, S&P 500 close down while Nasdaq posts second day of gains

At market close Monday, the Dow and S&P 500 traded down despite both trading up earlier in the day.

The S&P 500 whipsawed around the flatline in the afternoon, closing down just 0.1%. The Dow ended down 0.3% as investors focused on growth names as hopes grew over cooling inflation.

But the Nasdaq Composite ended up 0.6%, helped by a nearly 6% rally in Tesla and jumps in other tech names.

Losses were concentrated in recent winners, like health care, energy and aerospace and defense.

— Alex Harring, Scott Schnipper

2023 will be a stock picker year in the infrastructure and security sector

Investors looking to buy into the infrastructure and security sector in 2023 will be best served by picking individual stocks and focusing on those with high-quality business and management teams, according to Truist.

"With uncertainty running high, we take a more conservative posture with our estimates and believe that investors need to be selective in the group, focusing on high-quality businesses and management teams," wrote analyst Joel Fishbein in a Jan. 9 note. "Though the group remains sensitive to the rate environment, we believe that 2023 will be more of a stock pickers market than recent years in infrastructure and security software."

Last year was rough for the sector, which saw valuations tumble as concerns over sales weakness, foreign exchange headwinds and the customer base spooked investors. Many of these issues are expected to continue in 2023.

"We believe that the growth in economic reliance on cloud computing over the course of the last decade will make these businesses relatively more resilient than tech darlings of the past, but we see the elasticity of the cloud as a potential headwind as customers have the ability to optimize their workloads easier than ever before," said Fishbein.

The firm lowered price targets for many key players across the sector including CrowdStrike, ServiceNow, Check Point and Atlassian.

—Carmen Reinicke

Goldman Sachs adds Alibaba to conviction buy list

Goldman Sachs added Alibaba to his conviction buy list, saying the tech stock is the best way to play a rebound in the China internet sector.

"We see Alibaba at 11X 2023 adj. P/E as the best value stock proxy to enjoy advertising recovery, fintech (via. 33%-owned Ant) and cloud structural growth, add to CL as we believe the worst is behind us after two years of downward earnings revisions with the largest room for valuation multiple repair amongst the mega-caps as its top line growth resumes and 2022-25E earnings resume to mid-teens growth," Analyst Ronald Keung wrote in a Monday note.

The stock gained 3.6%, outperforming the Nasdaq Composite's 0.7% advance.

CNBC Pro subscribers can read the full story here.

— Sarah Min

More credit extended than expected in November

The latest consumer credit data showed individuals borrowed more than expected in November, according to Federal Reserve data released Monday afternoon.

Individuals borrowed a total of $27.9 billion in the month, which came above the consensus expectation of $25 billion compiled by FactSet. But that marked a decline from October, when individuals borrowed $29.2 billion.

The data includes short- and intermediate-term credit extended only to individuals, with the exception of real estate loans.

— Alex Harring

Raymond James upgrades Toll Brothers, sees attractive risk-reward for shares

Raymond James upgraded shares of Toll Brothers to an outperform from market perform rating as shares trade at an solid discount to its peers.

"With 20% of its affluent buyers still paying in all cash and the remainder being less sensitive to movements in mortgage rates, we believe there is less downside risk in TOL's 2023 guidance than most peers," said analyst Buck Horne in a note to clients Monday.

According to Horne, Toll Brothers' current book value multiple suggests an "attractive risk/reward" opportunity given the current housing climate.

Additionally, Horne views the company's $8.9 billion backlog in homes as a factor offering greater clarity into the company's 2023 earnings trajectory. His new $61 price target implies about 15% upside for shares from Friday's close.

Along with the upgrade, Horne downgraded shares of D.R. Horton to market perform from an outperform rating after the stock's 32% jump in the fourth quarter of 2022. He attributed the sentiment shift to this recent outperform, which puts its valuation and historical multiples ahead of some peers.

"Nonetheless, with a fortress balance sheet, ample liquidity, and established rental community production line — we remain constructive on DHI's longer term ability to continue taking market share and find a higher demand floor relative to its peers," Horne wrote

— Samantha Subin

Ark Innovation ETF pops over 5%

Cathie Wood's Ark Innovation ETF (ARKK) has jumped more than 5% on Monday, helped by strong performances from Tesla and Coinbase.

Here are some other notable ETF winners on Monday:

- Invesco Solar ETF (TAN): +2.6%

- iShares Semiconductor ETF (SOXX): +3.1%

- U.S. Global Jets ETF (JETS): +2.1%.

—Jesse Pound

Dow trades slightly down as markets enter final trading hour

The Dow dipped into negative territory as investors looked toward the final trading hour.

The 30-stock index was down 36 points, or 0.1%, despite previously trading up for most of the day. Health care stocks weighed as investors focused on technology and other growth names.

Meanwhile, the other major indexes remained in the green. The Nasdaq was up more then 1%, boosted by the outperformance of Tesla and other tech stocks. The S&P 500 gained 0.2%.

— Alex Harring

Coinbase shares surge in the afternoon

Coinbase shares climbed more than 17% Monday afternoon as bitcoin rose 2% to its highest level in almost a month.

The rise comes as part of a broader rally in tech stocks as investors bet inflation is easing and scoop up beaten up names. Jefferies also initiated coverage of the crypto services firm, saying it can weather the challenges the market is facing in a difficult macro environment and in recovering from the FTX scandal.

The move was exacerbated by a short squeeze, where investors that have profited from the steep losses in the stock were finally closing out their short positions by buying back the shares. The short interest on Coinbase has been building since the fallout of FTX and now accounts for more than 25% of the "float."

— Tanaya Macheel

Bank of America upgrades Helmerich and Payne and Core Laboratories

Bank of America, which sees another strong year for oil services stocks, upgraded both Helmerich and Payne and Core Laboratories on Monday.

Analyst Chase Mulvehill boosted Helmerich and Payne to buy from neutral, citing strong fundamentals and inexpensive valuation, and raised his price target by $1 to $54 per share.

"We think HP has room to run with the strong expected increase in realized revenue and gross margin per rig-day in its North America (NAM) Solutions business," Mulvehill wrote in a note.

Meanwhile, Core Laboratories was upgraded to neutral from underperform. Mulvehill, who raised his price target to $22 from $17, said there is a growing belief the company won't have to use its $60 million at-the-market equity offering to refinance $75 million 2011 notes sent to mature in September. Core Laboratories also has growing international/offshore momentum and a more palatable valuation, he wrote.

— Michelle Fox

Information technology leads S&P 500 sectors

Eight of the 11 S&P 500 sectors advanced in Monday trading as investors continued betting on cooling inflation.

Information technology led the way, adding 2.2% as investors bought beat-up technology stocks. Materials and consumer discretionary trailed in the second and third spots, each adding nearly 1.6%.

Health care was the worst performing sector, dropping 1.1%. Energy and consumer staples also traded down, shedding 0.1% and 0.3%, respectively.

— Alex Harring

Bank of America names Ferrari a top pick

Auto investors may want to take a ride in one of the top brands in the industry what could be a bumpy year for the car market, according to Bank of America.

Analyst John Murphy named Ferrari a top pick for 2023, citing the luxury automaker's "unique asset, pricing power, resilient performance, and conservative outlook."

Murphy also said in a note to clients that he expects overall sales volume in the auto market to be near recessionary levels in 2023.

Shares of Ferrari were up 6%.

— Jesse Pound, Michael Bloom

Semi ETFs on pace for third positive day in a row

Semiconductor ETFs SMH and SOXX both surged 3.5% Monday and are on pace for their third positive day, led by shares of Nvidia and AMD.

Both stocks jumped 8% or more and moving above their respective 50-day moving averages.

SMH is now trading above its 200-day moving average for the first time since Dec. 14 on an intraday and closing basis, and SOXX is nearing its own 200-day moving average as well.

This year, both ETFs are up more than 8%, rebounding after sharp losses in 2022. SMH shed more than 34% last year and SOXX lost more than 35%, both notching the worst annual performance since 2008.

—Carmen Reinicke, Gina Francolla

Tesla and Lululemon making the biggest midday moves

Here's some of the stocks making the biggest moves in midday trading Monday:

Tesla – Shares of Tesla rose 8% Monday after CEO Elon Musk's attorneys on Saturday asked a California court to move a trial over the company stock to Texas, citing local negativity.

Lululemon – The athleisure stock fell more than 8% after Lululemon's changed its guidance to show that it expects shrinking gross margins for the fourth quarter. The company did say it expects net revenue to be higher than its previous guidance range.

Zillow — Shares of the real estate marketplace company gained nearly 10% after Bank of America double upgraded the stock to buy and said they could rise 20% from Friday's close, citing its improved growth outlook despite a challenging macroeconomic environment.

—Carmen Reinicke

Las Vegas Sans, United Rentals and Caterpillar hit new highs

The stock market rally on Monday brought some company shares to fresh highs. Here's what stocks hit 52-week highs during the trading session:

- Las Vegas Sands Corp (LVS) trading at levels not seen since July 2021

- Caterpillar (CAT) trading at all-time high levels back to when it first began trading on the NYSE in 1929

- The TJX Companies (TJX) trading at all-time highs back to IPO in 1987

- Conagra Brands (CAG) trading at levels not seen since March 2017

- SLB (SLB) trading at levels not seen since October 2018

- Progressive (PGR) trading at all-time highs back to its IPO in 1971

- Everest RE Group (RE) trading at all-time highs back to its IPO in October 1995

- Willis Towers Watson (WTW) trading at levels not seen since June 2021

- Hologic (HOLX) trading at lows not seen since February 2021

- Ametek (AME) trading at lows not seen since January 2022

- Howmet Aerospace (HWM) trading at all-time highs back to its Alcoa spinoff in November 2016

- United Rentals (URI) trading at levels not seen since November 2021

At the same time, a few stocks hit 52-week lows:

- Baxter (BAX) trading at lows not seen since January 2017

- L3Harris Technologies (LHX) trading at lows not seen since March 2021

—Carmen Reinicke, Chris Hayes

Almost 9 out of 10 S&P 1500 sub-industries advanced last week

Nine of 11 sectors in the S&P 1500 advanced last week, according to Sam Stovall, chief investment strategist at CFRA Research.

Friday's rally was propelled by jobs data that showed wages increased less than expected despite employment being the opposite. Investors also digested data implying contraction within the services sector. The S&P 1500 contains all stocks listed in the S&P 500, S&P 400 and S&P 600, covering approximately 90% of total market cap within U.S. stocks.

The two losers were energy and health care. More granularly, 87% of the 148 sub-industries within the index gained price.

"Friday's stock surge turned an otherwise lackluster holiday-shortened weekly return into an impressive 1.4% advance that was accompanied by all sizes, styles, and nine of 11 sectors in the S&P Composite 1500, led by the communication services, financials, and materials groups," Stovall said in a note to clients.

At the end of the week, 64% of those 148 sub-industries traded above their 10-week moving average and 61% traded above their 40-week moving averages.

Friday marked the end of the first trading week for 2023.

— Alex Harring

Tesla jumps 7% as electric vehicle stock rallies off 2-and-a-half year low

Tesla rose more than 7% as investors pulled the electric vehicle maker off prior lows not seen in two-and-a-half years.

The stock is up more than 12% in 2022. That means the first few trading days have offered a respite after plummeting 65% in 2022.

Tesla has struggled in recent months amid CEO Elon Musk's chaotic purchase of Twitter. Investors are watching Tesla and Apple for insights into how some of the biggest technology names will fare after the industry was beat down last year.

— Alex Harring

Zillow gains 8% following double upgrade from Bank of America

Bank of America double-upgraded shares of Zillow Group to buy from underperform. The stock jumped more than 8% in trading Monday.

"While real estate fundamentals remain very challenged given the macroeconomic environment and rates pressure, we believe the market may trough in early 2023 and are more confident that growth can return to double-digits in 2024 on improving affordability," the firm said in a note to clients.

CNBC Pro subscribers can read the full story here.

— Sarah Min

Consumers see inflation, spending sliding over next year, according to New York Fed Survey

Consumers see the inflation burden easing while they expect to pull back considerably on their spending, according to a closely watched survey the New York Federal Reserve released Monday.

The central bank district's monthly Survey of Consumer Expectations for December showed that the one-year inflation outlook declined to 5%, down 0.2 percentage points from the previous month and the lowest level since July 2021.

— Jeff Cox

‘First five days’ stock market indicator bodes well for 2023

The S&P 500 rose again on Monday, the fifth trading session of 2023, bringing the gains over the first-five-day period to 2.6%. The early strength could be a good omen for the full year, according to the classic Wall Street indicator.

The so-called first five days rule suggests that if stocks perform well in the initial five sessions in a given year, the market is often up at the year-end, according to Stock Trader's Almanac, which studied the market phenomenon going back to 1950.

When stocks finish the first five days higher, the S&P 500 has been positive 83% of the time at year-end with an average gain of 14%, according to Stock Trader's Almanac.

— Yun Li

Impact from Brazil's 'January 6 moment' will be short lived, Wells Fargo said

Wells Fargo international economist Brendan McKenna said the impact from the Brazil insurrection on the country's economy and market will be short lived.

"While political risk is typically elevated in Brazil and could weigh on local asset prices, we believe Brazil's 'January 6 moment' will not have a long-lasting impact on local financial markets nor the economy," McKenna said.

"Despite more elevated political risk, we maintain our view that the USD/BRL exchange rate can hover around BRL5.30 by the end of Q1-2023 and that the real can strengthen by the end of this year," he added.

The Brazilian real fell against the U.S. dollar by 1.5% to 5.3028 reais. The iShares MSCI Brazil ETF (EWZ) also dipped more than 1%.

Shares of Petrobras dipped 0.4% in early trading, while miner Vale and bank Itau Unibanco fell more than 1% each.

— Fred Imbert

Piper Sandler upgrades Oracle

Piper Sandler upgraded shares of Oracle to overweight from neutral, saying years of low growth are coming to an end for the computer software company as it grows its cloud business.

"Truth be told, our long-term bias has been centered around growth, which has historically put us at odds with ORCL. For the past decade, it has delivered a paltry 1% 10YR CAGR in revenue and operating profits (F2012-F2022)," analyst Brent Bracelin wrote in a Sunday note.

The stock gained 2% in Monday trading.

CNBC Pro subscribers can read the full story here.

— Sarah Min

Stocks are up at market open

The three major indexes traded up at market open as investors tried to build on Friday's rally.

The Dow added 0.4% at 9:30 a.m. Meanwhile, the S&P 500 and Nasdaq Composite advanced 0.5% and 0.9%, respectively.

— Alex Harring

Metal and mining stocks climb higher

Metal and mining stocks led the gains in premarket trading Monday. The Global X Copper Miners ETF (COPX) jumped 2.6%, on pace for its fifth positive session in a row, which would be its longest rally since September. The VanEck Gold Miners ETF (GDX) is up 0.9% in the premarket, after gaining 10% last week in its best week since November.

Freeport McMoRan is up 1.1% in the premarket, while Iamgold climbed 1.9% and Anglogold Ashanti is up 2.7%.

Miners rose as commodity prices hit their recent highs .Copper futures hit their highest level since June Monday. Gold futures reached their highest levels since May.

— Yun Li, Nick Wells

Crypto-related stocks rise with bitcoin in premarket

Coinbase shares gained as much as 5% in premarket trading Monday after losing ground for the past five weeks in a row and for nine of the last 10 weeks, according to Coin Metrics.

The stock got a lift after at Jefferies initiated coverage of the crypto services firm, saying it can weather the challenges the market is facing in a difficult macro environment and in recovering from the FTX scandal. The current lull in trading activity makes the near-term outlook a little overcast, however, and Jefferies issued a hold rating on Coinbase.

The rise also comes as bitcoin climbs to its highest levels since mid-December, giving a boost to other crypto-related equities and particularly crypto miners, which have suffered as a group from low crypto prices. Marathon Digital and Riot Platforms added more than 3%. Hut 8 Mining climbed 7%.

— Tanaya Macheel, Nick Wells

Stocks making the biggest premarket moves

Here are some of the stocks making the biggest moves in the premarket:

Ferrari — Shares rallied 2.45% premarket after being named a top pick for 2023 by Bank of America. Analysts noted the automaker's balanced strategy, resilient financial performance and conservative 2023 outlook.

Hologic — The women's diagnostics provider reported fiscal first quarter revenue Sunday that topped its most recent guidance and Wall Street analyst estimates. Shares gained 2.79% premarket.

Bed, Bath & Beyond — Shares of the beleaguered retailer jumped nearly 26% in the premarket. Bed, Bath & Beyond last week warned of its ability to continue as a going concern, sending shares plummeting.

To read more premarket movers, click here.

— Michelle Fox

Duck Creek agrees to deal with Vista, Faber says

Duck Creek Partners has agreed to a takeover deal with Vista Equity Partners, according to CNBC's David Faber. The deal is for $19 per share, or about $2.6 billion, Faber reported.

Shares of Duck Creek surged more than 38% in premarket trading before being halted.

— Jesse Pound

The Fed can stop tightening now, Duke finance professor says

Duke University finance professor Campbell Harvey called the Fed a "wild card," saying its moves could determine if a recession comes to fruition.

He said the central bank was "late" to start combatting inflation. Harvey said the question now is if members will be late "again" on responding to current economic contraction, which could be taken to mean prior interest rate hikes have had their intended impacts.'

"Looking at the inflation data, it's pretty clear to me that we ... peaked and it's unnecessary to do additional tightening," Harvey said on CNBC's "Squawk Box" Monday morning. "But if they push really hard, they will drag us into a hard landing and it's completely unnecessary."

He also said the "time to stop is right now."

— Alex Harring

Piper Sandler upgrades Uber

Uber was upgraded to overweight from neutral by Piper Sandler, which said that higher car prices will push more consumers to use ride-sharing services — especially Uber.

"Vehicle prices are near all-time highs, and a quick reversion to historical pricing seems unlikely. As a result, we think cash-strapped consumers will increasingly opt to hail rides instead of trying to replace old cars," the firm said.

Uber gained 2.8% in premarket trading.

— Sarah Min

KeyBanc upgrades Visa, Mastercard

Visa and Mastercard received upgrades from KeyBanc, which noted that the credit card companies' 2022 momentum should carry over into the new year.

"V/MA: upgrade to OW as our prior travel-related dislocation concerns have faded and new flows (e.g., P2P, B2B, etc.) beyond consumer card are improving the diversification and growth durability," KeyBanc wrote.

— Sarah Min

Brazil stocks set to slide as world leaders condemn pro-Bolsonaro riots

Brazilian stocks are expected to fall on Monday after supporters of right-wing former president Jair Bolsonaro stormed government buildings on Sunday in protest against his election loss.

The iShares MSCI Brazil UCITS ETF was down 2.2% early on Monday, pointing to declines when markets open in South America's largest economy later in the day.

Bolsonaro's supporters stormed Brazil's Congress, Supreme Court and presidential palace in Brasilia on Sunday. The demonstrators refused to accept his legitimate October election defeat to leftist rival Luiz Inácio Lula da Silva.

- Elliot Smith

Where the major averages stand

Here's where all the major averages stand as the new trading week kicks off.

Dow Jones Industrial Average:

- Up 1.46% for the month and year

- Coming off its best week since November

- Sits 8.99% off its record high

- 84.65% above its pandemic low

S&P 500:

- Up 1.45% for January and 2023

- Wrapped up its best week since November

- Snapped a four-week losing streak

- 19.17% off its record high

- Sits 77.71% above its pandemic low

Nasdaq Composite:

- Up 0.98% for the month and 2023

- Finished its best week since December

- broke a four-week losing streak

- Sits 34.81% off its record high

- 59.38% above its pandemic low

— Samantha Subin, Chris Hayes

Stock futures open slightly higher

Stock futures opened slightly higher to start the new trading week.

Futures tied to the Dow Jones Industrial Average gained 49 points, or 0.15%, while S&P 500 and Nasdaq 100 futures added 0.17% and 0.29%, respectively.

— Samantha Subin