-

Investigation continues after credit card skimmers found at Big Y stores

Police are investigating after credit card skimming devices were found at 10 Big Y supermarkets across Massachusetts. Worcester police say three to four customers at that city’s Big Y were affected. “A few people used their cards, paid for their groceries and ended up getting their information stolen,” Lt. Sean Murtha of Worcester Police Department said. “This person then made…

-

Card skimming devices found at multiple Big Y stores: ‘It's so deceiving'

Big Y announced Thursday that it discovered card skimming devices at 10 of the supermarket’s locations in Massachusetts. According to Big Y, between Dec. 19 and 21, 2023, an unknown person allegedly placed a device in the following supermarkets: Additionally, a card reading device was placed on a single card reader at its Westfield location on East Silver Street between…

-

With money tied up in senior living fees, family struggled to pay for mother's care

A proposed Massachusetts law aims to protect families owed large sums of money from retirement communities. Ivey Cooley’s 98-year-old mother lived in a senior residential community in western Massachusetts for years before she needed a higher level of care. But, when she and her sister moved her to an assisted living facility, they hit a financial roadblock. “I was… panicked...

-

Credit card debt is at a record high – here's what you can do if you feel buried

Holiday bills are starting to roll in and you may find yourself buried under big credit card balances. You’re not alone. The country’s credit card debt is higher than it’s ever been. According to the Federal Reserve Bank of New York, credit card balances now total $1.08 trillion. And a lot of people are struggling with it. ...

-

Reset your finances for 2024 in one afternoon with this 5-step money checklist

Consider making these 5 money moves for 2024 if you have some extra time during the holidays.

-

More people seeking help in managing credit card debt, National Credit Counseling Agency says

Sticking to cash and a budget may be the best strategy to follow in a year where budgets have been stretched and the number of people asking for help with debt appears to be on the rise.

-

38-year-old financial coach spends only $124 on groceries a month—her No. 1 ‘secret tip' for food shopping

Carly DeFelice keeps her grocery bill low by planning meals in advance and meticulously sticking to her list.

-

28-year-old health-care worker earning $210,000 a year shares her biggest money mistake

Anesthesiologist assistant Chabely Rodriguez has a regret from accepting her first job offer.

-

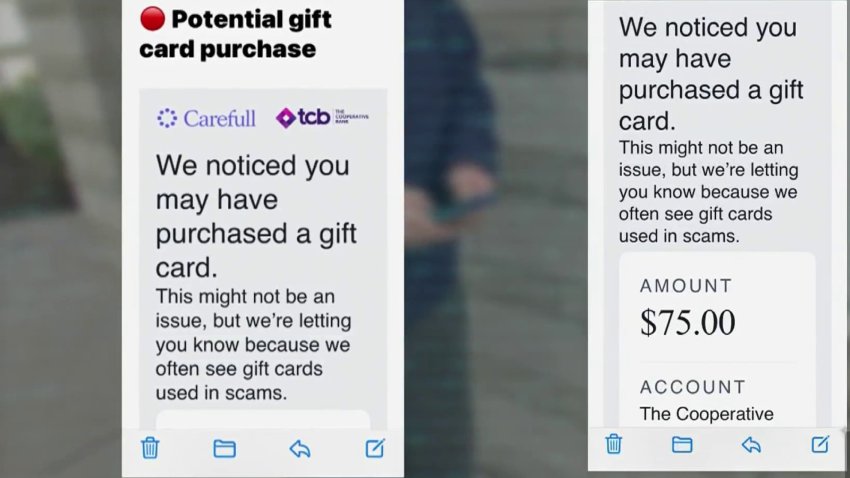

New monitoring service could help seniors protect themselves from bank fraud

A new monitoring tool aims to help seniors and their caregivers be on alert for potential fraud on their accounts, and it’s now being used by a local bank. The Cooperative Bank in Roslindale was recently recognized by the American Banker’s Association Foundation for its efforts to protect older Americans. It was also the first in the country to...

-

Customers grapple with deposit delays at big banks. What it means for you

Customers at several big banks on Friday wrestled with direct deposit delays, stemming from an industry-wide processing issue.

-

Why it's so expensive to be single in the U.S.

The high cost of living can be even more expensive when you’re paying for everything on your own — and some federal policies make things even harder for singles.

-

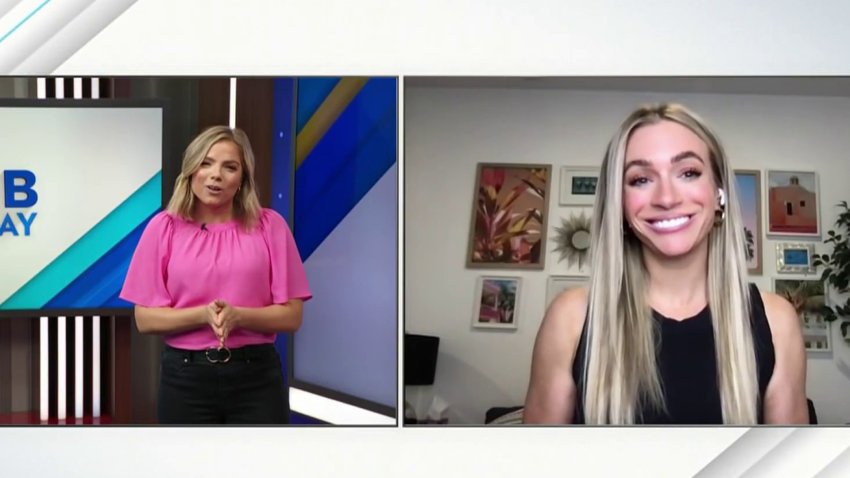

How to make a budget and discuss money with friends

Discussing money with friends and making plans that fit in everyone’s means can be difficult, but Amanda Wolfe, founder of ‘SHEWOLFEOFWALLSTREET” tells Hannah all about how to approach the conversation and make a budget.

-

Student loan payments are back and so are the scammers

What’s worse than restarting your student loan payments? If a scammer offers help and you end up losing more of your money. Get ready for an onslaught of scam attempts. The long-anticipated restart of federal student loan payments has begun. Scammers are moving in to try to take advantage of people via calls, emails, text message and social media. ...

-

Looking for help with your credit? Be careful who you trust

Consumer credit card debt is at an all-time high. Add to that trillions of dollars in mortgages, personal lines of credit, home equity lines of credit, and student and personal loans on top of that. People are tapped out and struggling to get your debt under control can feel overwhelming. If you’re considering getting help from a credit or...

-

Do you know how to freeze your credit? It may be a good idea

Do you know what a credit freeze is and how to put one in place? A credit report is a record of your financial history. If you want to take out a loan or mortgage, finance a car or open a credit card, your credit report gets accessed. You can freeze it to prevent a criminal from doing any of…

-

Here's why Americans can't stop living paycheck to paycheck

With well over half of Americans living paycheck to paycheck, many are failing to meet some of their modest financial goals.

-

4 things to do if you win the lottery – and 1 thing you should never do

Winner winner chicken dinner! You just won the lottery, but do you know what to do next? Here’s what to know before you cash out.

-

People are losing more money to scammers than ever before. Here's how to keep yourself safe

Business for scammers is booming. The most recent Federal Trade Commission data from 2022 shows that reported consumer losses to fraud totaled $8.8 billion. That’s a 30 percent increase from 2021. The biggest losses were to investment scams, including cryptocurrency schemes, which cost people more than $3.8 billion. Younger adults ages 20-29 reported losing money more often than older adults...

-

Parents can start helping teenagers to build a financial foundation at home without spending

This could sound rare, but there are several options for parents or guardians of minors who want to provide financial education without having to save or invest any money.

-

Here's how parents can start helping teenagers to build a financial foundation at home without spending

Amid a wave of uncertainty due to changes in the U.S. economy, many parents may be asking themselves the same question: How can I help my child build a financial foundation without hurting my pocket?