- The explosive growth in SPACs has been centered mostly around the U.S. where it took the market only three months to outdo its record-breaking 2020.

- SPACs are not new and have been around since the 1990s.

- The recent hype can be attributed to a low interest rate environment which has resulted in a lot of liquidity, said Max Loh, Asean IPO Leader at EY.

Wall Street's hottest trend may be headed to Asia.

SPACs — or special purpose acquisition companies — are attracting interest in Asia and the first wave of local listings will be a test of investor appetite in the region, experts told CNBC.

"I think there's definitely interest because SPACs, obviously, offer that alternative platform from a traditional IPO," Max Loh, Asean IPO Leader at EY, told CNBC in late February.

SPACs are shell companies set up to raise money through an initial public offering (IPO), with the sole purpose of merging with or acquiring an existing private company and taking it public.

That process typically takes two years. If acquisitions are not completed within that time frame, the funds are returned to investors.

SPACs are sometimes referred to as "blank check companies" as investors don't know ahead of time which private firm will be acquired with the funds.

Money Report

Growing interest in Asia

To be clear, SPACs are not new — they have been around since the 1990s.

Some of the recent interest can be attributed to a low interest rate environment which has resulted in a lot of liquidity, said Loh, adding that SPACs present an "attractive proposition."

Private companies see SPACs as an alternate way to access the capital market, instead of the traditional IPO route, which can be more time-consuming and involve greater scrutiny.

A growing number of Asia-based sponsors are backing SPACs.

- China's state-owned alternative investment management and advisory firm CITIC Capital raised $240 million through a SPAC listing in the U.S.

- Malacca Straits Acquisition, also listed in the U.S., is backed by Hong Kong-based Argyle Street Management and focuses on Southeast Asia.

- Singapore-based entrepreneur David Sin set up a health care focused SPAC in 2019.

- Even Japanese tech giant SoftBank has joined the SPAC frenzy and is reportedly backing multiple blank check companies to raise millions of dollars.

Asia is also a target region for acquisition for many of the SPACs — particularly highly valued companies in Southeast Asia that are primed to go public. Ride-hailing giant Grab is reportedly in talks to go public by merging with a SPAC, according to Reuters.

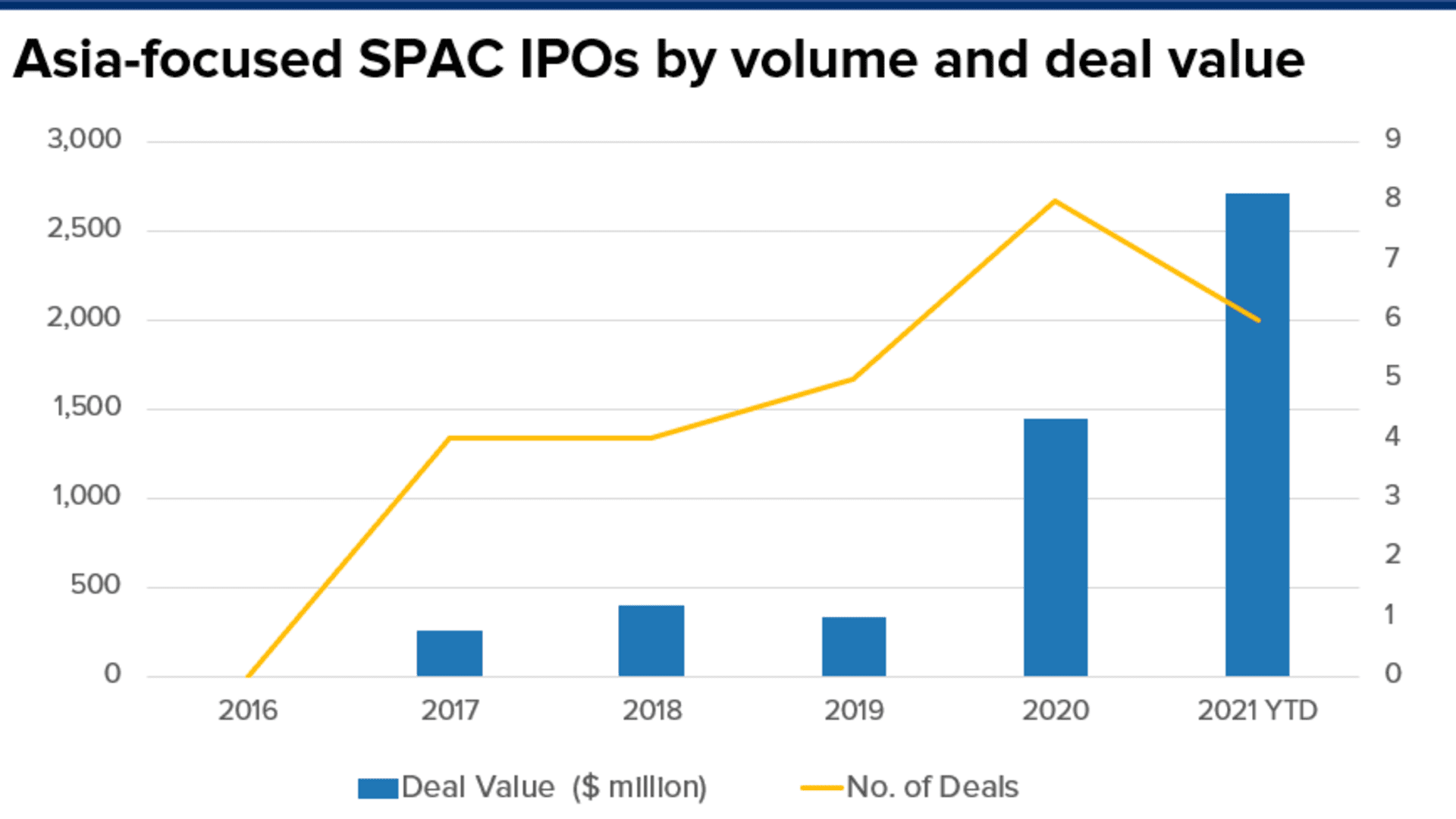

Data shared by analytics provider Dealogic showed the number of Asia-focused SPAC companies grew from 0 in 2016 to 8 last year, raising about $1.44 billion. But only four Asia-targeted SPACs were successfully completed in 2020.

In the first three months of 2021, there have already been six such companies that have collectively raised $2.7 billion.

Chew Sutat, head of global sales and origination at Singapore market operator SGX told CNBC last week that SPACs can provide a relatively easy path for companies to raise funds in volatile conditions.

"With a good framework that balances and aligns the interests of investors, companies and sponsors, it could catalyse and strengthen SGX's role in helping regional companies grow and access global investors through Singapore's capital market platforms," Chew said by email.

Test of investors' appetite

The explosive growth in SPACs has been centered mostly around the U.S. where it took the market only three months to outdo its record-breaking 2020. Funds raised by U.S. SPACs so far this year totaled more than $87 billion, compared to the $83.4 billion issuance in all of last year.

That trend is expected to continue where SPACs listings in the U.S. are outpacing traditional IPOs, according to Romaine Jackson, head of Southeast Asia at Dealogic.

"The first few SPACs in Asia will be a test of investors' appetite, the market needs to understand if investors would be comfortable to invest without the same level of access to the issuer and scrutiny," he said by email last month.

Currently, very few Asian markets allow SPACs to list on local bourses and Asia-based sponsors are mostly going to the U.S.

Financial hubs like Singapore and Hong Kong are exploring ways of listing SPACs but there are no concrete indications of when blank check companies would be allowed to list on their exchanges.

Asian companies and investors are looking to ride the SPAC wave, regardless of which exchange is going to emerge as the SPAC center in the East, according to Bruce Pang, head of macro and strategy research at China Renaissance Securities.

"Asian exchanges with the home market effect are with advantage of providing a playfield with more understanding of business models and rationales for homegrown new economy sectors, as enterprises thrived and entrepreneurs prospered in Asia," he told CNBC.

Right rules for SPACs in Asia?

Having the right rules and methods to execute SPAC listings would be key for Asian bourses, according to Loh from EY.

When a SPAC raises money, people buying into the IPO do not know what the eventual acquisition target company will be. Instead, many investors rely on the track records of success for the SPAC sponsors to invest the blank check companies.

One concern among investors is whether there will be the same level of scrutiny and due diligence performed on target companies as there are in traditional IPOs, Loh said. Having proper rules and regulations can mitigate that worry, he said.

Loh explained that there isn't "too much of a difference" between companies going on the IPO route and those going through SPACs, adding that it's the quality of the underlying company that matters.

China Renaissance's Pang explained that regulatory uncertainties remain one of the major concerns of adopting SPACs in Asia as authorities and exchange have to provide popular and convenient ways for regulation.

"Considering Asian exchanges' prudent attitude and tightening reviews on shell companies, backdoor listing, reverse takeover or reverse merger, all of which are vehicles similar to SPACs that may also allow companies to circumvent IPO scrutiny and regulatory oversight, the bourses are unlikely to fully embrace SPACs anytime soon," he said.

Pang also expects Hong Kong to be better positioned than Singapore as an Asia-Pacific SPAC hub because of its "diverse and liquid IPO market" that's on par with New York and London.

Loh added that SPACs will provide another alternative platform to raise capital, aside from traditional IPOs as well as venture funds and private equity.

"Being a major SPACs hub makes sense for Singapore because we're a financial center. The key is the rules, the execution and the quality of companies," he said.